Your end-to-end supply chain, all in one platform

Flexport is the platform that coordinates global logistics from factory to customer door — empowering businesses to ship anywhere, sell everywhere and grow faster.

A Single System For All Your Shipments

Simplify Workflows

Step out of the messy reality of calls, faxes, and endless emails and into a new world, where everything is connected to a single platform — suppliers, shippers, customs, ports, and more.

Coordinate With Confidence

You’ll gain shipment visibility for every order, at every step of the way, with the ability for everyone involved to instantly pull it up on-demand and respond with in-app messaging.

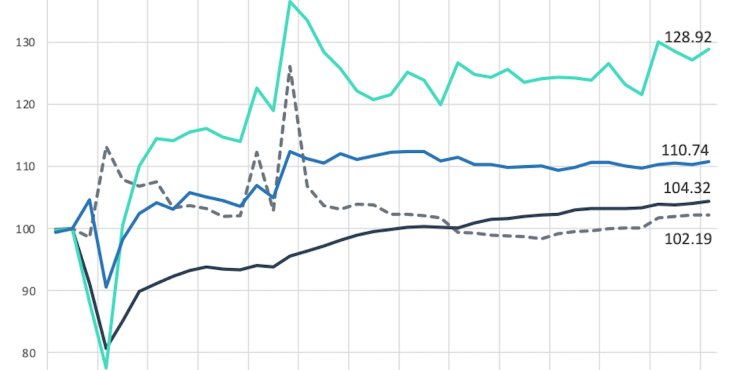

Make Smarter Decisions

Your previously siloed data now unlocks predictive modeling, powerful analytics, and actionable insights that our seasoned trade advisors can help you interpret and implement.

We have a dedicated space for communication on each shipment, reporting tools, line level invoices — all of this information allows us to make educated decisions.

From Factory Floor To Customer Door

Launch Products on Time

Hit your release dates and nail inventory forecasting with shipment visibility, seamless in-app collaboration, and a control tower view of all the information.

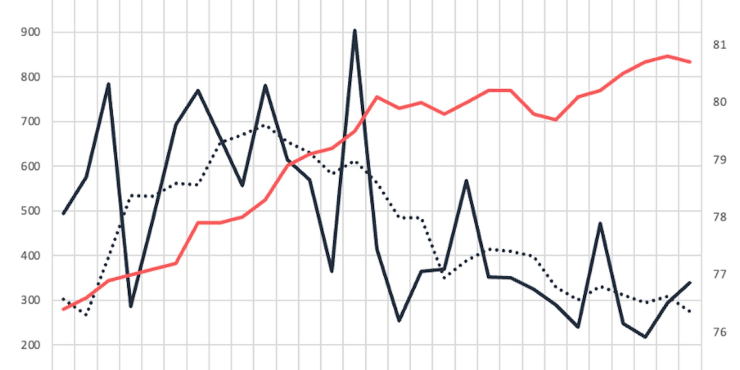

Set Your Margins Free

Act on surfaced insights to cut waste across your supply chain, minimize spend, avoid surprise fees, and strike the perfect balance between speed and cost.

Make Success Enduring

A strengthened supply chain unlocks growth and builds brand value. Smoothly launch your newest products in more markets to a rapidly expanding customer base. The future is bright.

Take full control of your supply chain

Streamline

News & Events

Latest Insights

Global Reach, Local On-the-Ground Expertise

- Flexport Office

- Flexport Coverage

Put Us to Work as Your Global Logistics Platform

Schedule a call to learn how our platform delivers end-to-end results.