Insights & Analysis

Historical Freight Market Research

Looking for historical freight market and economic research? Flexport, a global leader in logistics technology, offers original research and expert insights using proprietary and third-party data to help customers, partners and the industry at large understand how disruptions over the past five years, from the Sec. 301 tariffs to Covid, impacted global supply chains and the economy.

Flexport Indicators

Flexport Indicator

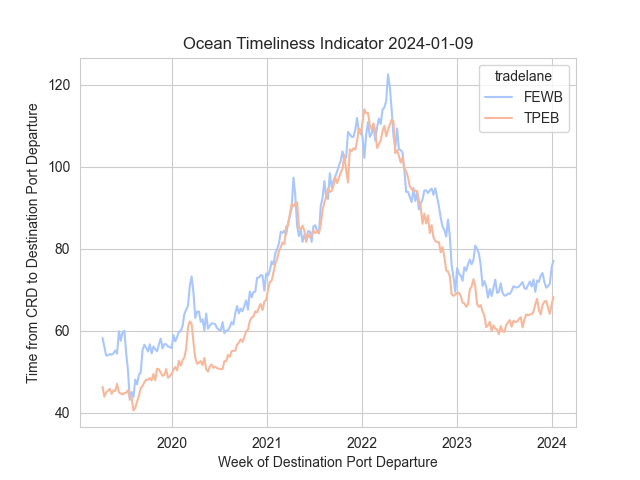

Ocean Timeliness Indicator (OTI)

Flexport’s Ocean Timeliness Indicator measures the amount of time taken to ship freight from the point at which cargo is ready to leave the exporter to when it is collected from its destination port. The ocean shipping world tends to run along “trade lanes.” The two biggest trade lanes carry goods from Asia to North America and from Asia to Europe. The OTI captures timeliness on each of these.

Flexport Indicator

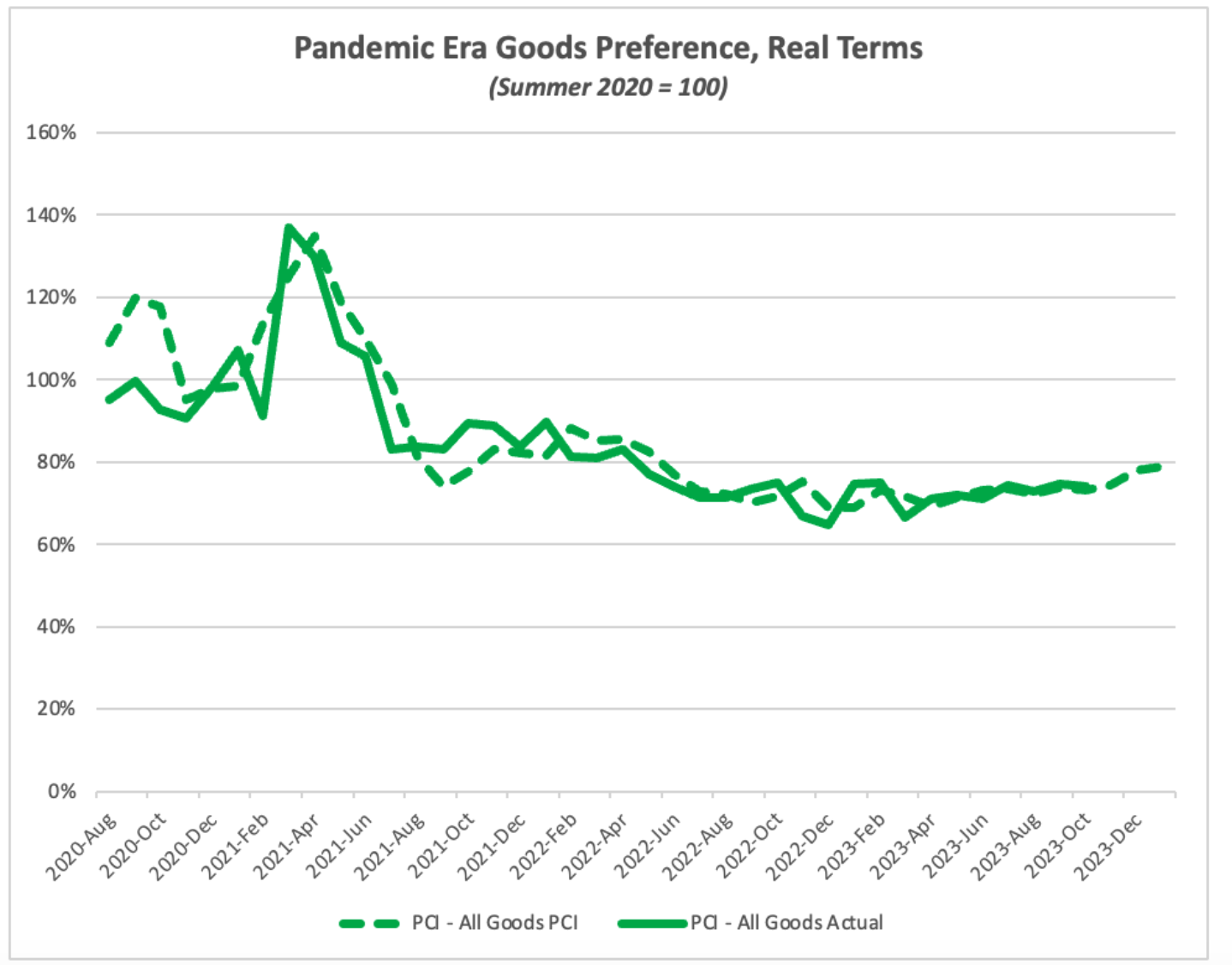

Post-Covid Indicator (PCI)

Flexport’s Post-Covid Indicator measures the balance between U.S. consumers’ spending on goods versus services, now augmented with divides between durable and nondurable goods and between nominal and real (inflation-adjusted) figures. Last Update: December 18, 2023

Flexport Indicator

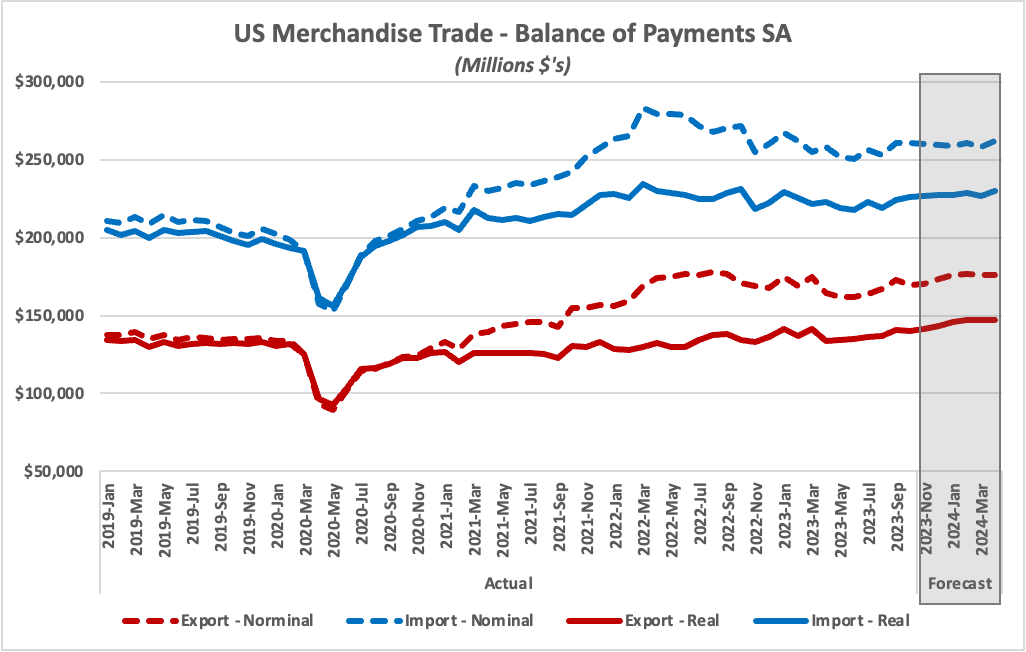

Trade Activity Forecast (TAF)

Flexport’s Trade Activity Forecast augments traditional economic techniques for predicting U.S. merchandise imports with Flexport’s proprietary data. Details are provided for six industrial categories with versions available on seasonally adjusted and non-adjusted bases. Last Update: December 16, 2023