Global Logistics Update

Freight Market Update: December 5, 2018

Ocean, trucking, and air freight rates and trends for the week of December 5, 2018

Freight Market Update: December 5, 2018

Want to receive our weekly Market Update via email? Subscribe here!

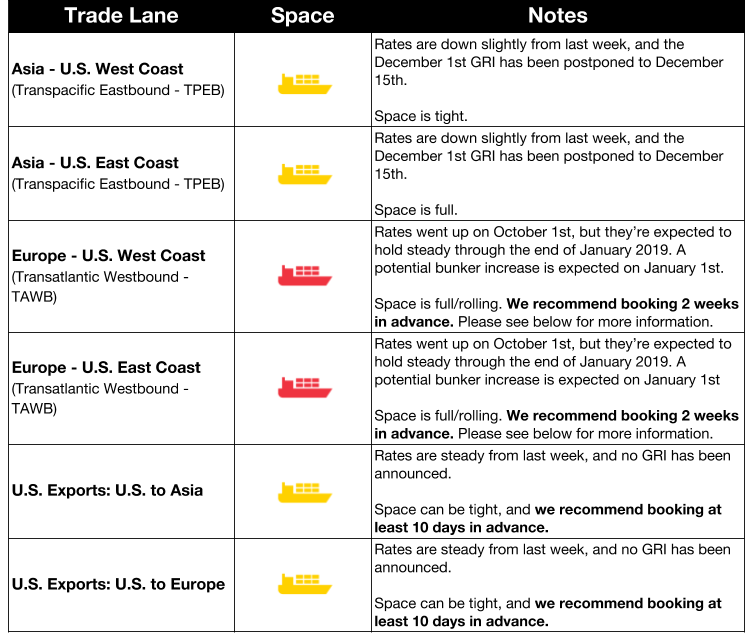

Ocean Freight Market Updates

UK Ports Remain Extremely Congested

UK ports are very congested, which is causing tight trucking capacity and a decline in port productivity. The tight congestion is expected to continue through late January when Chinese New Year cargo will arrive.

ONE to Implement Recovery Strategy

After Ocean Network Express (ONE) launched in April, the carrier group suffered a loss of business related to a lack of staff, and a lack of familiarity with the systems and data. Going forward, ONE plans to restructure parts of the business including cargo portfolio and product optimization, and to improve detention and demurrage collection.

Transpacific Rates Begin to Fall

Rates on the Asia-to-U.S. trade lane began to fall this week as we approach January 1st, 2019. The rise in import volume and subsequent rise in rates was attributed to front-loading as shippers tried to import goods before the increase in tariffs, but that import volume is slowing down.

The January 1st, 2019, tariffs have also been postponed, as reported in the Tariff Insider.

Impact of New IMO ECA Regulations

The International Maritime Organization (IMO) has mandated under new Emission Control Area regulations that by 2020, all merchant vessels must reduce their sulfur emissions to 0.5% from 3.5%.

Whether they install scrubbers, build new vessels, or use higher-quality fuel, carriers will need to undertake significant changes to comply with the new regulations, and those changes will come at a cost to shippers. Rates may climb between now and 2020 as a result.

MSC has announced that they will introduce a bunker surcharge at the beginning of next year, to pass on the estimated $2 billion in additional fuel costs that will result from the 2020 regulations.

Feeder vessels are set to benefit from these regulations, as larger vessels are temporarily put out of commission while scrubbers are installed.

For an in-depth look at the regulation and how to prepare, read our blog post: IMO 2020: What Shippers Need to Know Now.

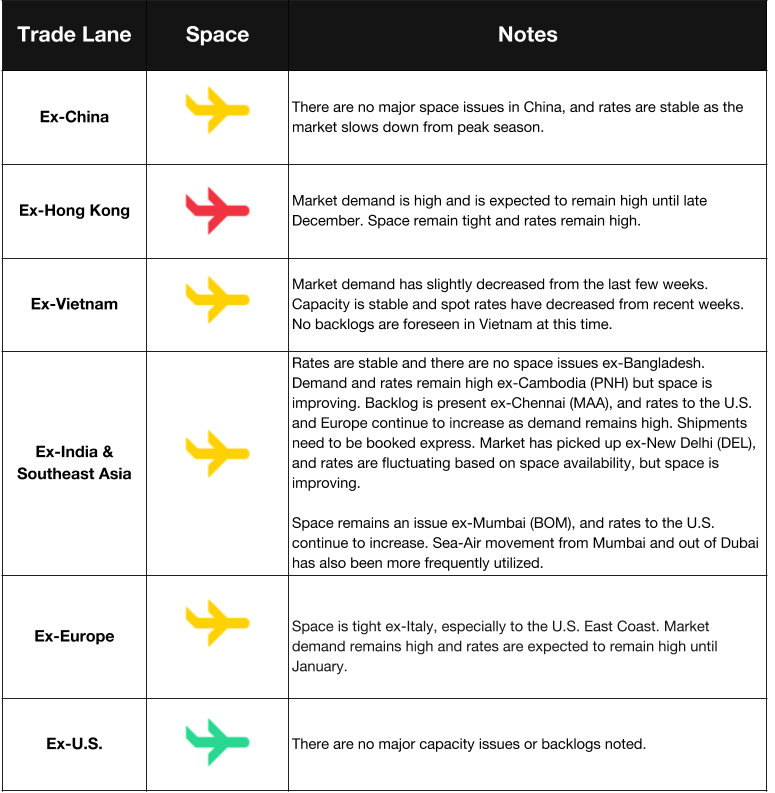

Air Freight Market Updates

Bangladesh Exports to be Shipped via India

A new truck service from Bangladesh to India’s Kolkata Airport allows goods to be shipped out of Bangladesh and flown to Europe out of India. A ban on direct flights from Bangladesh to Europe was only recently lifted, and congestion and security issues at the Bangladesh airport make this trucking service a better option. Bangladesh exports have increased since India allowed Bangladesh goods to be imported duty-free.

U.S. and UK to Maintain Open Skies

The U.S. and the UK have agreed to an Open Skies pact that will continue the air services currently allowed under the U.S. and EU Open Skies pact. After the UK leaves the European Union in March 2019, the U.S. and the UK will continue allowing transatlantic commercial passenger and cargo flights.It is uncertain what air agreements the UK will establish with other countries.

Trucking Market Updates

Tax Cuts and Jobs Act Encourages Truck Leasing

We’re likely to see an increase in trucking leasing instead of purchasing in the future. Purchasing trucking equipment is no longer as beneficial because the depreciation deduction was reduced to 21% from 35% in the Tax Cuts and Jobs Act of 2017, and new Financial Accounting Standards will increase the value of a leased asset.

LA Trucking Experiencing Congestion

The trucking market is tight as we near the holiday season. Vessel and terminal delays trickle down into trucking, and we’re likely to see longer dwell times at port, increased detention and demurrage charges, and frequent pre-pulls. The Thanksgiving holiday caused a backlog that is still being worked through, and many terminals at LA and Long Beach ports are experiencing a chassis shortage.

UK Trucking Faces Number of Critical Issues

The Road Haulage Association (RHA) warns that ignoring the current trucking problems will lead to disaster for the market in the future. A shortage of truck drivers, high costs to train new and younger drivers, and constricting regulatory practices are stifling the UK trucking market and will lead to a “catastrophic cocktail of disaster” if not addressed. Trucking currently needs to be booked 15 days in advance.

New: Customs and Trade Updates

U.S. and China Agree on Temporary Trade Truce

President Trump and President Xi Jinping met on December 1st to discuss trade for the first time since trade tensions began between the two countries, and the aluminum and steel tariffs were first implemented. They agreed on a truce, and any possibility of future increases is postponed until March 1st, 2019.

For more information on this and other trade war news, check out our weekly blog series, Tariff Insider_. _

USMCA Signed Although Obstacles Remain

The United States Mexico Canada Agreement (USMCA) was signed by each country’s president on November 30th, but still needs to be passed through the legislative bodies of each country for final approval. The Section 232 (steel and aluminum) tariffs must also be removed before Mexico or Canada will ratify the deal, and the agreement may not be passed through the Democratic majority of Congress. President Trump has also said he would repeal the North American Free Trade Agreement (NAFTA), which if possible would mean that the country return to a pre-NAFTA state.

Scrutiny on Origin Changes

U.S. Customs and Border Protection is heavily monitoring and auditing for any changes where an HTS code subject to the Section 301 tariffs changes from a country of origin of China to another country not subject to those tariffs. CBP is using the CEE’s (Centers of Excellence and Expertise) to test different importers within similar industries. Importers need to keep detailed records for any changes they make to their country of origin determination, because CBP will examine origin changes even after the tariffs are lifted.