Global Logistics Update

Market Update: March 28, 2018

Ocean, trucking, and air freight rates and trends for the week of March 28, 2018.

Market Update: March 28, 2018

Want to receive our weekly Market Update via email? Subscribe here!

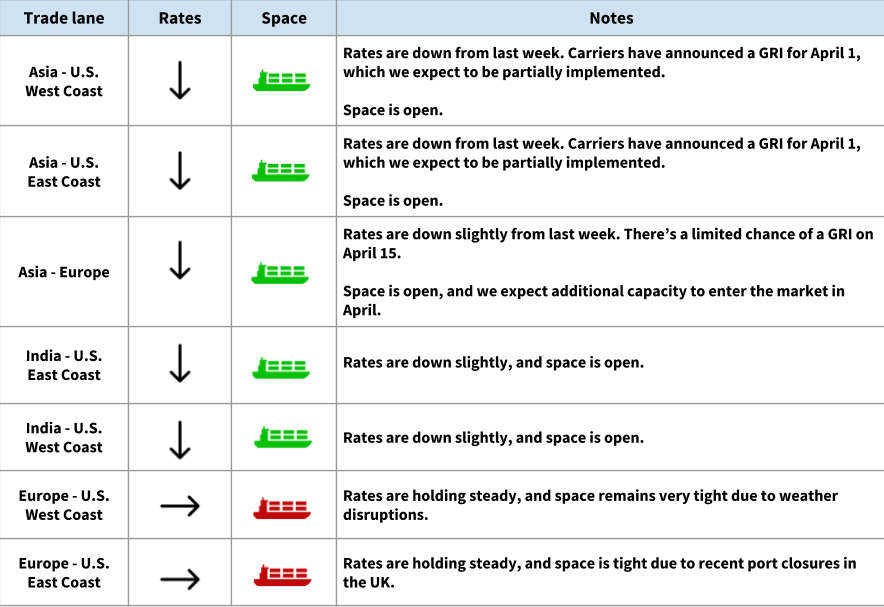

Ocean Freight Market Updates

Planned Steel & Aluminum Tariffs Could Fuel Asia-Oceania Trade

Carriers predict a 5 to 7 percent growth in demand for Asia-Australia-New Zealand trade in 2018, but this may increase as a result of U.S. planned tariffs. There’s potential for China to increase imports from Australia and New Zealand, as both are well positioned to “pick up any slack.”

**GRI Announced for April 1 **

There’s a GRI expected on April 1. Rates from Asia to the U.S. and from Asia to Europe are slightly down this week, while rates from Europe to the U.S. remain stable.

Europe-U.S. space remains tight due to weather disruptions and port closures. We expect space to remain tight for the next two weeks.

ONE Launches April 1

ONE (Ocean Network Express) will officially launch on April 1. The new line represents the integration of the three major Japanese carriers: MOL, NYK, and ‘K’ Line.

With this merger, ONE will represent about 16 percent of Far East - US Eastbound trade (if we’re looking at liftings share from May 2017 - January 2018, as reported by the Alphaliner).

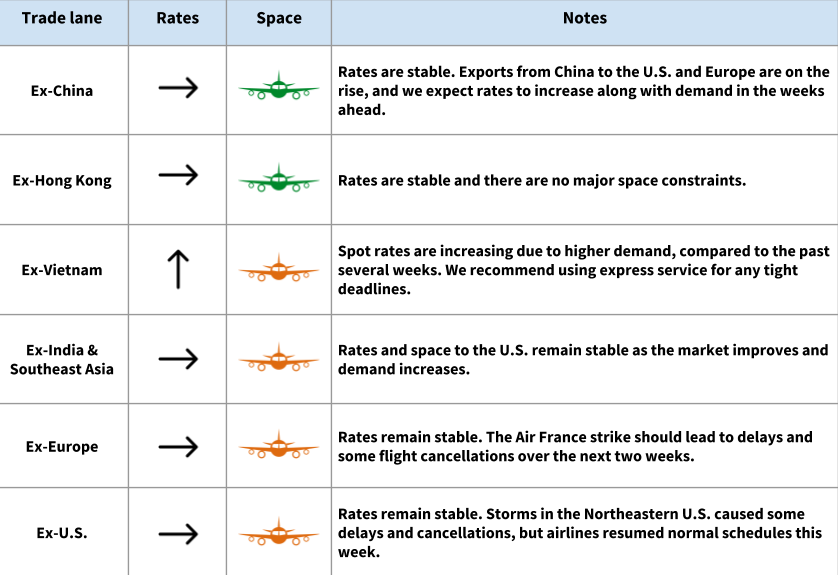

Air Freight Market Updates

Air Rates Remain Consistent

Rates remain consistent across trade lanes, with minor increases ex-Vietnam compared to the last several weeks. This market is also seeing increased spot rates as demand increases.

**Air France Strikes to Continue **

Air France employees are going on strike on Friday, March 30, and are expected to also strike on Tuesday, April 3, and Saturday, April 7. The airline was forced to cancel a quarter of its flights due to the strike on Friday, which left just 70 percent of its long-haul flights and 80 percent of the airline's medium-haul flights in operation.

The strikes should lead to additional delays and some flight cancellations.

Trucking Market Updates

Ports have slowed down a bit with Chinese New Year behind us, and there are no major issues or congestions.

ELD Mandate Enforcement to Begin April 1

Although the electronic logging device mandate officially went into effect on December 18 with a “soft enforcement,” the full ELD enforcement will begin on April 1. This mandate means stricter enforcement of federal hours-of-service rules through the use of GPS-enabled ELDs.

Drivers can be placed out of service for actions such as:

- Driving more than 11 hours a day within a 14-hour workday

- Using a logging device not registered with the Federal Motor Carrier Safety Administration

- Driving a vehicle that isn’t equipped with a required ELD

- Failure to produce data from an ELD to an authorized law enforcement officer

The ELD mandate will likely cause additional trucking rate increases when noncompliant truck drivers are placed out of service by law enforcement. Updates are also expected to negatively affect trucking productivity.

Ocean carriers expect that decreased productivity and rail ramp delays will also slow down chassis turnaround time.