Global Logistics Update

Market Update: May 23, 2018

Ocean, trucking, and air freight rates and trends for the week of May 23, 2018.

Market Update: May 23, 2018

Want to receive our weekly Market Update via email? Subscribe here!

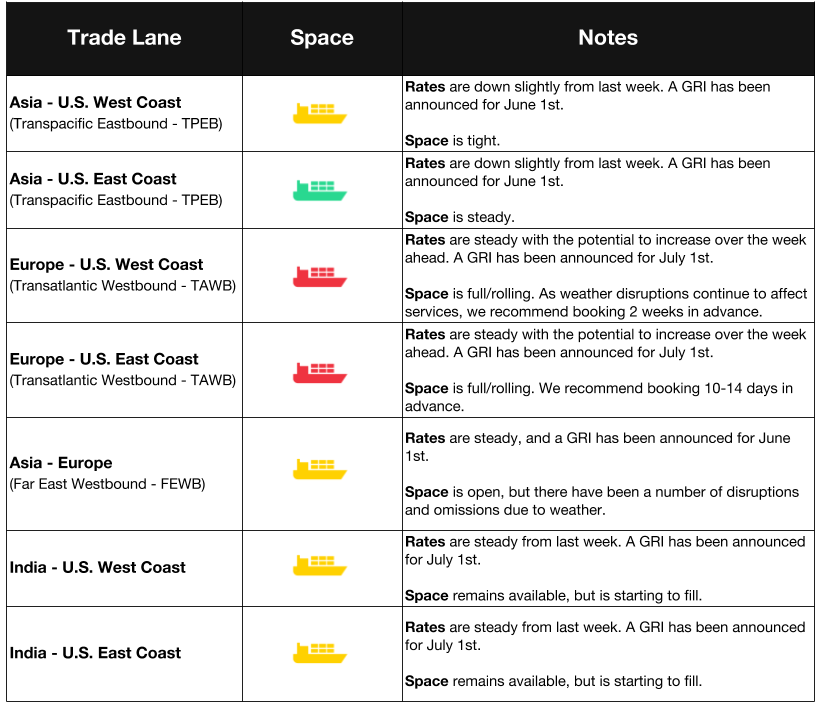

Ocean Freight Market Updates

Trans-Pacific Spot Rates Rise

Just in time for the summer-autumn peak season, Trans-Pacific spot rates made their first year-over-year gain of 2018. This is a sign that eastbound Pacific is returning to normal seasonal trends after two years of disruption.

Carriers on Asia-North Europe & Mediterranean Trades to Increase Rates

Due to the rising bunker fuel costs, unit costs have increased for carriers. According to IHS Markit, the price of ISO 380 bunker fuel jumped 21.4% since April.

As a result, carriers are quickly responding to get spot rates up to more profitable levels. Hapag-Lloyd announced that beginning on June 1st, it wants FAK levels to be $1,200 per TEU and $2,300 per FEU on the Asia-North Europe and West Mediterranean trades, and $1,750 per TEU and $3,400 per FEU on the Asia-North Europe and East Mediterranean routes.

Maersk to Add Trans-Atlantic Loop

Beginning July 2nd, Maersk Line will launch a new trans-Atlantic service. This will connect four ports in the Mediterranean with two in Canada. Aided by two new trade deals, the Comprehensive Economic and Trade Agreement (CETA) and the Comprehensive and Progressive Agreement for Trans-Pacific partnership (CPTPP), Maersk believes maritime container volume will grow by 7% in 2018.

Brazilian Customs Offices Hit With More Strikes

The National Union of Fiscal Auditors began a 30-day walk out on Monday, which will affect operations across all customs offices in the country. The union approved a continuous shutdown on May 7th, but “essential” services will continue to be provided.

A statement from the union says these efforts are linked to “non-compliance” with laws surrounding the regulation of workers’ rights. Please be aware that there may be delays for any freight moving through Brazil.

India - U.S. East Coast: New Service in June

Pacific South Loop (PS3), the first direct service from Northern India to the USWC, will begin in June.

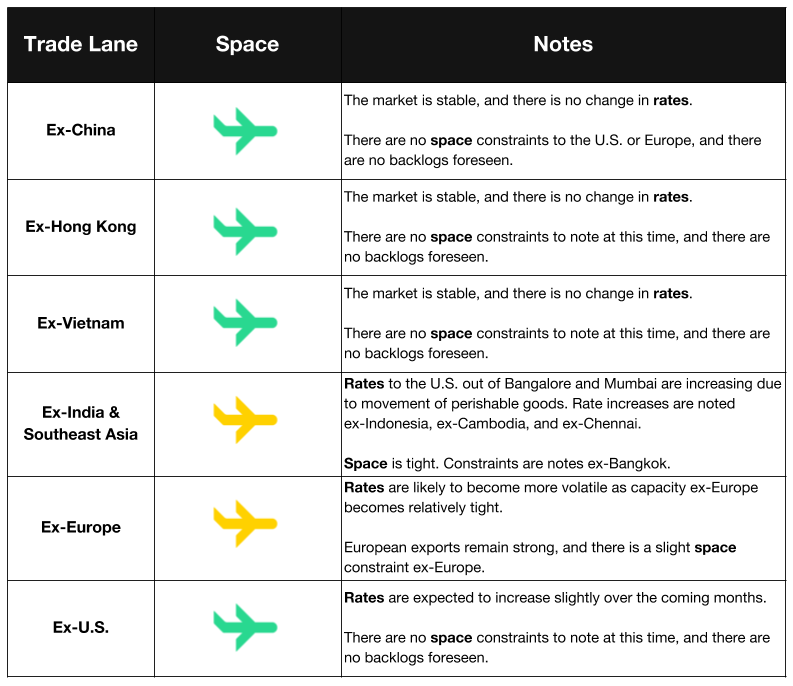

Air Freight Market Updates

Boeing Plans to Ramp Up Production of 767s

Betting on the air freight market, Boeing plans to increase production of 767s from 2.5 to 3 a month, starting in 2020. In a recent earnings call, Boeing's CEO Dennis Muilenburg said, “We do see long-term strength in the (air cargo) market.”

Air freight demand is growing at its fastest rate since 2010, the International Air Transport Association reports. The growth of e-commerce and temperature-sensitive goods has also benefited passenger planes, as they’re “filling their bellies with more cargo.”

Air Freight Demand Increases With E-Commerce Trend

According to a recent UPS study, online shoppers are increasingly looking to international vendors when shopping. The e-commerce trend places pressure on air freight, as shoppers look for fast delivery times. The increase in demand could lead to rate increases and capacity shortages.

Trucking Market Updates

Truck Drivers in Brazil Strike Over Rising Fuel Prices

ABCAM, the national truckers association in Brazil, said that 200,000 of the country’s 1,000,000 truck drivers are protesting the country’s rising diesel fuel prices. Fuel represents about 42% of the trucker’s costs, and the average price is up 16% from a year ago.

Truckers have blocked highways and urban traffic areas, affecting the transportation of a number of key global goods, including grains, meat, coffee, and sugar. There is no date set for the strike to end.

**Vancouver Rail Delays **

Rail dwell times are between 9-13 days in Vancouver. Please be prepared for delays, and plan shipments accordingly.

Trucking Capacity Eases in April

According to the DAT Freight Index, freight availability rose 32% in April. Despite this, flatbed, van, and reefer rates were up from March. Trucking shipments increased 2.1% month-to-month in April.

LA-LB Terminals Agree to Restructure PierPass Program

Agreeing to restructure the 13-year-old PierPass program, Los Angeles-Long Beach marine terminal operators will reduce the traffic mitigation fee to $31.52 per TEU, a 55% reduction.

Assuming the Federal Maritime Commission approves the restructuring, the new pricing will take effect in August 2018.