March 18, 2024

The Future of Carrier Alliances

The Future of Carrier Alliances

The puzzle of ocean container carrier alliances remains partially unsolved.

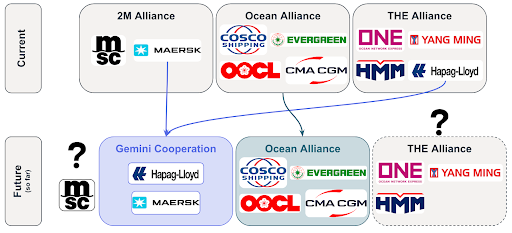

As a refresher, in January, Hapag-Lloyd and Maersk announced they will commence the Gemini Cooperation beginning in February 2025. The Gemini Cooperation will consist of vessels with 3.4 million TEUs of capacity focused on major east-west trades. This is a subset of the total vessel capacity the two carriers operate in aggregate which is about 6.1 million TEUs, or 22% of global container capacity.

Then in February, the Ocean Alliance, which was set to expire in 2027, announced they will extend their partnership through March 2032. The Ocean Alliance consists of CMA CGM, COSCO, Evergreen, and OOCL. Together, the Ocean Alliance members currently operate vessels with a capacity of about 8.4 million TEUs which is 29.6% of global container capacity.

This means the alliance puzzle is “solved” for six of the largest container carriers in the world, but leaves outstanding questions around MSC, other carriers in THE Alliance, and carriers that operate independently today. There is significant speculation around the strategy each of these carriers will take and where they will end up.

We believe there is a strong case for the biggest outstanding carriers to proceed independently instead of going with an alliance. MSC, for example, could use their vessel capacity as the largest carrier in the world with about 5.7 million TEUs or 20% of the global container capacity. They could still operationalize vessel sharing agreements (VSAs) with other carriers in specific sub-tradelanes and regions to boost asset utilization where needed.

With Hapag-Lloyd leaving THE Alliance in February 2025, there is now a large capacity gap the other members – ONE, Yang Ming, and HMM – will need to figure out. There are several options the carriers could pursue, including adding a currently independent carrier like ZIM or Wan Hai to THE Alliance, disbanding THE Alliance and teaming up with Gemini, Ocean Alliance, or MSC, or becoming independent and pursuing a strategy of vessel sharing agreements rather than an alliance.

Independent carriers like ZIM, Wan Hai, and Pacific International Lines are also on the playing field and may not necessarily remain independent.

Alliance Alternative: Vessel Sharing Agreements

One strategy that has gained traction among carriers is VSAs. VSAs are very similar to alliances in that they both aim to boost service coverage and operational efficiency. However, alliances are broader in geographical scope, have higher levels of operational integration and decision-making, and are longer term. On the other hand, VSAs are typically more tactical on certain routes and can be spun up and dissolved more easily. For these reasons, several carriers could use the smaller, purpose-built VSAs on specific lanes to optimize vessel utilization, reduce costs, and maintain agility.

The Takeaway

While the future remains uncertain, we expect many carriers to increase the usage of targeted vessel sharing agreements in their networks. For shippers, this means you'll have the option to purchase a greater variety of services. This is important as you should always have a diverse portfolio of transportation providers and freight forwarders as part of a resilient supply chain. For any questions related to these service changes, please reach out to your Flexport account manager who can help you build the best modal strategy for your supply chain.

To learn more about these carrier network changes and how you can plan ahead, be sure to to sign up for Flexport’s Freight Market Update Live webinar on April 11.

The contents of this blog are made available for informational purposes only and should not be relied upon for any legal, business, or financial decisions. We do not guarantee, represent, or warrant the accuracy or reliability of any of the contents of this blog because they are based on Flexport’s current beliefs, expectations, and assumptions, about which there can be no assurance due to various anticipated and unanticipated events that may occur. This blog has been prepared to the best of Flexport’s knowledge and research; however, the information presented in this blog herein may not reflect the most current regulatory or industry developments. Neither Flexport nor its advisors or affiliates shall be liable for any losses that arise in any way due to the reliance on the contents contained in this blog.