PRODUCT CLASSIFICATION

Master the Codes. Level Up

Your Supply Chain.

Your HS codes determine your compliance, your admissibility, and which supply chain advantages you can capture. See how precision classification can protect your finances and unlock greater strategy.

Set Up Your Records in Record Time

Flexport Customs can classify up to 500 new SKUs in three days; up to 2,000 in a week or 20,000 in a month. Codes then follow goods in the Flexport Platform. Ship with someone else? We’ll still help, just as fast.

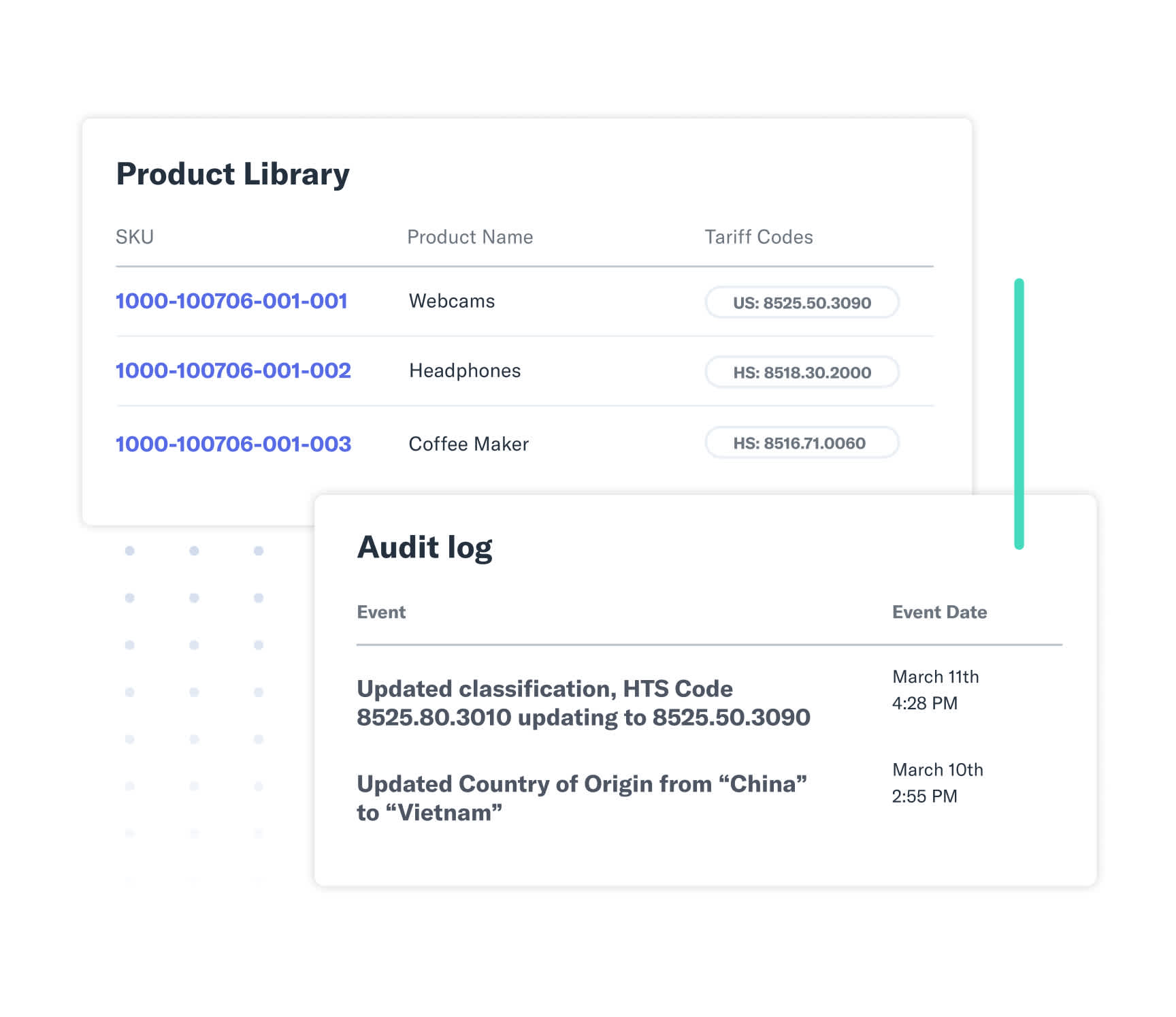

Get a Close Read on Your Product Library

Flexport Customs' brokers can assess your product catalogs and recommend the codes that are most favorable and still 100% compliant. Fix risks, now or from history, amend submissions, or reduce duty exposure.

Decode the Rules as Codes Change

Rules, regs, and product specs can change. When they do, so could your product codes. And your compliance programs. And your FTA eligibility. Secure all the trade benefits you can with astute solutions for change.

FLEXPORT PLATFORM

A Few Digits Can Make a Big Difference

The HTS codes in your Flexport Product Library are used for total transactional consistency. Data is structured to advance trade strategy: With the right eyes on it, your six to ten-digit codes could reveal six-digit or higher financial opportunities.

TARIFF ENGINEERING

Minor Product Changes Major Duty Reductions

Should that pocket move down, that piece of glass curve? Tariff engineering is the genius practice of modifying products to satisfy import classifications at a lower duty rate. Tweak a little, save a lot.

BLOG

Can You Engineer Lower Duties? Yes, if You Can Find the Customs Codes

Rules don’t have to be broken to lower or limit duties. Certain circumstances allow for tariff engineering, shaping the design of goods for better duty rates.

Frequently Asked Questions

Go Further

Sign Up for Global Logistics Update

Why search for updates when we can send them to you?