March 16, 2023

Tariff Engineering: Lower Duties Are Possible if You Can Find the Right Customs Codes

Tariff Engineering: Lower Duties Are Possible if You Can Find the Right Customs Codes

Simple steps are often the best place to start developing even the most complex of processes—for example customs compliance strategy.

Customs compliance starts with ensuring accurate product classification. An effective customs strategy, however, looks deeper under the hood at the classification engine, diving into the nuances of how products are classified to identify cost-saving opportunities—a process known as tariff engineering.

Whether classifying for the first time or looking to optimize your classification strategy, the journey begins by understanding the tariff codes in the sprawling resource known as the Harmonized Tariff Schedule of the United States (HTSUS).

What Is the Harmonized Tariff Schedule?

Think of the Harmonized Tariff Schedule of the United States (HTSUS or HTS) as the Rosetta Stone for U.S. import classification. Actually using it to translate your product to the right numeric code, however, can be complicated.

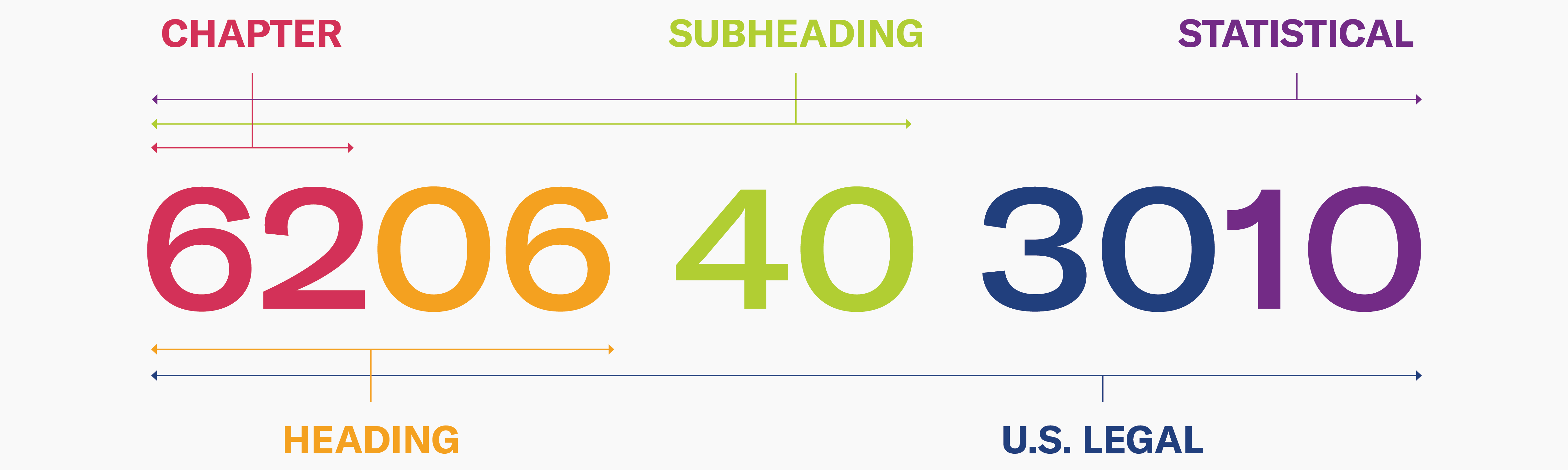

The HTSUS is based on the international Harmonized Commodity and Description System (Harmonized System, or HS). The HS was designed as a “core” product classification system, and standardizes the first six digits in the tariff schedules of over 200 countries. At the international level, the structure of the HS consists of approximately 5,000 article descriptions organized as headings and subheadings. These descriptions are arranged into 97 chapters, grouped into 21 sections—and that’s what forms the basis of the HTSUS.

The HTSUS expands on these first six digits by adding U.S.-specific article descriptions, first at the 8-digit “legal” subheading level and then the 10-digit “statistical reporting” level—totaling roughly 19,000 potential HTS codes.

Generally speaking, it’s the 8-digit legal classification that determines your base duty rate on any good imported into the U.S.—but compliance matters down to all ten digits. To the trained eye, a 10-digit HTSUS code reveals a customs description and a duty rate. But to the trade compliance expert, knowing that 10-digit classification is just the starting point to understanding complex customs risk—and to identifying opportunity.

At the Chapter, Heading, and Subheading levels, duty mitigations opportunities exist—but only for those importers who know where to look.

Optimizing Classification Codes with Tariff Engineering

Tariff engineering is the design and manufacture of a product’s characteristics specifically to qualify for a lower tariff rate than might otherwise have applied.

Tariff engineering has been an importer sweet-spot since the 1800’s, when the Supreme Court found that changing the characteristics of certain sugar imports was a legal means to alter the classification and duty rate. In the years since, strategic importers have reaped enormous benefits by undertaking purposeful product design and manufacturing changes to uncover duty savings.

And many prominent U.S. retailers continue to reap the benefits of tariff engineering. Shoe maker Converse, for instance, added felt on the bottom of their sneakers, shifting the product classification from footwear to slippers—resulting in duty savings of 25-30 percent plus. Or take Columbia Sportswear, whose chapstick pocket is not only a saving grace at high altitudes—it’s also the result of an effective tariff engineering strategy. Columbia was importing blouses without a pocket below the waist, and thus paying a 26.9% duty. When a clever trade compliance professional pointed out that blouses with a pocket below the waist were subject to a lesser 16% duty rate, the company took notice—and realized serious savings.

Finding Your Opportunity

Tariff engineering can mean serious duty savings—but those savings can only be realized when the trade compliance team joins forces with the product design team.

While legitimate tariff engineering is fully permissible, it is not without some risk. Importers can hedge against potential customs delays or challenges by submitting a binding ruling request for potential product changes. Turning a classification dream into a reality, however, takes cooperation across business functions and close consultation with your customs advisors.

Effective tariff engineering is comprised of three main elements:

Step 1: Know Your Product.

Review your product design, composition, sourcing, and manufacturing with your product teams. Use those details to review your current product classifications with a trade compliance professional.

Step 2: Know Your Opportunity.

Simply knowing that there are HTS codes subject to lower duties isn’t enough. Recognizing how Customs interprets the differences among those codes is the key to unlocking tariff engineering opportunities. In addition to the HTSUS, the savvy importer knows where to look for interpretive guidance:

- Explanatory Notes (ENs)

These are the official interpretation of the tariff at the international level, and are treated as persuasive evidence by U.S. Customs when defending a product classification. - CROSS Rulings

Binding rulings issued by Customs on the classification of similar products can suggest acceptable and commercially practicable product changes. - Informed Compliance Publications (ICPs)

Product-specific ICPs explain the nuances of classification for complex commodities and can illuminate minor changes needed for classification shifts.

Step 3: Know Your Process.

Once your trade compliance team has identified an opportunity, coordination with product development and design is crucial to ensuring you are remaining both strategic and compliant.

Flexport Can Help Level Up Your Customs Game

Savvy classification is the first step in upgrading your customs strategies to your advantage. For expert help classifying your goods or identifying tariff engineering opportunities, reach out to classification@flexport.com.

Or, to see a panel discussion on how to choose a broker, view our past webinar, Customs Broker RFP Process: The Do’s and Don’ts.

Related content

![Dave TPM header 1600x800]()

BLOG

Building the Future of Supply Chain: Key Takeaways from Flexport CEO Dave Clark’s Remarks at TPM