Global Logistics Update

Market Update: October 25, 2017

Recent news and updates related to the ocean and air freight market for the week of October 25, 2017.

Market Update: October 25, 2017

Want to receive our weekly Market Update via email? Subscribe here!

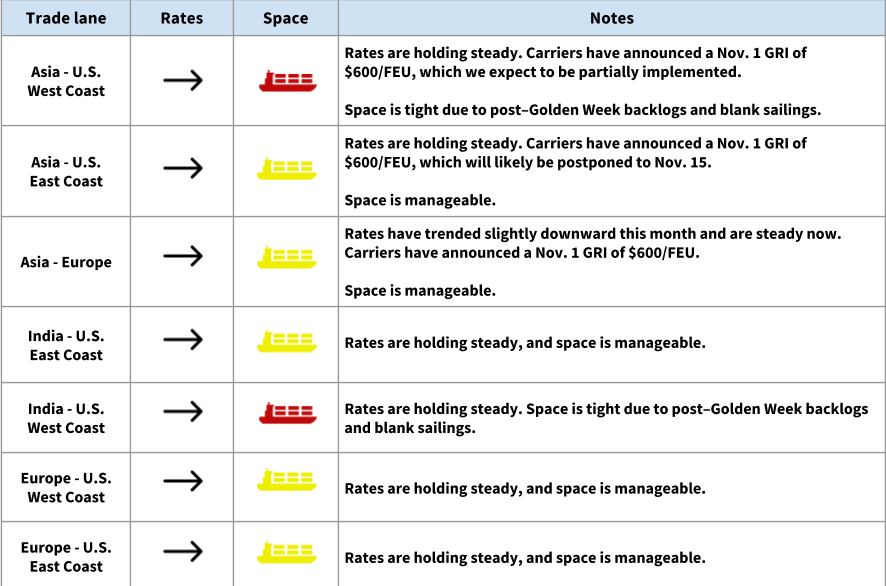

Ocean Freight Market Updates

GRI announced for November 1

Rates from Asia to the U.S. have been trending slightly downward since September 1. Carriers have announced a November 1 GRI of $600/FEU, which we expect to be partially implemented to the USWC. The GRI will likely be postponed to Nov. 15 for the USEC.

Rates will increase in advance of Chinese New Year

Starting in mid-December, we’ll see rates begin to go up in anticipation of Chinese New Year. This will constrain space, too. Expect more GRI announcements for December and January.

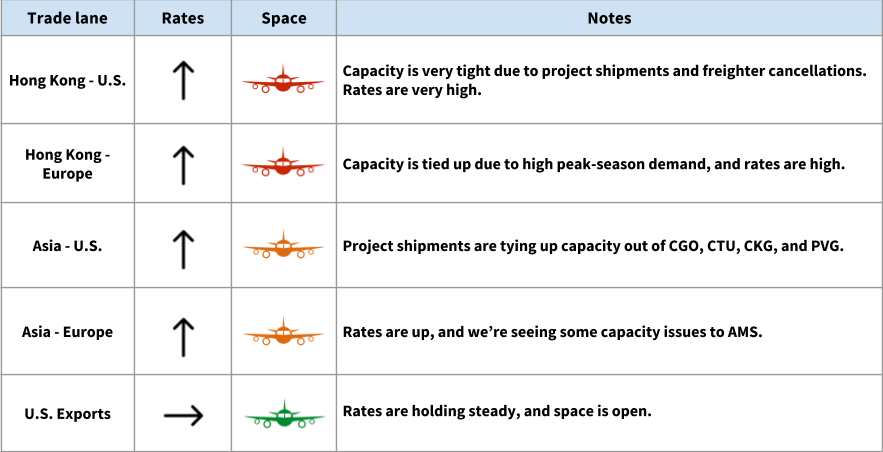

Air Freight Market Updates

We’re in peak, but rates will rise further

Air rates are high -- as they have been for months -- and we expect them to rise further in the coming weeks. There will be a “super-peak” in November, with higher rates and even tighter capacity.

**Space is very, very tight **

Demand has been high for months, but capacity is extremely constrained now -- exacerbated by the generally high demand of peak season, and by huge project shipments from a number of enterprise companies.

Book early, and book direct flights for urgent shipments

Book your air shipments as far in advance as possible! For urgent shipments, you should also consider booking direct flights. It's more expensive, but direct flights will avoid potential delays at transshipment airports.

Capacity on passenger planes will dip next month

At the end of October, passenger airlines in China will change from their summer to winter schedules, which will lead to anywhere from a 30-50% reduction in weekly flights as they enter slow season.

The iPhone launch will affect rates and space out of China

The November launch of the iPhone will drive up rates further, and will constrain space even more. The impact may continue to be felt as late as January.

Another fuel surcharge increase for cargo out of Hong Kong

Air carriers have announced another fuel surcharge increase for cargo ex-Hong Kong. Beginning November 1, the fuel surcharge will be $0.16/kg, up from $0.09/kg.

AMS capacity issues

Due to airport capacity constraints and increasing demand for passenger air travel, AMS has canceled slots for some freighters. Many are re-routed to other EU airports, and there is still capacity available on passenger planes.

Other Freight Market Updates

Rates are up in regions receiving FEMA aid

FEMA is still shipping supplies in some areas, and the urgency of their shipments drives up FTL rates.

**Fuel tax increase in California **

As of November 1, California will increase its diesel tax to 36 cents per gallon (this is a 20-cent increase). We expect FTL and LTL providers to increase their rates as a result, and we may also see an increased fuel surcharge rate for California drayage providers.

Driver shortages will drive up costs

In an effort to retain drivers, many larger FTL carriers are increasing driver pay. This will increase costs overall if you’re moving cargo with large FTL carriers.

The ELD mandate is approaching

Beginning December 18, truck drivers will be required to utilize Electronic Logging Devices (ELDs). This will change the game for long-distance trips, and after implementation, we’ll see a slight increase in rates across the market.