Global Logistics Update

Freight Market Update: February 27, 2019

Ocean and air freight rates and trends; trucking and customs news for the week of February 27, 2019.

Freight Market Update: February 27, 2019

Want to receive our weekly Market Update via email? Subscribe here!

⚠️Reminder Notices ⚠️

LA and NY Trucking Still Experiencing Congestion

Congestion at the ports of Los Angeles/Long Beach has eased up some after Chinese New Year, but delays are still longer than usual. New York and New Jersey ports are still heavily congested, which is expected to be made worse by severe winter weather.

UK Ports Remain Extremely Congested

UK ports are very congested, which is causing tight trucking capacity and a decline in port productivity. Quay side operations have improved, but a shortage of haulage capacity restricts movement.

Haulage capacity in Germany and the Benelux also remains a challenge, impacted by low water in the river Rhine, reducing intake of barges and increasing moves via rail and truck.

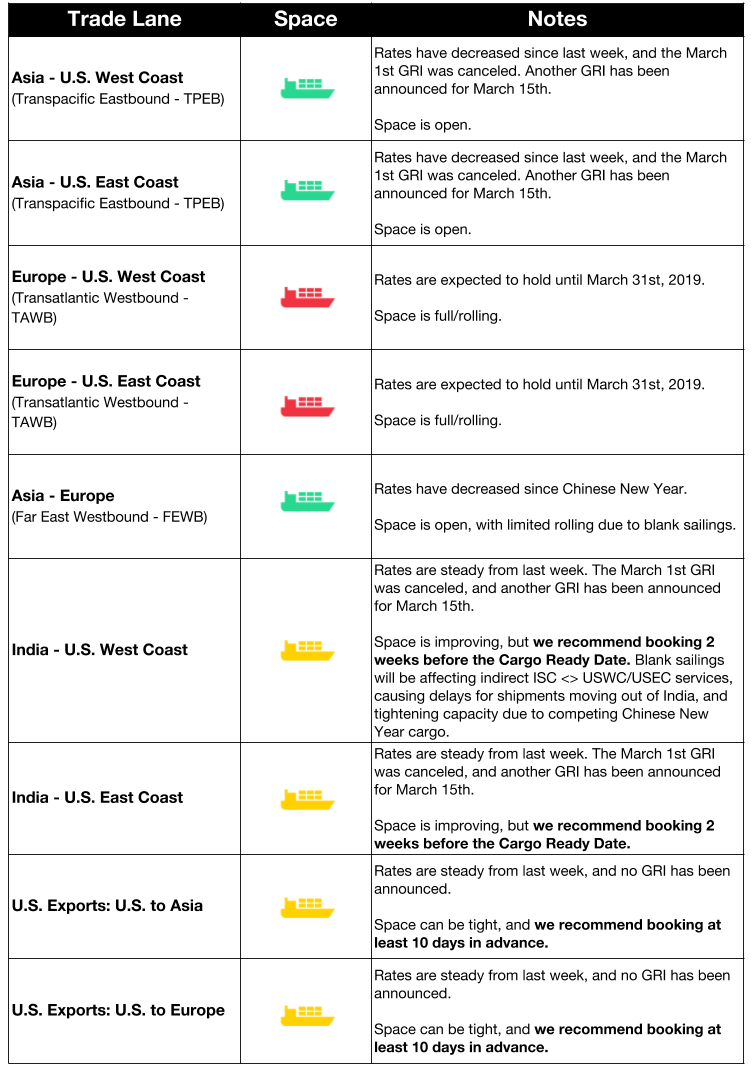

Ocean Freight Market Updates

Chinese New Year Blank Sailings Announced

A number of blank sailings have been announced surrounding Chinese New Year. More information and a list of the affected ports and strings is available on our blog.

**Port of Oakland to Expand **

The Port of Oakland is planning on accommodating more mega-container vessels in the future, and is adding three more cranes in late 2019 in preparation. When ports can expect to start seeing these large vessels is not yet determined, but ports are anticipating seeing these vessels start to dock in 2-3 years.

Port of Tilbury to Build Terminal

The UK’s port of Tilbury will build a multi-million pound terminal across its current site on the Thames. The new terminal will increase capacity and is expected to double cargo volume over the next 10-15 years.

Impact of New IMO ECA Regulations

The International Maritime Organization (IMO) has mandated under new Emission Control Area regulations that by 2020, all merchant vessels must reduce their sulfur emissions from 3.5% to 0.5%.

Whether they install scrubbers, build new vessels, or use higher-quality fuel, carriers will need to make significant changes to comply with the new regulations, and those changes will come at a cost to shippers. Freight rates may climb between now and 2020 as a result.

For an in-depth look at the regulation and how to prepare, read our blog post: IMO 2020: What Shippers Need to Know Now

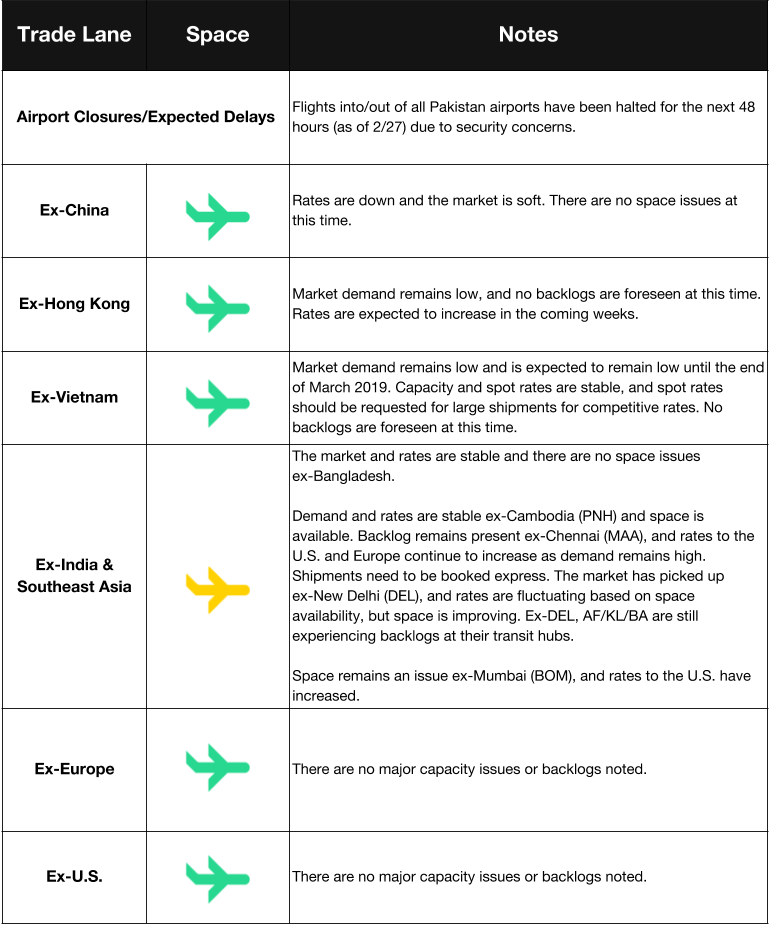

Air Freight Market Updates

Brexit Air Contingency Plans

The private air sector has set up contingency plans in the event of a no-deal Brexit and will offer air services in case the the trucking industry across the English Channel is disrupted. Capacity overall is being ramped in preparation of Brexit.

Pakistan Flights Halted

Pakistan has closed its air space following tensions with India, causing Emirate and Qatar Airways to suspend flights beginning on February 27. Flights that fly between Pakistan and India have been forced to a temporarily reroute.

Trucking Market Updates

Irish Trucking to Seek Aid

The Irish haulage industry is planning to seek support from the Irish and European Union governments if Brexit causes delays and damages to the industry. Post-Brexit customs procedures will likely cause delays at the border, and the industry expects compensation for the associated business losses.

Amazon Advising UK Sellers to Prepare for Brexit

Amazon is advising its FBA sellers to stock up with at least four weeks worth of inventory in case the UK leaves the EU in March without a trade deal in place. Delays in trucking and customs clearance are expected in the event of a no-deal Brexit, and the resulting longer shipping times may make UK products less competitive. Sellers are advised to have additional stock imported by March 17th.

Customs and Trade Updates

Blockchain Testing Results Released

The Commercial Customs Operations Advisory Committee (COAC) released a document on some of the blockchain testings they've performed on NAFTA and Central America-Dominican Republic Free Trade Agreement (CAFTA) entries. The tests, done by DHS and CBP along with CBP auditors, import and entry specialists, CBP legal and policy personnel, importers, technology companies, and suppliers tested the feasibility of the certificate of origin transfers. The results were very positive as blockchain technology is a much more efficient and expedited process. The next testing scheduled will facilitate the tracking of IPR rights in late 2019.

FDA Enhancing Screening and Enforcement

The Food and Drug Administration released a statement on the plans and strategies to modernize the tools to ensure food safety on imported products. It isn’t creating new rules, just updating and finding better ways to implement the ones it already has in place. The FDA wants to put a strong emphasis on the Foreign Supplier Verification Program (FSVP) by using the data it has to implement more safeguards through defining risks based more on analysis than happenstance. It also wants to improve screening equipment and testing systems to make them less labor-intensive.

For a roundup of tariff-related news, read to our Tariff Insider.