Global Logistics Update

Freight Market Update: August 29, 2018

Ocean, trucking, and air freight rates and trends for the week of August 29, 2018.

Freight Market Update: August 29, 2018

Want to receive our weekly Market Update via email? Subscribe here!

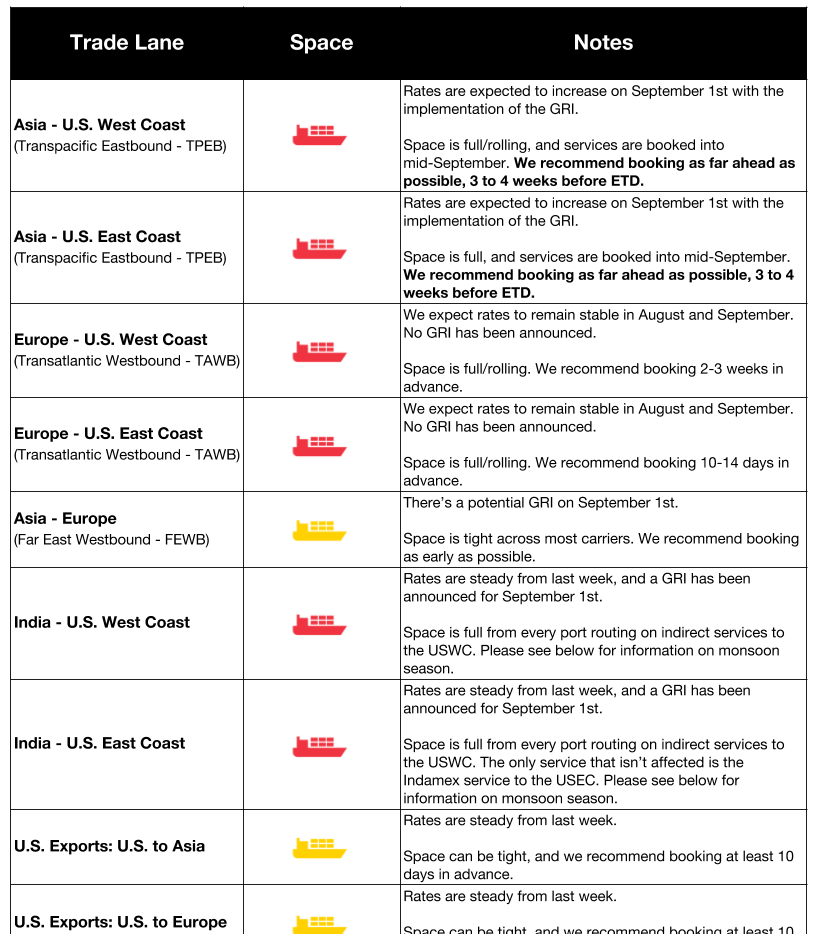

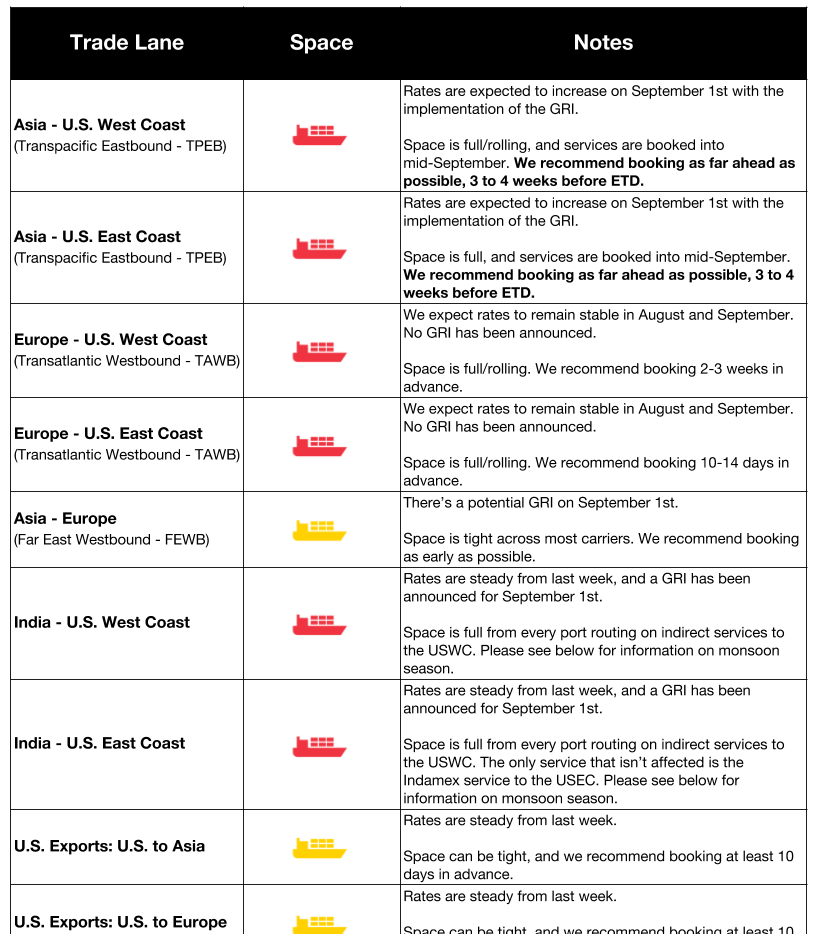

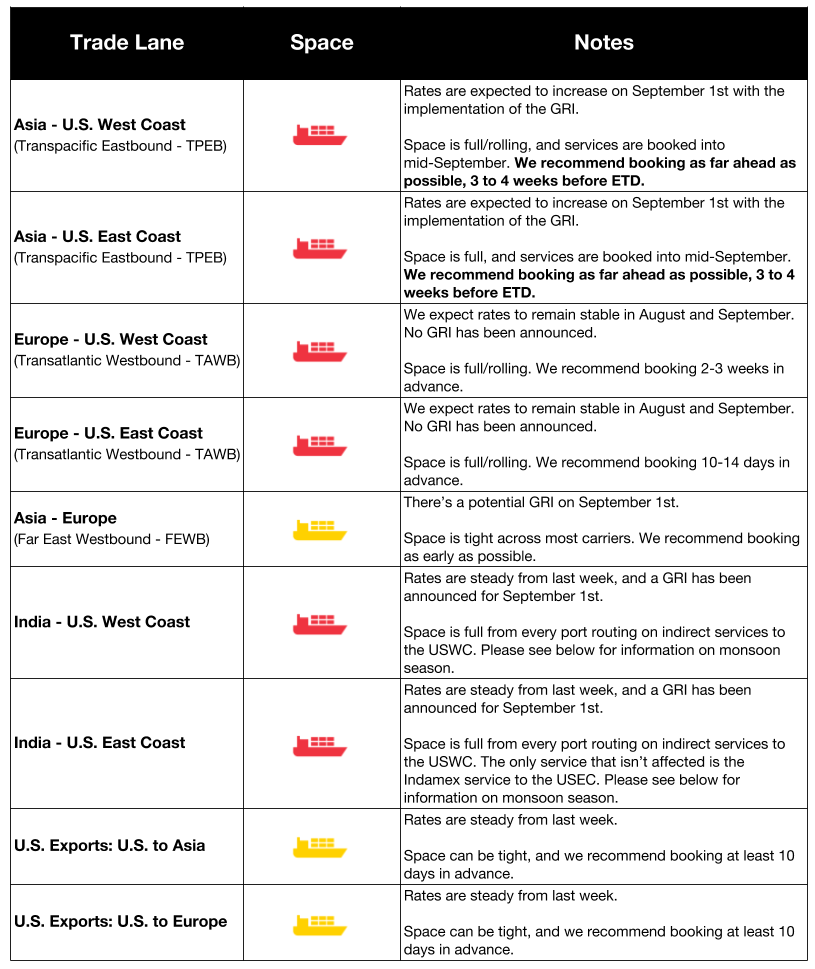

Ocean Freight Market Updates

**Despite Stable Capacity, Ro-Ro Sector Remains On Guard **

The roll on, roll off (ro-ro) sector remains on guard due to factors such as threatened tariffs, depressed freight rates, and looming IMO 2020 emissions regulations, reports JOC.

Overbooked Ships Cause Thousands of Containers to Roll

U.S. importers are having a more difficult time this year getting their cargo on ships due to the very low capacity. JOC reports, “The eagerness of carriers to capitalize upon an early surge in cargo resulting from importers’ panic over Trump administration tariffs, typhoons in Asia, and a calculated reduction in capacity, is fraying relationships with customers.”

We recommend booking shipments as early as possible to guarantee space.

India’s Monsoon Season is in Effect

Monsoon season is in effect from June through October:

- We highly advise shrink wrapping all FCL/LCL pallets and cartons that may be prone to being affected at the time of origin stuffing

- Expect vessel delays/port closures due to weather constraints

- Indian POL’s that receive the most rainfall are Chennai, Tuticorin, and Kochi

Peak Season Came Early This Year

U.S. import volumes are increasing ahead of the holiday retail season for a number of reasons, including:

- Capacity cuts and service changes

- Tariff deadlines

- Slow Q1 & Q2

Read the full analysis from Flexport’s VP of Ocean Freight here_. _

**Trans-Pacific Peak Season Sees Higher Rates **

U.S. importers shipping in trans-Pacific should expect higher rates, as peak season has caused very low capacity on most ships. As JOC reports, “Ocean carriers in certain cases are holding the line on weekly minimum quantity commitments (MQC) as they have done in prior periods of tight capacity, meaning that any given shipper will be allocated only one week’s worth of capacity out of its total annual MQC.”

**TPEB Services Are 3-4 Weeks Out **

TPEB services are three to four weeks out, and we recommend booking at least 14 days in advance of the cargo ready date. Carriers are continuing to announce blank sailings and canceling services, which will likely lead to a tightening of the market and an earlier onset of peak season.

Impact of New IMO ECA Regulations

The International Maritime Organization has mandated under new Emission Control Area regulations that by 2020, all merchant vessels must reduce their sulphur emissions to 0.5% from 3.5%.

Whether they upgrade their vessels or their fuel, carriers will need to undertake significant changes to comply with the new regulations, and those changes will come at a cost to shippers. Rates may climb between now and 2020 as a result.

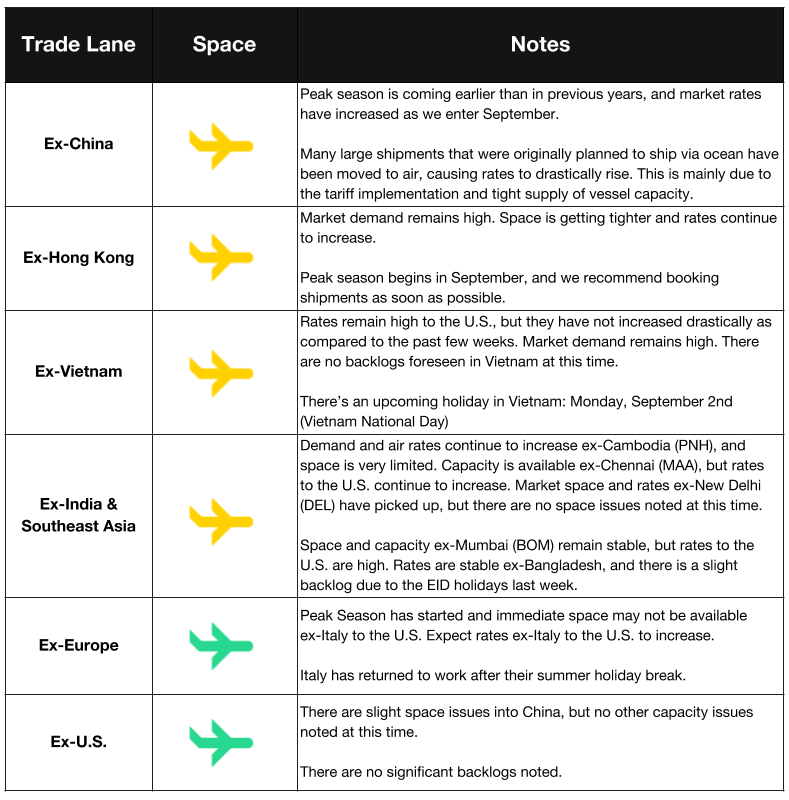

Air Freight Market Updates

Trade Dispute Hasn’t Yet Affected Peak Season Expectations for Air Freight

Air cargo expectations are still high for the “second half and into the end-of-year peak season” as the strong demand seen in the first six months is expected to continue. According to the JOC, volume has been steadily increasing in the east-west trades.

While trade relations may affect how goods move in the near future, there hasn’t yet been any change in consumer behavior.

Trucking Market Updates

Early trans-Pac Peak Means Higher Truck Rates Ahead

JOC reports that the early peak shipping season could mean earlier-than-usual rate increases for truck and intermodal shipments in the U.S. As capacity tightens and rates increase, we recommend booking shipments as early as possible.

U.S. Businesses Feel the Effects of Low Trucking Capacity

As factories ramp up production to meet the needs of the fast-growing U.S. economy, many businesses report that it’s been very difficult to find trucking capacity in the current market. This is affecting companies to the point of cutting their full-year earnings reports, as they know they won’t be able to move product as previously expected.

**U.S. Truckload Carriers Predict Even Tighter Capacity Ahead **

With no indication that freight demand is slowing down anytime soon, trucking carriers are experiencing rapid revenue growth. As a result, shippers who don’t book in advance may be out of luck when looking for capacity.

**Big Rigs Get an Update Aimed at Efficiency **

Trucks are getting “smarter” as companies upgrade to new technology. From new tires to advanced navigation and communication systems, companies are looking for avenues to improve efficiency and lower the cost to serve.

Heavy-duty trucks are leveraging the internet to pull data from trucks with the goal of improving transit times and reducing the rate and impact of human errors. While the cost of upgrades can seem high, companies report that they’re saving money in the long run.