Global Logistics Update

Freight Market Update: January 15, 2020

Ocean and air freight rates and trends; customs and trade industry news for the week of January 15, 2020.

Freight Market Update: January 15, 2020

Want to receive our weekly Market Update via email? Subscribe here!

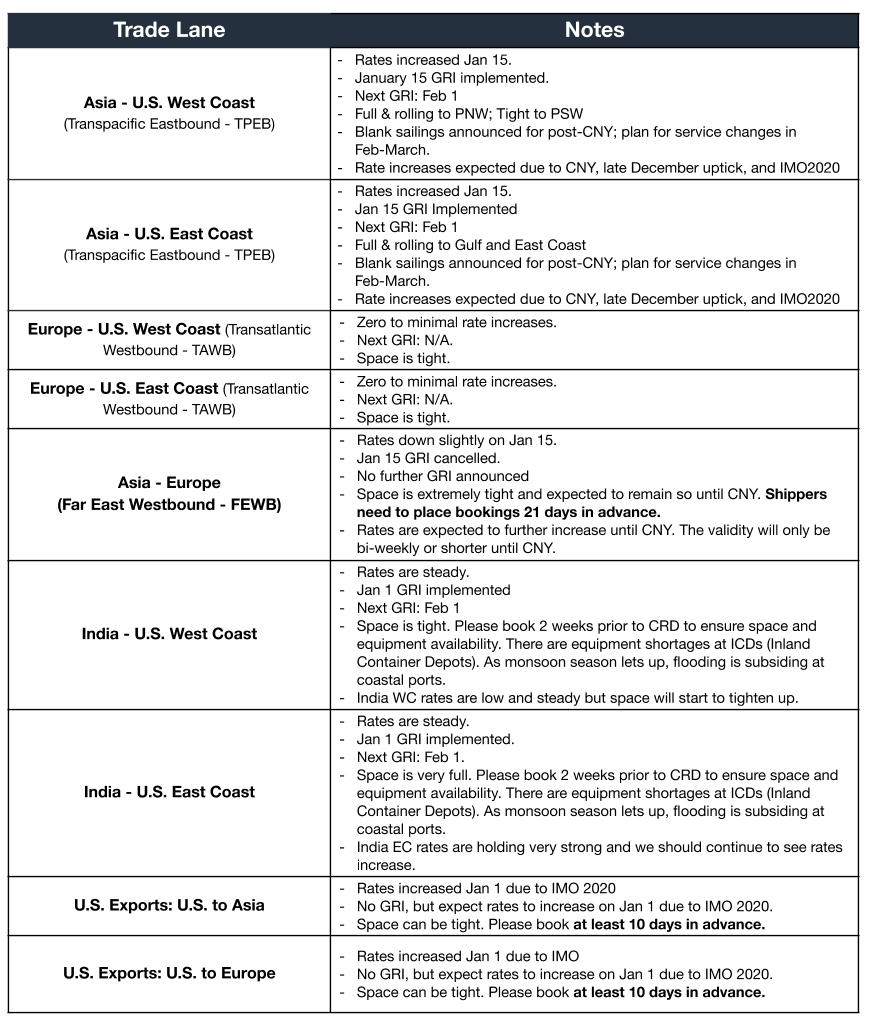

Ocean Freight Market Update

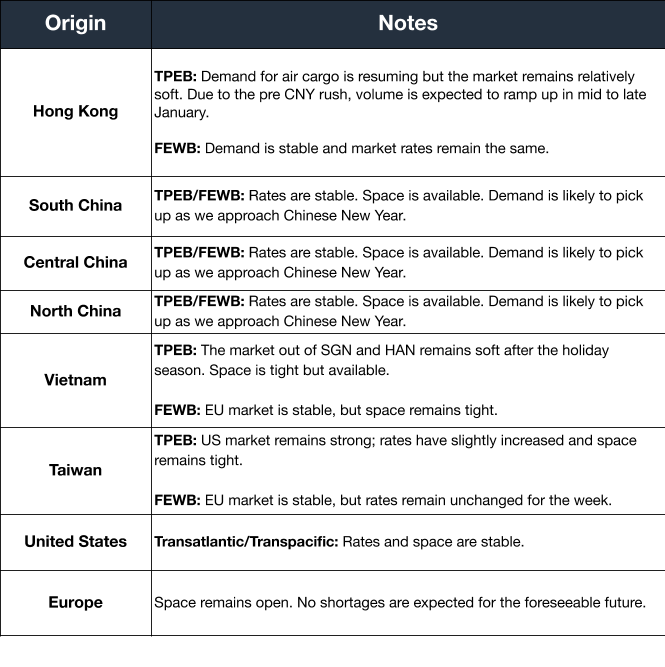

Air Freight Market Update

Freight Market News

US Bike Makers Struggle to Replace Chinese Supply Chains The Phase 1 trade deal signed by the US and China today leaves the 25% tariff on bikes and many other products from China. The difficulty of sourcing bicycles from outside China will be familiar to many industries, according to Reuters, which cites a Cowen & Co. survey showing only 28% of North American companies had moved supply chains away from China.

Carrier Overcapacity Will Continue in 2020 New research predicts that supply will continue to surpass demand in container shipping this year. New ships are likely to add 1.2 million TEUs, with about half of those on ultra large container vessels (ULCV), according to American Shipper. Conversely, even if blank sailings equal or surpass the 253 recorded in 2019 (up from 145 in 2018) while hundreds of ships stop sailing to be fitted with scrubbers, surplus supply should give freight buyers a pricing advantage in 2020.

Meanwhile, this week, Flexport Chief Economist Dr. Phil Levy noted the following economic highlights:

- US Job Market Moderation. Nonfarm payrolls increased by 145,000 jobs in December, slightly below expectations. The unemployment rate remained at a very low 3.5%. One closely watched indicator of whether the economy is overheating, wage growth, came in at an annual 2.9%. That figure was below expectations and the first reading below 3% since mid-2018.

- World Bank Gloom. In its Global Economic Prospects report, the Bank estimated global growth at 2.4% in 2019, the lowest level since the global financial crisis. That, and the prediction of 2.5% for 2020, were downward revisions from previous estimates.

- The report also lamented a broad-based slowdown in labor productivity growth—a key determinant of living standards. It warned of rapid global debt buildup, of the sort that usually brings financial crises in the developing world.

- China Phase One Deal Signing. As expected, a Chinese delegation will be coming to Washington this week to sign the trade deal that has been bruited since October. In two less-anticipated developments: China purchased Brazilian soybeans, casting further doubt on ambitious agricultural targets in this week’s deal; and President Trump said he may wait to conclude Phase Two until after the November election. That delay would leave 25% or 7.5% Section 301 tariffs in place on well over half of U.S. imports from China.

- An academic study updated earlier work to confirm that the cost of the China tariffs is falling almost entirely on U.S. consumers and businesses.

- An academic study updated earlier work to confirm that the cost of the China tariffs is falling almost entirely on U.S. consumers and businesses.

Customs and Trade Updates

MTB Petition Process

The International Trade Commission (ITC) received more than 4,000 petitions for reduced duties under the Miscellaneous Tariff Bill. The next step is the public commenting phase, where comments can be submitted between January 10 and February 24 for the ITC to consider. Feedback must be filed through its portal. Once the comment period closes, the ITC will compile a final list and submit it to Congress for approval in the fall of 2020.

CBP Releases 2020 Calendar and Updates its User Fees

Customs and Border Protection (CBP) sent a Cargo Systems Messaging Service (CSMS) message listing the Federal Holidays that will be observed during the 2020 calendar year. In addition, it updated its user fees page to reflect all fees, outside of duties in connection with import or export of goods from the US.

**For a roundup of tariff-related news, visit Tariff Insider