Global Logistics Update

Freight Market Update: March 11, 2020

Ocean and air freight rates and trends; customs and trade industry news for the week of March 11, 2020.

Freight Market Update: March 11, 2020

As the WHO declares COVID-19 a global pandemic, the effect on supply chains deepens even as China may be showing progress in its human and economic health. To help you plan your response, Flexport publishes a weekly blog by our Chief Economist focused on how the virus affects supply chains and economies.

Want to receive our weekly Market Update via email? Subscribe here.

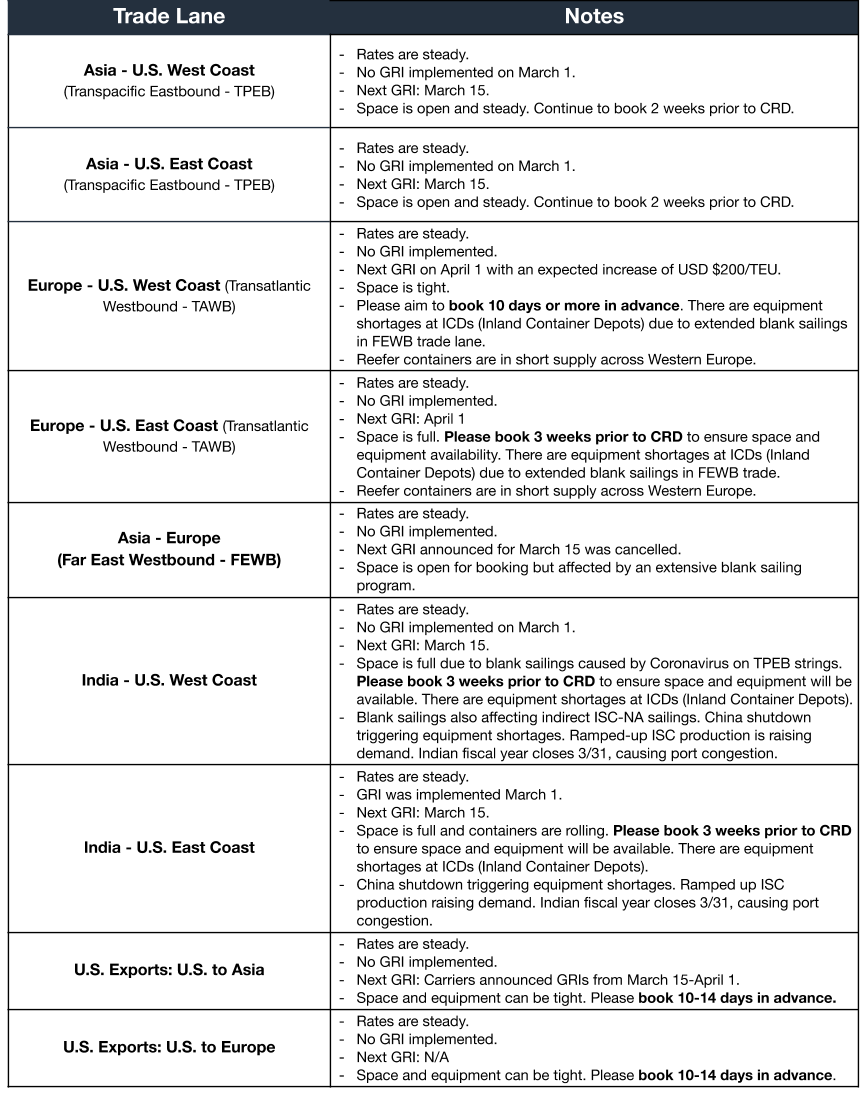

Ocean Freight Market Update

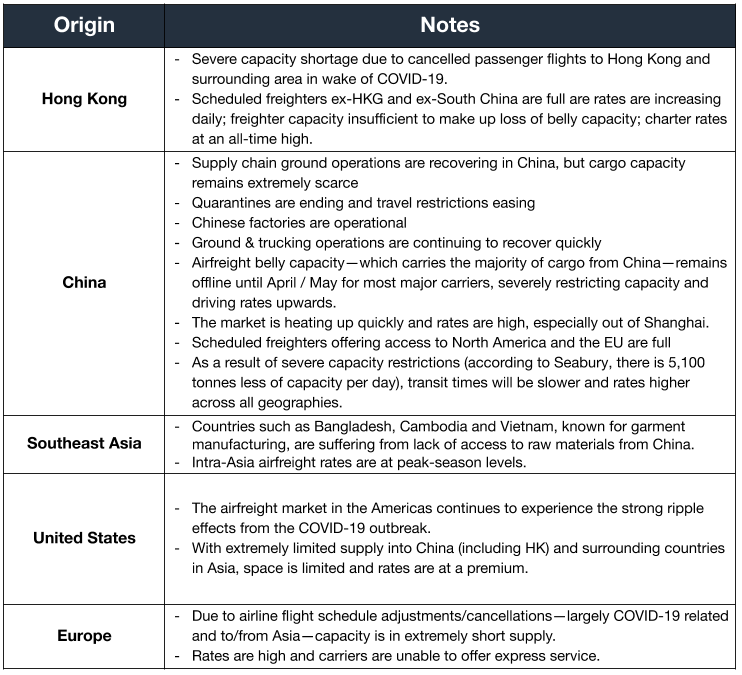

Air Freight Market Update

Freight Market News

TransPacific Containers Held Up in China A shortage of 40-foot shipping containers is disrupting the flow of US agricultural goods to China as US produce and meat suppliers await containers stayed in China or idling in the Pacific, according to WSJ. The setback is another hit for US farmers who struggled during the US-China trade war.

Scrubber Savings Wiped Out by Coronavirus Historic dips in crude oil prices due to Coronavirus have surprised ship owners by resulting in IMO 2020-compliant Very Low-Sulphur Fuel Oil (VLSFO) that costs less than High-Sulphur Fuel Oil cost one year ago. Ship owners who installed scrubbers based on the original price spread between the two fuel types saw their strategy pay off in Q1 2020 with nets of $10K-$25K more than non-scrubber ships, reports American Shipper, but those fuel savings are now less than $1500 per day on average.

Meanwhile, this week, Flexport Chief Economist Dr. Phil Levy noted the following economic highlights:

- Oil prices plunged after Russia refused to join an OPEC production cut. Brent Crude dropped as low as $31.02 per barrel, down from just under $70 in early January.

- Bond markets predict trouble as yields on US Treasury bonds fell sharply to hit record lows last week—below 0.5% on the 10-year in weekend trading, with the 30-year yield near 1%. Such yields usually reflect pessimism or outright fear.

- Central banks respond to Coronavirus as the US Federal Reserve last Tuesday cut its benchmark interest rate by 50 basis points. The move was noteworthy because it was done outside the regular meeting schedule of the Federal Open Market Committee (FOMC). It was the first time the Fed has done that since the global financial crisis.

- US equity markets fell immediately following the cut, most likely for two reasons: 1. The dramatic move signaled that the Fed saw very worrying signs about economic prospects; 2. It is unclear that an interest rate cut will do much to address the economic challenges posed by COVID-19.

- Other major central banks did not immediately match the US rate cut, though that may have been because their policy rates were already negative (Europe, Japan) or very low (England). Those banks were reportedly exploring more targeted ways to address business borrowing needs, as China has done.

- Not coincidentally, the broad US Dollar Index is down 4.3% from a recent high on February 20—a depreciation to its lowest level in over a year.

Customs and Trade Updates

Section 301 Exclusions on Medical Products

The USTR released an exclusion list for products that were under list 4 of the Section 301 tariffs with China. All 8 of the tariff numbers stated did not have additional requirements to qualify for the exclusion. The list appears to be focused on supplies tied to the Coronavirus outbreak, but there was no official word that was the reasoning. These exclusions will apply retroactively to the September 1st, 2019 implementation date and will stay in effect until September 1st, 2020.

USTR Calls China's Compliance Poor

The US Trade Representative recently issued its annual report to the World Trade Organization detailing many of the same problems noted in previous annual reports. New topics include the enforcement of the Phase One portion of the recent trade deal and the issue of forced labor and how to gain unrestricted access for inspections of prison labor camps where the products destined for the US may be made.

US-Brazil Trade Agreement

After a recent meeting in Florida, the US and Brazilian presidents issued a joint statement expressing interest in a bilateral trade agreement that would benefit both countries and be completed by the end of year.

For a roundup of tariff-related news, visit Tariff Insider.

Also, pre-register now for FORWARD 2020, a three-day event that brings together the greatest minds in global trade for ideas and insights to advance the industry