The Flexport Platform offers unprecedented visibility and control for you, your partners, and suppliers.

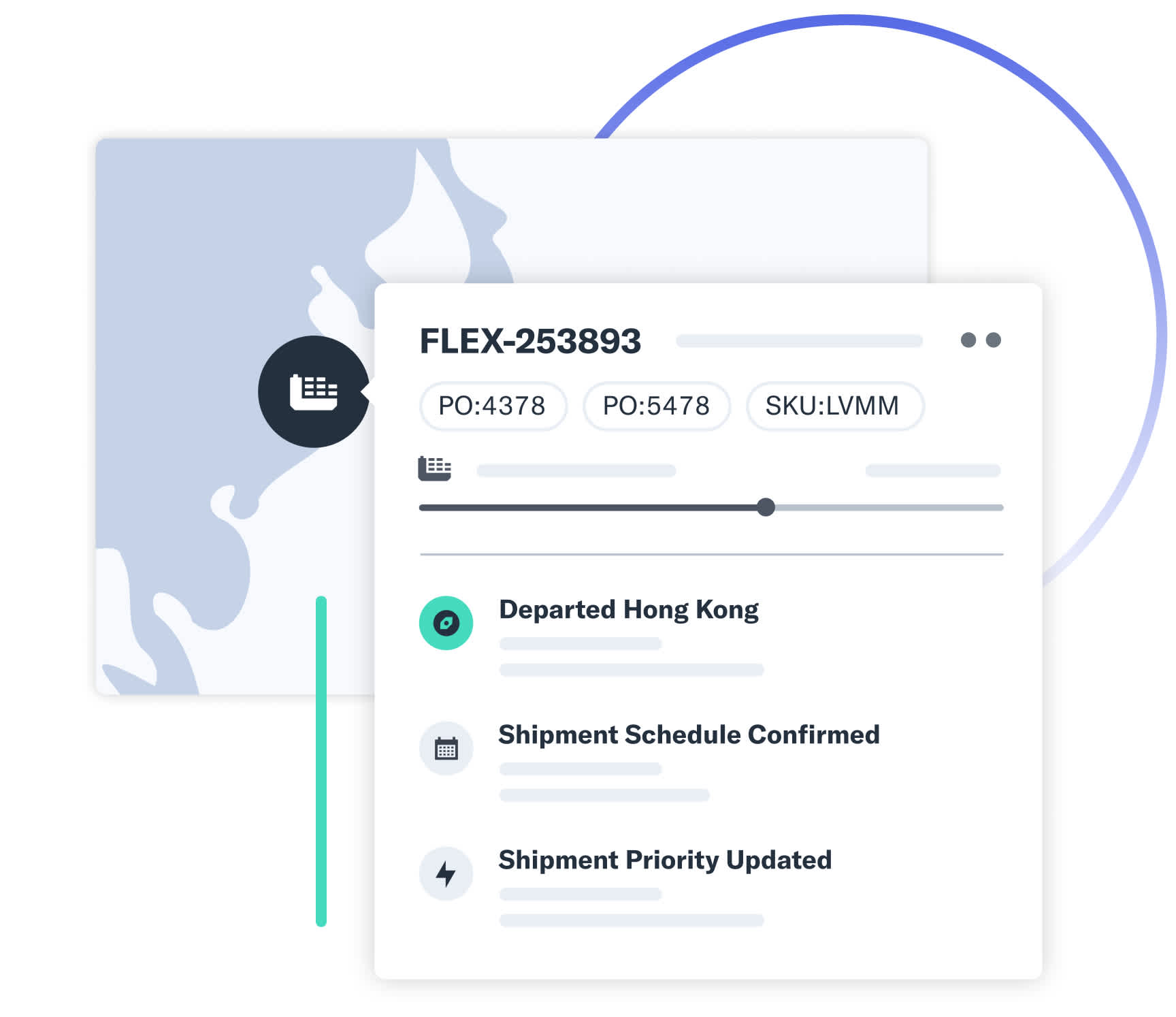

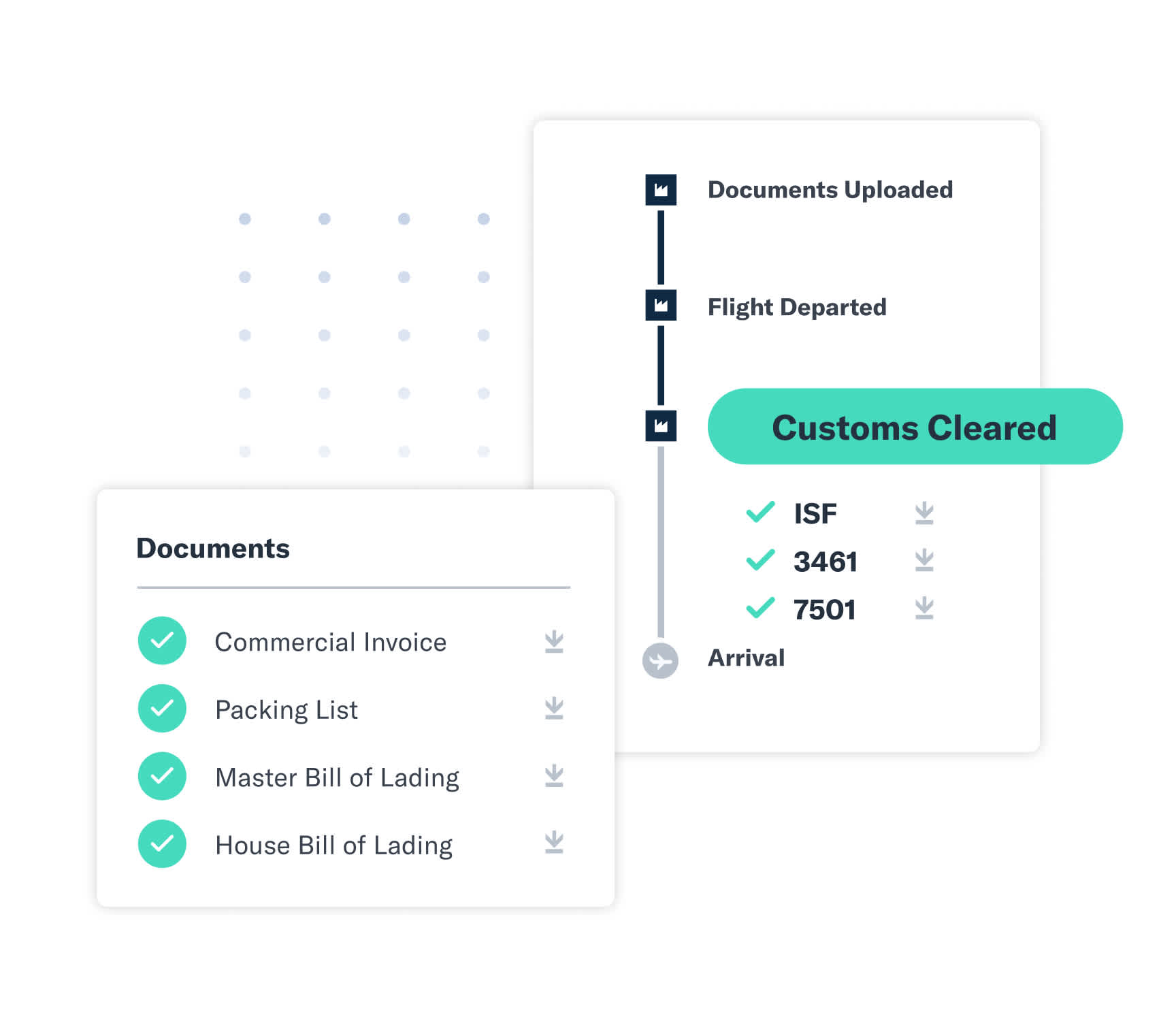

Track Everything Effortlessly

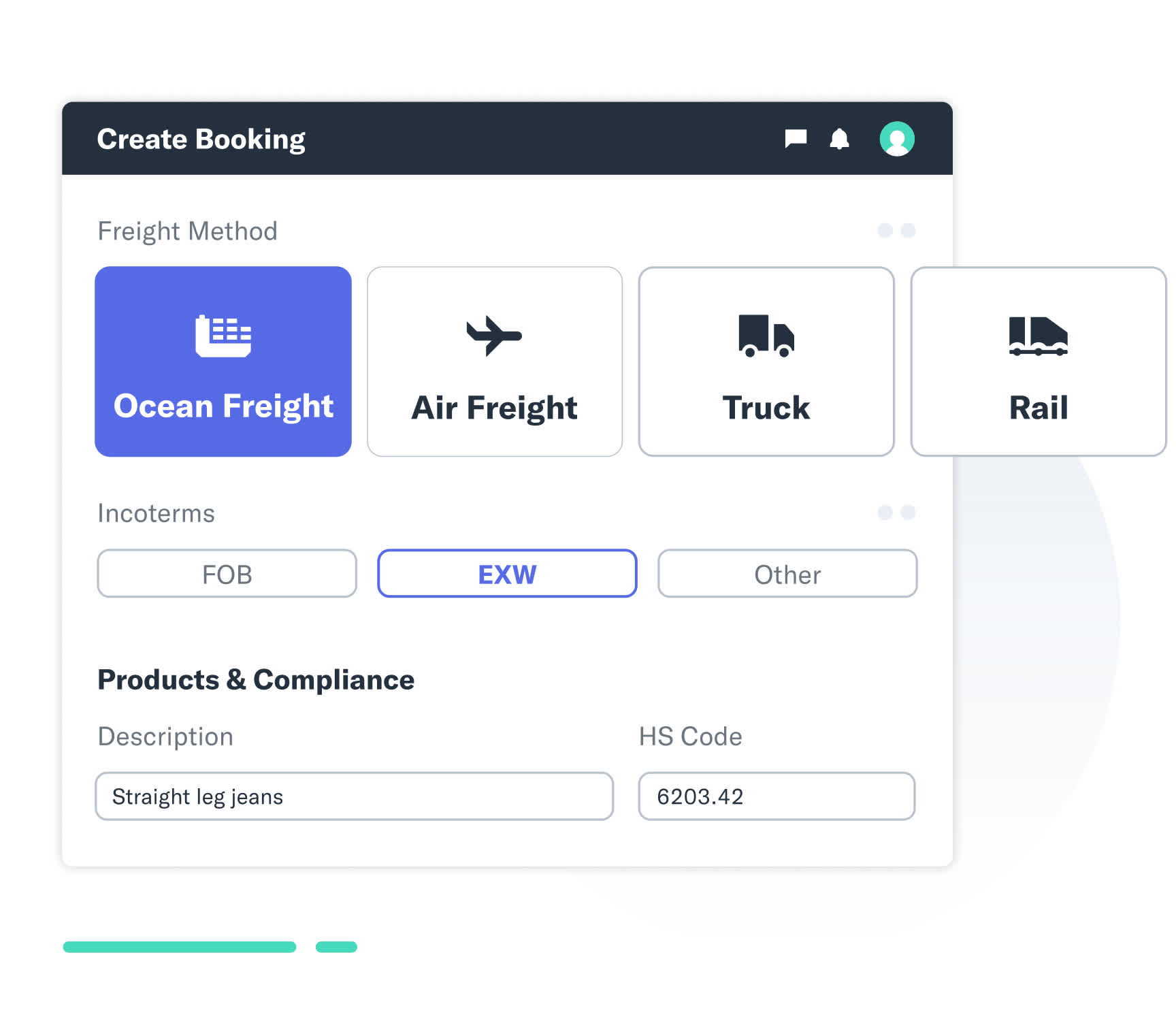

Track your freight over ocean, air, and land. Get milestone updates, exception alerts, landed cost, and inventory impacts at a glance.

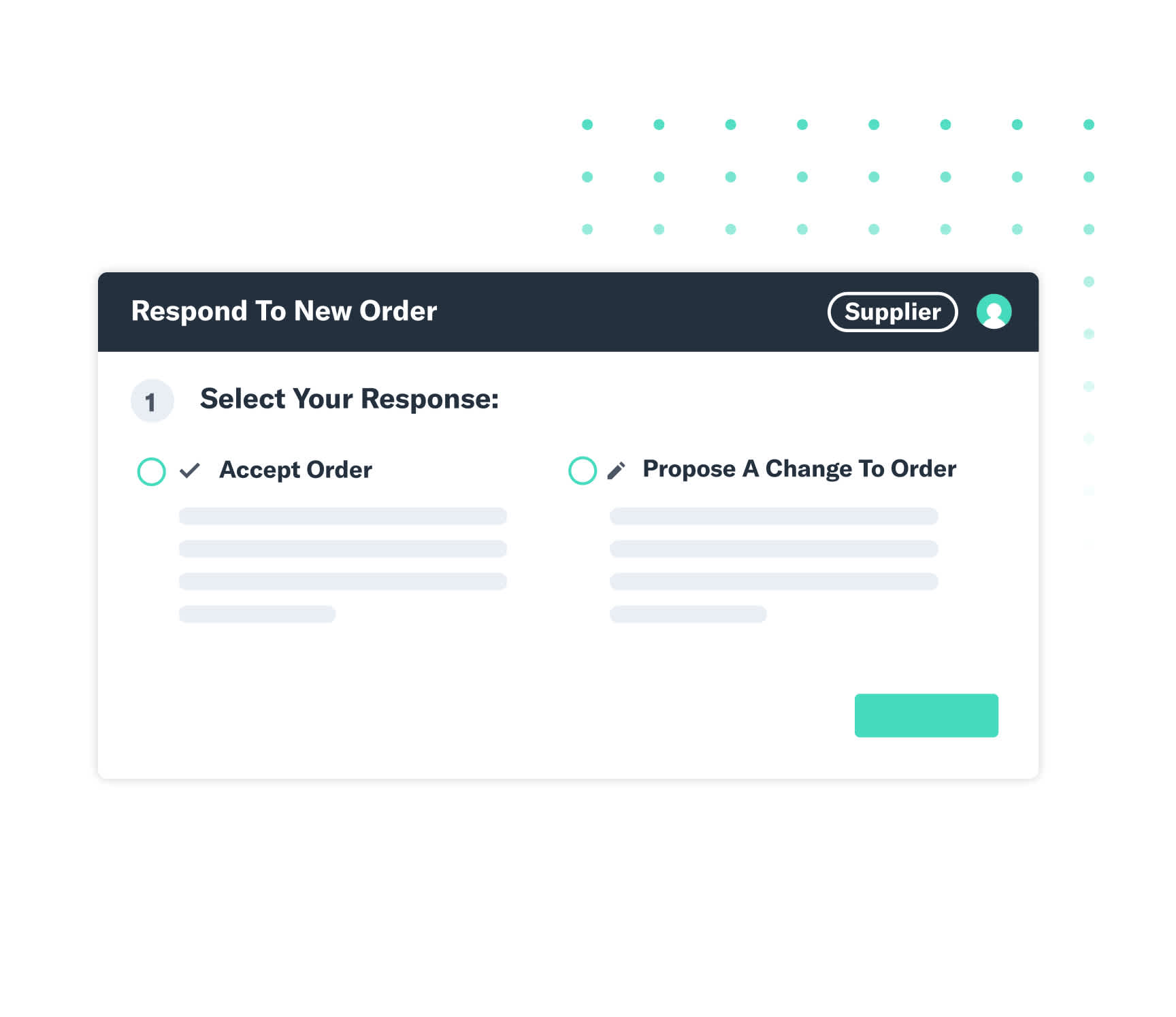

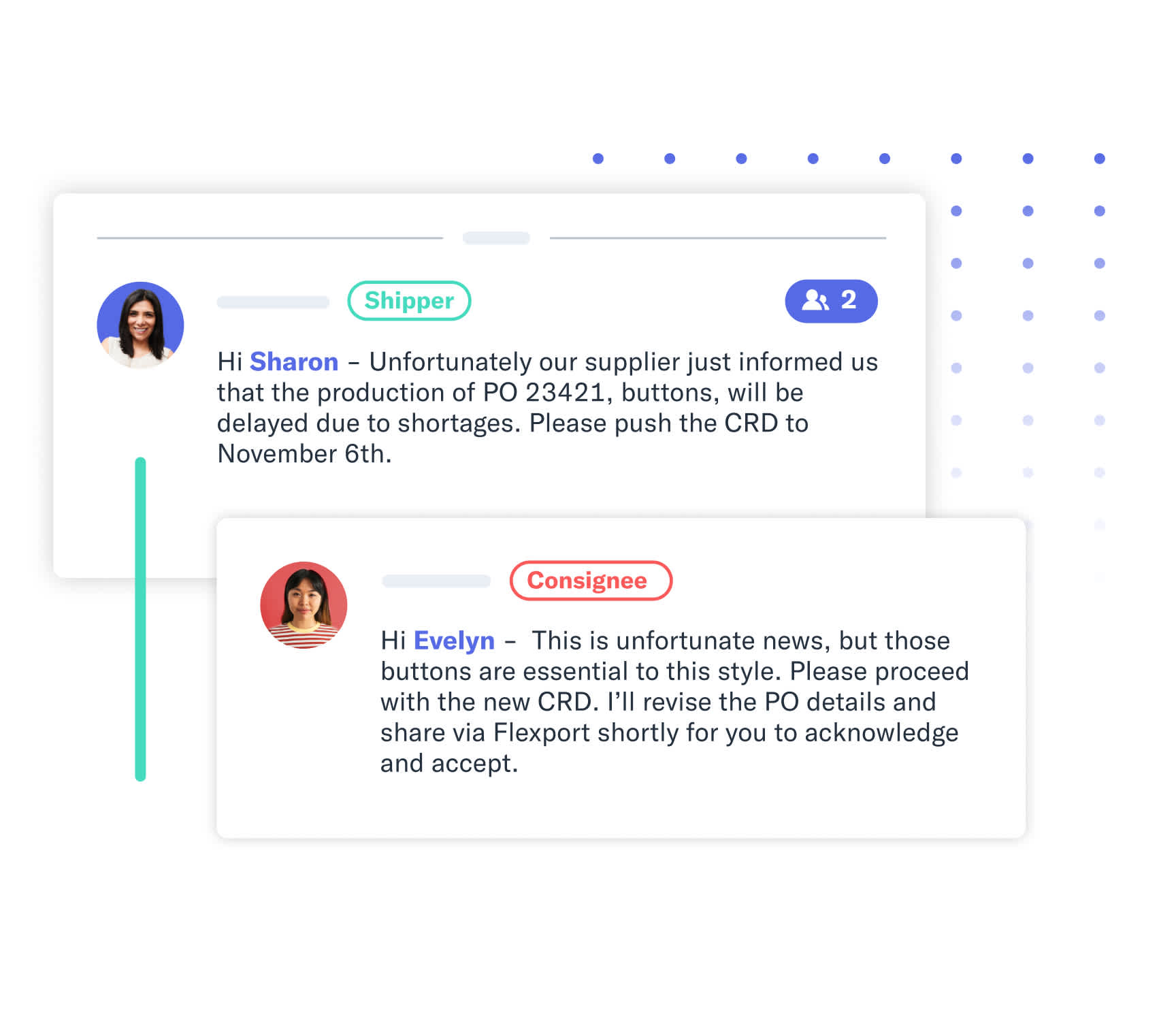

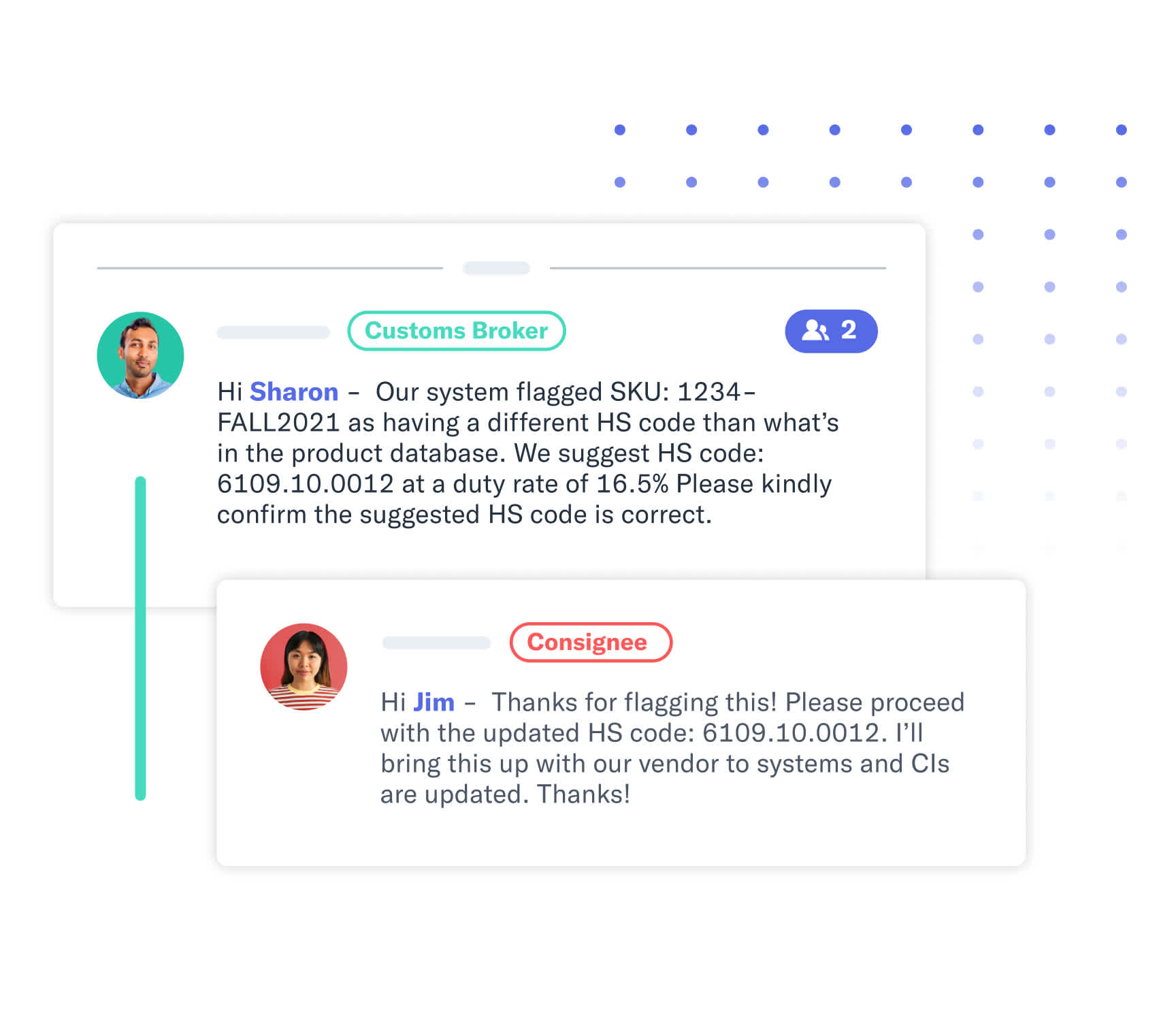

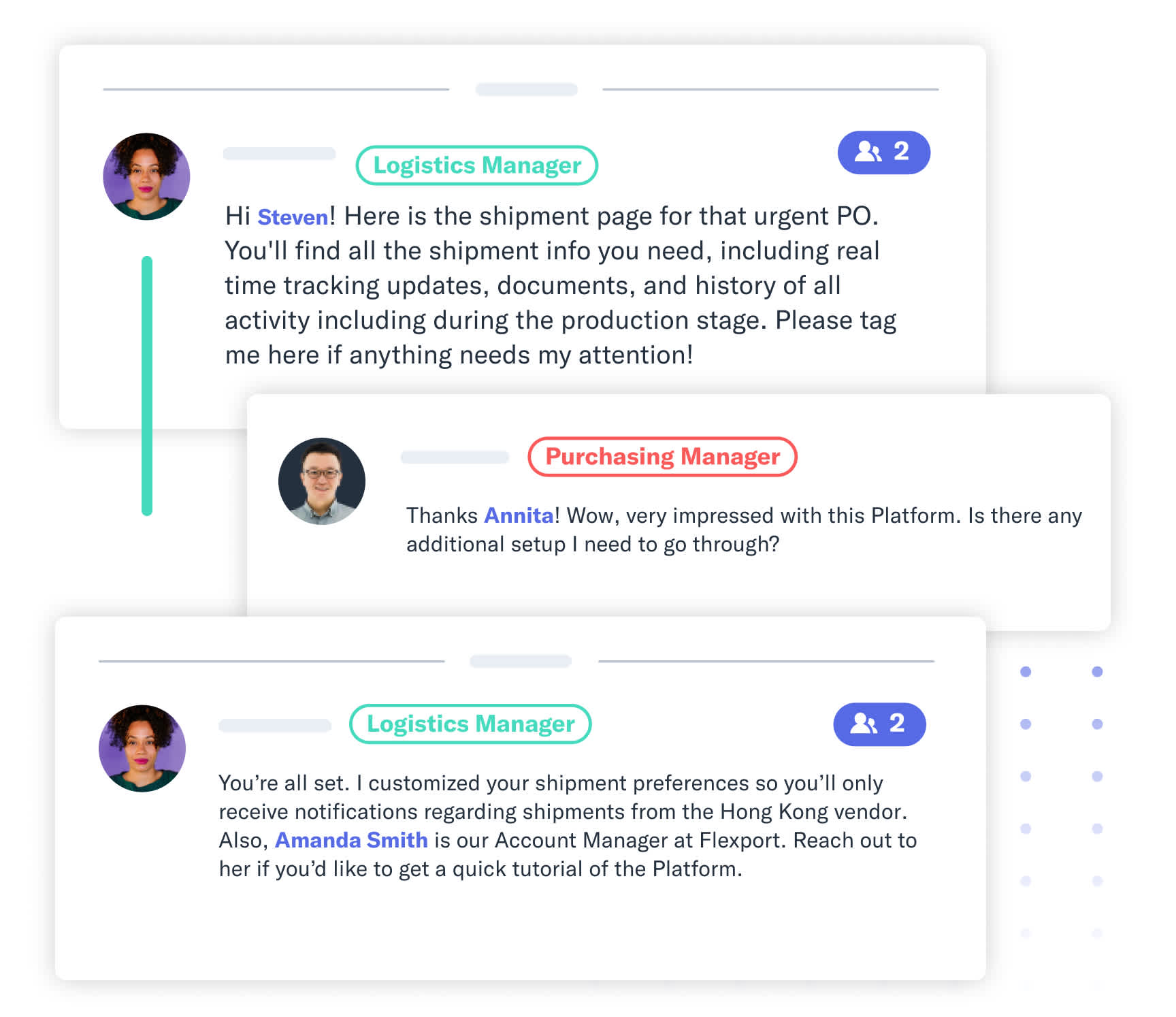

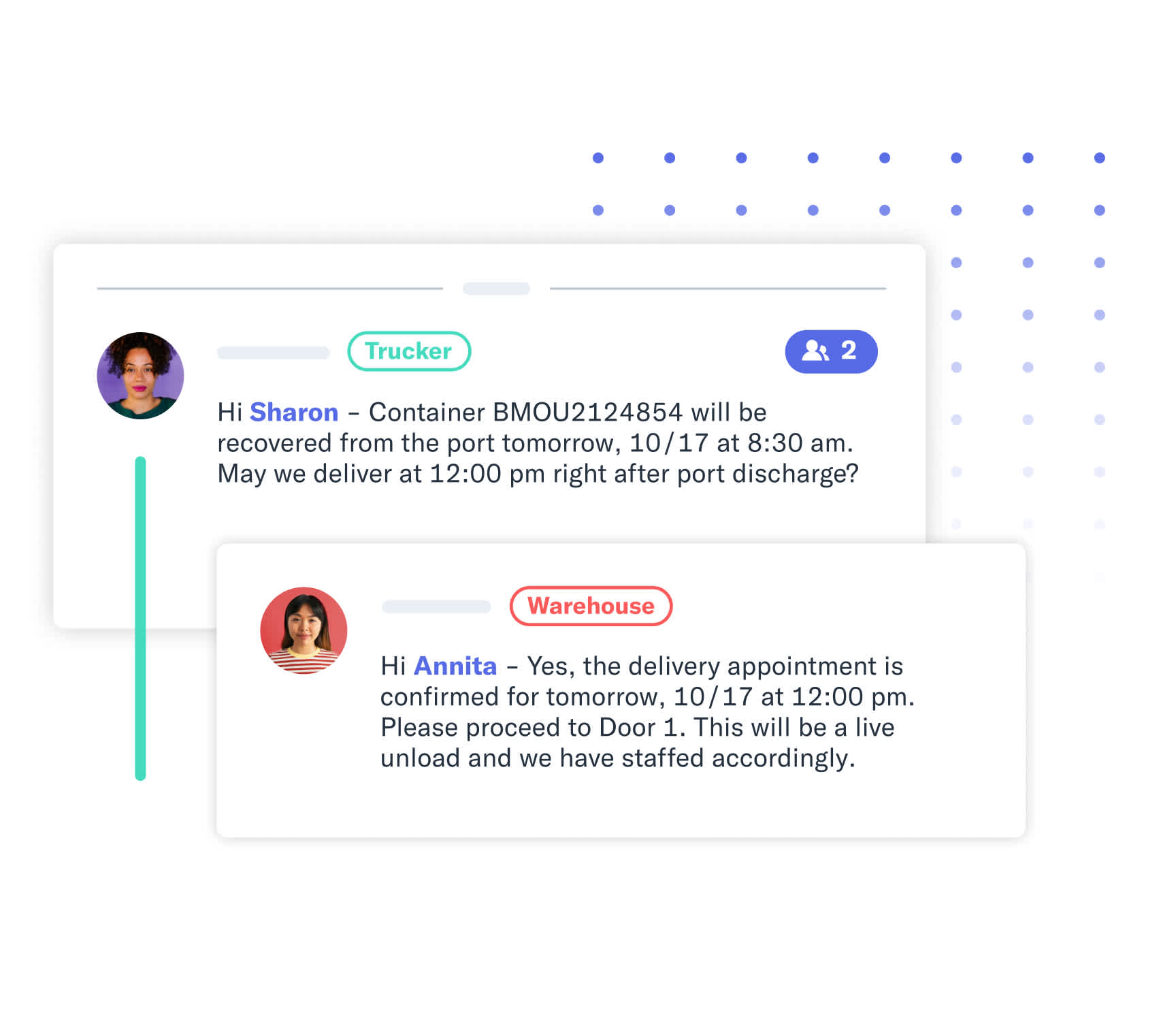

More Flow. Less Work.

Collaborate in real time. Order from suppliers. Track inventory in motion. Message your warehouse. The Flexport Platform speeds workflows for everyone in your supply chain.

Your Data for Better Decisions

Transit time, landed costs, and container utilization are now metrics within reach—thanks to the Flexport Platform’s power to structure, store, and safeguard your data.

Join Thousands of Leading Brands on Flexport

91% of Flexport customers agree that the Flexport Platform allows for clear and fast communication and collaboration with suppliers, partners, and their team.* Learn how medical technology company Qardio puts data at the heart of its business with Flexport.

Our current customers save 4 hours a week on average using Flexport over other freight forwarders.* *Based on 2020 TechValidate survey of 200+ current Flexport customers.

On average, Flexport customers onboard 55 users at their company onto the Platform across supply chain, customer support, finance, and sales.

Integrations

Unlock Your Shipping Data with APIs

Deploy our growing collection of public APIs. Integrations automate full data visibility from purchase order to invoicing. Save time, reduce errors, and improve decisions.

Take Your Digital Flow Further

Control Tower

A unified platform to manage all your logistics service providers and suppliers.

Sign Up for Global Logistics Update

Why search for updates when we can send them to you?