December 10, 2020

Businesses Look for Solutions to Address Ongoing Ocean Woes

Businesses Look for Solutions to Address Ongoing Ocean Woes

Ocean shippers are facing a nightmare scenario as carriers turn away bookings and struggle to adhere to current agreements. The cause? A tangle of equipment shortages, cargo backlogs, and booking stops that are likely to continue well past Chinese New Year and into 2021.

US imports are skyrocketing. In fact, growth in October was especially impressive—up 21% on a year-over-year basis; and imports from Asia were up 23.7% percent from October 2019, while imports from China increased 30%. But around the world, companies and their supply chain partners are scrambling to keep up with the ocean market turmoil—changes often occur with very little notice.

What began in February, with factory closures in China due to Covid-19, has set off a domino effect, leading up to the industry-paralyzing equipment and infrastructure crisis of today.

Contributing Factors

A long-running equipment imbalance spanning driver, rail, and chassis shortages is driving the current scenario:

- Part of the problem is the container shortage with container factories sold out until at least February 2021.

- To get equipment back to Asia faster, carriers have been bringing boxes back empty, creating issues for exporters.

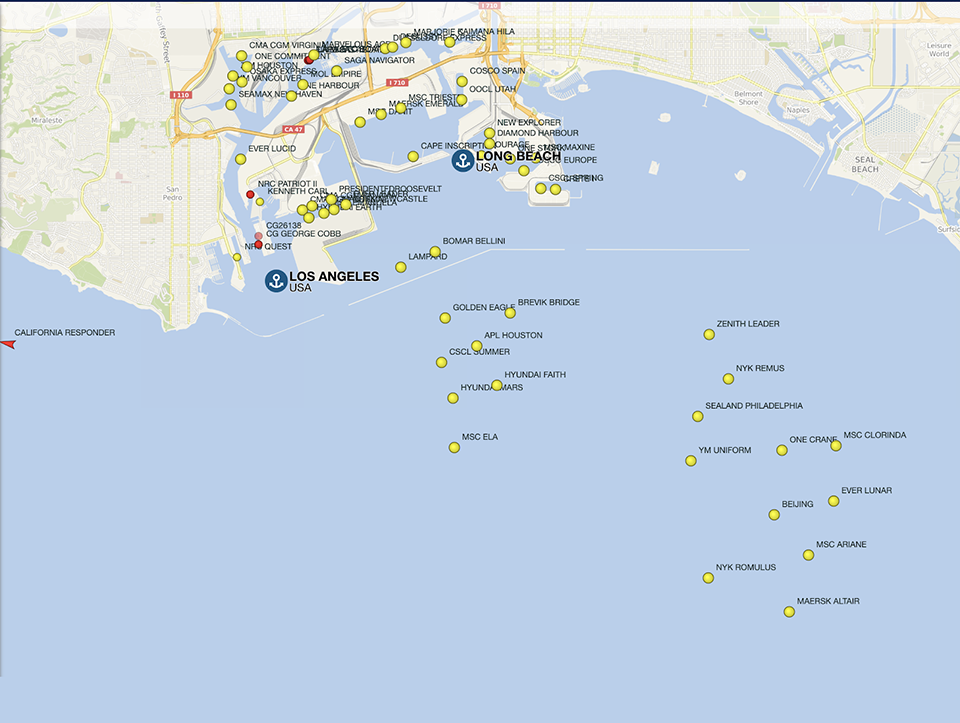

- At the same time, port congestion is delaying vessels in the US, Canada, Australia, New Zealand, and the UK by up to 10 days.

- As the domino effect continues, alternative routing options for rail and truck are also getting congested. And in the next three weeks, at least in Europe, trucking will be reaching absolute peak.

- Shippers are now hedging their bets by booking multiple carriers, making it more challenging to get a read on the actual conditions.

Now, parts of the industry are slowing to a standstill. Some shipping lines have suspended service, citing reduced capacity from local feeder operators in South China, due to Covid restrictions. Blank sailings are cropping up throughout January, further delaying the repositioning of empty equipment.

The entire globe feels the impact. Heading to Europe, some ships have had to sail light, because there aren’t enough containers. And in the US, the Federal Maritime Commission has expanded the scope of an investigation into carrier decisions to withhold containers from US hinterlands.

Meanwhile, inbound containers sit at terminals, waiting for importers to receive them, in a situation that is illustrating the fallout of labor and equipment shortages alongside high consumer demand.

While this shakes out—and it could be a while—companies may want to reassess existing supply chains and adjust based on timing and availability of transport.

- How fast are containers moving between ports?

- How will backlogs in some ports impact delivery?

- How will container demand change at the start of 2021?

- When do shipping rates sink current business models?

- What sourcing or distribution alternatives circumvent delays?

An important guideline to keep in mind: Circumstances can change suddenly. Many companies are positioning themselves now to make rapid adjustments to supply chain strategies as new information arises.

Strategies and Solutions

For now, a company’s shipping history may not earn it any particular loyalty from a carrier—even with certain types of premium services if they don’t include guarantees.

A strong freight forwarding partner, however, can help secure space, navigate route options, and access premium ocean services with equipment and space—though current conditions challenge such options.

To help clients during this time of extreme disruption, Flexport advises:

- Keep current with the situation as situations can change overnight. Don’t rely on a single source of information—check with various sources to ensure accuracy.

- Work with smaller shipments and ship LCL to get bookings accepted faster.

- Use 20-foot containers, which are less limited in Asia than 40-foot boxes.

- Take advantage of non-operating reefers (NORs), which are more readily available, for cargo that doesn’t require refrigeration.

- Avoid the worst of congestion through cross-border traffic from mainland Europe into the UK—tunnels and ferries are especially backed up.

Having visibility to conditions as they unfold is key. For instance, Flexport clients have transparent access to a wide range of current and historical data housed in its digital platform. That kind of visibility can bring reliability to transit time predictions, expose potential cost efficiencies, and reveal possible route alternatives.

Over time, deeper data lets shippers discover alternative solutions more rapidly. And that can inform a major save in the weeks approaching Chinese New Year or other rush times when volatility is heightened.

Adding Value to RFPs

As RFP season approaches, shippers can shape strategies to add value to upcoming contracts, although current wisdom says to expect higher prices across the board.

Be sure to ask about service capabilities, like route optimization, or negotiate for escalated solutions during periods of intense competition for space. By partnering with the right freight forwarder, companies may be able to mitigate the risks of delay and extreme expense in 2021.

Learn more about Flexport’s ocean services to discover how to keep cargo moving during wild-card market conditions.