Global Logistics Update

Nations Brace for Aug. 1 Reciprocal Duties; FEWB Faces Blank Sailings and Backlogs

Updates from the global supply chain and logistics world | July 17, 2025

Global Logistics Update: July 17, 2025

July 17, 2025

Trends to Watch

Talking Tariffs

- President Trump Announces Upcoming Reciprocal Duty Rates for More Trade Partners: Since last week, President Trump has announced proposed reciprocal tariffs for three more trade partners: Canada (35%), the European Union (30%), and Mexico (30%).

- It is currently unclear whether imports that fall under the United States–Mexico–Canada Agreement (USMCA) will be exempt from the upcoming duties.

- So far, President Trump has published tariff letters detailing proposed reciprocal tariffs for more than two dozen trade partners. All are expected to take effect on August 1, pending official confirmation via executive order or Federal Register notice. For a full list of proposed duty rates, check out our live blog.

- According to the tariff letters, if any of the involved nations increases its tariffs on the U.S., the U.S. will increase its reciprocal tariff rate on that nation by an identical amount.

- The letters also state that any goods transshipped to evade a higher tariff will be subject to that higher tariff.

- In light of the extended country-specific reciprocal tariff pause, all U.S. trade partners will remain subject to existing reciprocal tariffs until August 1—with the exception of China, whose 10% reciprocal duty rate expires on August 12.

- U.S. and Indonesia Reach Trade Deal: On July 15, the U.S. and Indonesia announced a trade agreement that will impose a 19% reciprocal tariff on Indonesian goods imported into the U.S. The announcement walks back the previously proposed 32% tariff on Indonesia that President Trump had announced on Truth Social last week.

- EU Postpones Retaliatory Tariffs on the U.S.: Shortly after President Trump indicated plans to impose a 30% reciprocal tariff on the EU, the EU announced on July 14 that it would delay retaliatory duties on the U.S. until early August. In the meantime, the EU will attempt to reach a trade agreement with the U.S., said European Commission President Ursula von der Leyen.

- U.S. Trade Representative (USTR) Launches Section 301 Investigation into Brazil: On July 15, the USTR launched a Section 301 probe into Brazil—less than a week after President Trump proposed a 50% reciprocal duty on Brazilian goods. The investigation will examine Brazil’s policies on digital trade and electronic payment services; “unfair, preferential tariffs”; anti-corruption enforcement; and more.

- Other Potential Tariffs on the Horizon:

- On July 2, President Trump announced he would impose a 20% reciprocal tariff on Vietnam, along with a 40% tariff on goods transshipped through Vietnam.

- On July 6, President Trump announced plans to levy a 10% tariff on imports from BRICS—an intergovernmental group that includes Brazil, Russia, India, China, and several other nations. The 10% duty would be levied on top of any other applicable tariffs.

- On July 8, President Trump also indicated that he plans to impose pharmaceutical tariffs as high as 200%—but before doing so, he intends to give pharmaceutical manufacturers at least a year to relocate their operations to the United States.

- On July 9, President Trump announced that a 50% tariff on copper imports will take effect on August 1, now that the Commerce Department’s national security investigation into copper has concluded.

Get the latest updates and guidance on U.S. tariffs and trade on our live blog.

Ocean

TRANS-PACIFIC EASTBOUND (TPEB)

- Capacity and Demand:

- Demand is expected to remain flat through July and August.

- Overall carrier capacity deployment for July is 80%-90%, with a slight decrease to 75%-86% in August. Despite some service suspensions to the Pacific Southwest (PSW) and ad hoc blank sailings, the market is experiencing ongoing overcapacity compared to demand. Overall, space is open.

- Services originating in Southeast Asian ports are experiencing some delays due to continued congestion in Malaysia and Singapore. Expect three to five days of additional transit time, versus proforma.

- Equipment: Equipment availability across most TPEB origins is sufficient, with no immediate shortages reported.

- Freight Rates:

- West Coast: Some carriers have announced and implemented July 15 General Rate Increases (GRIs). Meanwhile, other carriers are extending existing rates or applying “bullet rates,” which has widened the spread in rates for West Coast destinations.

- East Coast and Gulf regions: Floating rates for these regions have been mitigated. Peak Season Surcharges (PSSs) have also been mitigated for the remainder of July.

FAR EAST WESTBOUND (FEWB)

- Capacity and Demand:

- July weekly capacity is averaging 306,100 TEUs (+19% vs. June), reflecting peak season expansion.

- Week 29 blank sailings have created significant cargo backlogs. Carriers will prioritize backlog clearance over the next one to two weeks.

- Peak season demand has exceeded carrier expectations, growing steadily since June.

- Vessel delays and rollovers are extending Black Friday and Christmas shipment windows, potentially resulting in a longer peak season than in 2024.

- Equipment:

- Ongoing rollovers and strict equipment controls will persist in the short term.

- Gemini has added a mid-month extra loader vessel, but alternative routing will add two to four weeks to ETAs.

- Ocean Alliance (OA) and Premier Alliance (PA) are aggressively restricting equipment access to limit fresh bookings in Weeks 31 and 32.

- Container release and booking windows have been significantly compressed.

- Outlook:

- In the near term (July): Rates and volumes are expected to remain stable. Tight capacity controls may not fully meet stronger-than-expected demand, with space and equipment shortages likely to last until late July or early August.

- In the mid-term (August and beyond): Carriers may pause further rate hikes to maintain current levels in an attempt to get more volume and extend the profitable peak season.

- Freight Rates:

- Rates have become increasingly stable since the June rebound. The latest Shanghai Containerized Freight Index (SCFI) rate is $2,099/TEU (-$2/TEU).

- This indicates market stabilization in July, and potential difficulties implementing further GRIs in the second half of July.

- External Risk Factors:

- Red Sea: Renewed Houthi attacks on container ships mean carriers cannot consider Red Sea routing in the near term (the next month or two).

- President Trump’s proposed 30% tariff on EU goods, expected to take effect on August 1, may disrupt European manufacturing demand and lead to slower inventory turnover and weaker Asia-Europe demand. However, Asia-Europe trade remains consumer-goods-dominant, limiting industrial and raw material impacts during peak season.

TRANS-ATLANTIC WESTBOUND (TAWB)

- Capacity and Demand:

- PSA Antwerp is still congested, with a dwell time of eight days.

- Hamburg, Bremerhaven, and Rotterdam are experiencing vessel delays of up to three to four days.

- Piraeus, Genoa, and Valencia continue to report significant congestion and persistent yard overcrowding.

- Export demand along the North Europe–U.S. corridor remains consistent and stable, with a notable uptick in bookings from Germany, Benelux, and Spain, driven by pre‑holiday.

- ~5% of sailings are blanked—the fewest since March. Capacity is stable.

- Equipment: Austria, Slovakia, Hungary, and Southern/Eastern Germany continue to face container and chassis shortages. Portugal is also experiencing container imbalance issues.

- Freight Rates: In Northern Europe, the West Mediterranean, and the East Mediterranean, all carriers have postponed PSSs announced for July. Rates are expected to remain stable until the end of Q3.

INDIAN SUBCONTINENT TO NORTH AMERICA

- Capacity and Demand:

- Capacity to the U.S. East Coast has increased, with July kicking off the traditional Indian subcontinent peak season.

- One carrier is adding vessels back to their Northeast India to U.S. East Coast service, but temporarily omitting Charleston to enable enhanced service reliability.

- Capacity to the U.S. West Coast is again available, related to the sharp increase in capacity in the TPEB market and services that enable Indian subcontinent shippers to deliver cargo to the U.S. West Coast.

- Freight Rates:

- For cargo moving to the U.S. East Coast: GRIs and PSSs have been announced for the first half of July, but in general, those increases have not been implemented. Based on what carriers are seeing, there appears to be a large spread in the market across booking intakes and utilization. There may be a lack of typical peak season demand to support the rate increases, especially given the capacity reinjected into the Indian subcontinent to U.S. East Coast trade.

- For cargo moving to the U.S. West Coast: GRIs did not stick in the market and the PSS has come down, in line with TPEB lanes.

- Exports from Pakistan continue to see elevated costs and transit times due to additional feeder services needed to service the country in light of the India-Pakistan conflict.

Air

WEEK 27: JUNE 30 - JULY 6, 2025

- Global Air Cargo Volumes Fell -3% WoW in Early July: This was led by an -11% decline from North America due to the U.S. Independence Day holiday. Meanwhile, global rates rose +2% WoW, driven by the Asia-Pacific.

- China and Hong Kong to Europe Volumes Jumped +15% YoY in June, Reaching Their 2025 Peak: Meanwhile, Asia-Pacific to U.S. volumes dropped -3% WoW, while spot rates on that lane rose +3% WoW.

- Holiday Impacts and Frontloading Dynamics Disrupted Demand Patterns: But the pre-tariff surge ahead of the postponed end date for the U.S.’s country-specific reciprocal tariff pause (moved from July 9 to August 1) was limited.

- Capacity Shifts and Trade Rerouting: Capacity and trade route shifts, particularly from the Asia-Pacific, can be attributed to tariff risks, de minimis rule changes, and ecommerce routing adjustments.

(Source: WorldACD)

Please reach out to your account representative for details on any impacts to your shipments.

North America Vessel Dwell Times

Webinars

North America Freight Market Update Live

Thursday, August 14 @ 9:00 am PT / 12:00 pm ET

Tariff Trends 2025: Expert Insights on the New U.S. Customs Landscape (July 16, 2025)

Webinar on Demand

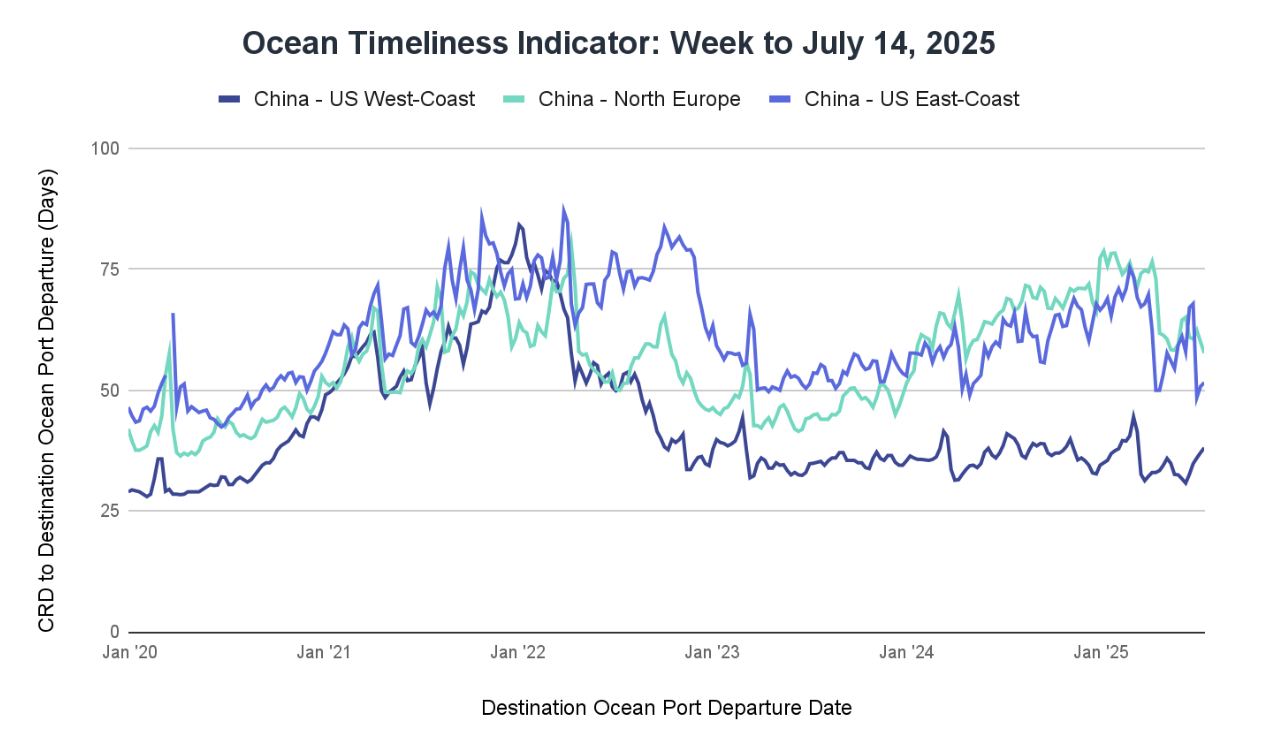

Ocean Timeliness Indicator

Transit times from China to the U.S. West Coast and China to the U.S. East Coast both experienced modest increases, while the route from China to North Europe saw a notable reduction in transit time.

Week to July 14, 2025

Transit time from China to the U.S. West Coast increased by 1 day, rising from 37.1 to 38.1 days. The China to North Europe route saw a 2.3-day decrease, falling from 60 to 57.7 days. Meanwhile, the transit time to the U.S. East Coast increased by 0.8 days, moving from 50.8 to 51.6 days.

See the full report and read about our methodology here.

About the Author

July 17, 2025

Related content

Ready to get started?

Learn how Flexport’s supply chain solutions can help you capture greater opportunities.