April 11, 2023

In Focus - U.S. Containerized Imports: Eastbound and Down

Over the past five years, there have been brief periods of disconnect between the real value of U.S. imports and the volume of seaborne container throughput. We’ve seen a recurrence in recent months, potentially driven by an ongoing shift in destination ports and also towards increased overland imports from Mexico.

The value of U.S. imports, sans petroleum and cars and trucks, which are not containerized, have remained above $200 billion per month for the past two years (seafoam blue line in the chart below).

Meanwhile, U.S. seaborne containerized imports across all US ports peaked in May 2022 at 2.62 million twenty-foot equivalent units, or TEUs, the standard unit used by the shipping and logistics industries to track volumes. After holding steady around or just below that amount from June through August, there was a sudden and sharp drop beginning in September, when they fell by 305,000, or 11.8% (darker blue line, expressed as a 3-month rolling average to better show the trend). After a brief pause in October, they fell another 11.6% in November before recovering slightly in December. The annual total came to 28.7 million TEUs, a decline of around one million year-on-year but still well-above the annual totals for 2019 and 2020.

The two lines in the chart didn’t always move in lockstep, but with a few, brief exceptions, they tended to be roughly correlated. Until March of last year. From then on we start seeing that above-mentioned disconnect – a significant spike in values without a corresponding spike in container volumes, then volatility and then, most recently, a negative correlation.

It’s a mystery that merits investigation.

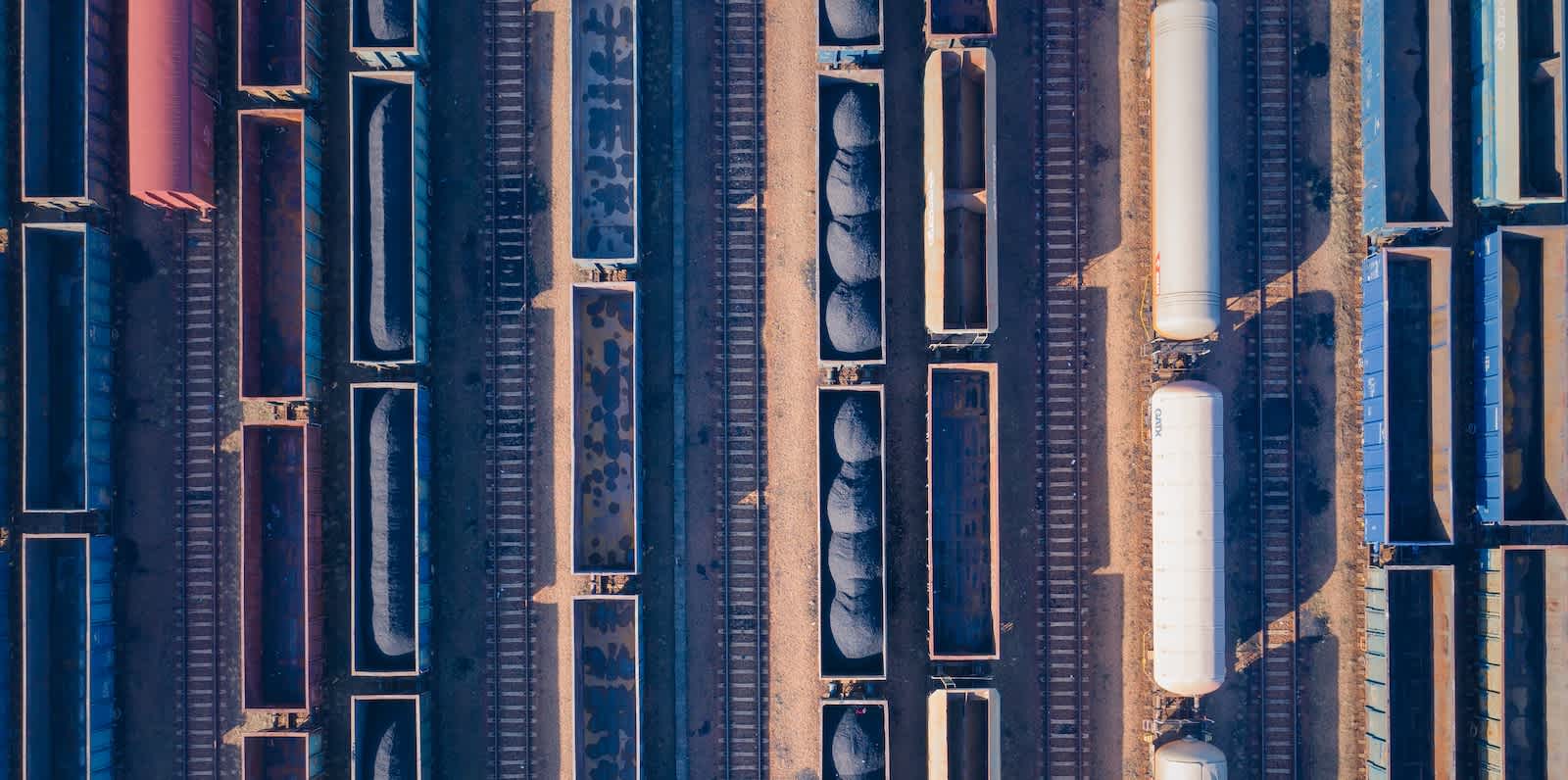

When thinking about imports, the images that first spring to mind for most people are of long ships carrying tall stacks of containers and arriving at vast port complexes. That’s not inaccurate, but it’s not the entire picture. Seaborne, or maritime, imports have accounted for 43 - 46% of the nominal value of all US goods imports over the past five years. Faster but significantly-more-expensive imports by air – often high-value electronics and perishable goods – accounted for 26 - 30% and overland imports by truck and rail from Canada and Mexico 27 - 28%. It’s not equally apportioned between the three, but it is a diverse mix of modes nonetheless.

We might begin with where the containers have been arriving. Early in the pandemic, congestion at the major West coast (LA / Long Beach, Oakland and SeaTac) ports slowed down offloading, with dwell times lengthening and there being as many as 80 - 90 vessels waiting off-shore. As can be seen in the chart, this really started to hit late summer / early fall of 2020. There was a brief recovery, even as the congestion was still being worked through. But then fears of an escalation in the ongoing labor dispute at LA / LB started to have an impact.

Two shifts begin happening around this time. The first was increasing volumes of TEUs arriving at the Major East and Gulf ports (Newark, Savannah, Norfolk, Houston, Charleston, and Miami). In aggregate, they increased their share of total containerized seaborne TEUs by six percentage points from the start of the pandemic to more than 38.0% and although they, too, have been falling over the past six months, in February that figure stood at 41.5%.

There are indications that some port operators believe this shift to be permanent, enabled, in part, by the 2016 expansion of the Panama Canal. The canal now accommodates Neo- or Post-Panamax ships, which can carry 12,000 - 14,000 containers, or two-and-a-half times the number older Panamax vessels can. As a result, shipping direct to the South and East from Asia has become, for some, more economical than shipping to the West coast and using rail or long-haul trucking.

Then there was the rise in container throughput at Laredo, Texas. As far back as 2019, Laredo had already briefly overtaken LA / Long Beach as the busiest ‘port’ in the US; it’s long been busier than Charleston and Miami – two top-ten ports – combined. Being inland, it is not a ‘port’ in the conventional sense, but the TEUs passing over the Mexico - U.S. border there by truck and rail reached an average of 200,000 per month for a four-month stretch between April and July last year. Investors are betting this shift will be permanent, as well.

As with so many changes caused by the pandemic, only time will tell if these are temporary changes, lasting ones that will fade over time or if they are indeed permanent.

Disclaimer: The contents of this report are made available for informational purposes only and should not be relied upon for any legal, business, or financial decisions. Flexport does not guarantee, represent, or warrant any of the contents of this report because they are based on our current beliefs, expectations, and assumptions, about which there can be no assurance due to various anticipated and unanticipated events that may occur. This report has been prepared to the best of our knowledge and research; however, the information presented herein may not reflect the most current regulatory or industry developments. Neither Flexport nor its advisors or affiliates shall be liable for any losses that arise in any way due to the reliance on the contents contained in this report.