March 27, 2025

Early Updates on the Trump Administration’s Tariff and Trade Policies, Part II

March 27, 2025

This page contains Flexport’s updates on the Trump administration’s tariffs and trade policies from late March - mid-June. Find updates from late June - mid-July here, and older updates (including our original blog on the 2024 election) here.

For Flexport’s up-to-date developments and guidance, check out our live tariff and trade blog.

Calculate and analyze tariff impacts in real time with the new Flexport Tariff Simulator. Get started here.

Updated June 17, 2025:

Yesterday (June 16), the White House published an executive order that will implement some aspects of the U.S.-U.K. trade agreement announced on May 8. The executive order, which will take effect seven days after publication in the Federal Register, will:

- Maintain a 10% baseline IEEPA reciprocal tariff on U.K. imports

- Reduce Section 232 tariffs on U.K. auto parts from 25% to 10%

- Reduce the effective Section 232 duty rate on U.K. automobiles from 27.5% to 10%, applicable to an annual quota of 100,000 vehicles

- Eliminate IEEPA reciprocal tariffs and Section 232 steel and aluminum tariffs on U.K. products that fall under the World Trade Organization Agreement on Trade in Civil Aircraft

Additionally, the order states that the U.S. may implement a quota of U.K. steel and aluminum imports that will be subject to most-favored-nation rates, contingent upon the U.K. meeting “American requirements on the security of steel and aluminum supply chains, and on the nature of ownership of relevant production facilities.” Currently, the U.K. is subject to a 25% duty on steel and aluminum, having avoided the 50% tariff rate imposed on all other U.S. trade partners earlier this month.

Per the order, the U.K. is also likely to receive “significantly preferential treatment” when it comes to potential upcoming Section 232 tariffs on pharmaceuticals, as long as the U.K. “complies with certain supply chain security standards.”

Separately, on June 13, CBP released updated guidance on reporting the country of smelt and cast for derivative aluminum products subject to Section 232 duties. Beginning June 28, aluminum imports with an unknown or indeterminable country of smelt and cast will be subject to a 200% Section 232 tariff—the same duty assessed on Russian-origin aluminum imports.

Finally, on June 12, the U.S. Department of Commerce added washing machines, refrigerators, and other steel consumer appliances to its list of derivative products subject to Section 232 tariffs. Effective June 23, the 50% duty rate will apply to the value of steel content in each product.

Updated June 12, 2025:

Yesterday, Treasury Secretary Scott Bessent stated it is “highly likely” that the 90-day country-specific reciprocal tariff pause, which is currently set to end on July 9, 2025, will be extended for “18 important trading partners” involved in “good faith” trade negotiations. President Trump’s proposed 50% tariff on the EU, currently postponed until July 9, 2025, is also likely to be pushed back further.

Updated June 11, 2025:

Following two days of negotiations between U.S. and Chinese trade representatives in London, President Trump announced on Truth Social today that the “deal with China is done, subject to final approval [from himself and] President Xi.” Details of the agreement include:

- A 55% total tariff rate on Chinese goods imported into the U.S. (comprised of a 10% baseline IEEPA reciprocal tariff, a 20% IEEPA “fentanyl” tariff, and a 25% tariff that includes levies imposed during the president’s first term)

- A 10% total tariff rate on U.S. goods imported into China

- A streamlined process for importing Chinese rare earth shipments into the U.S.

- Resumed access to U.S. colleges and universities for Chinese nationals

Exactly how and when the deal will be implemented—pending President Trump’s and President Xi’s final approval—is currently unclear.

Separately, the U.S. Court of Appeals for the Federal Circuit issued a longer-term stay last night that will continue freezing the Court of International Trade (CIT)’s May 28 ruling that invalidated President Trump’s IEEPA tariffs. Last night’s longer-term stay follows the temporary stay issued by the appeals court on May 29, and will keep President Trump’s IEEPA tariffs in place while litigation continues. Both parties will prepare for oral arguments, which will be heard by the appeals court on July 31, 2025.

Updated June 3, 2025:

On June 3, the White House released a proclamation titled “Adjusting Imports of Aluminum and Steel Into the United States,” announcing a significant increase in tariffs on steel and aluminum imports. Effective for covered goods entered for consumption, or withdrawn from warehouse for consumption, on and after 12:01am EDT on June 4, 2025, tariffs on these materials and their derivatives will rise from 25% to 50%.

The decision follows updated findings from the Department of Commerce, which indicate that ongoing low-cost dumping by foreign producers continues to threaten the viability of the U.S. steel and aluminum industries, sectors critical to national defense.

Key highlights of the proclamation include:

- Tariff Increase: The duty rate on steel and aluminum imports, and their derivatives, will double to 50%.

- U.K. Exception: Imports from the United Kingdom will remain at the 25% rate, aligned with the recent U.S.-UK Economic Prosperity Deal (EPD). However, rates may rise after July 9th, if the U.K. fails to meet EPD conditions.

- Reciprocal tariffs will now apply to non-steel and non-aluminum content.

- Compliance Enforcement: CBP will issue authoritative guidance mandating strict compliance and outlining maximum penalties for noncompliance.

- Stacking order of 232 steel/aluminum for products of Canada or Mexico has been revised. 232 will now apply instead of the IEEPA tariff.

The administration states that it views this action as essential for achieving sustained capacity utilization in domestic industries, thus reducing reliance on foreign suppliers during national emergencies or defense build-up needs.

In tandem with the proclamation, U.S. Customs and Border Protection (CBP) has issued updated guidance through CSMS #65236574 to clarify how these increased tariffs interact with other existing trade measures under Executive Order 14289.

As enforcement ramps up, importers should consult trade counsel or compliance professionals to ensure filings align with the updated priority structure and avoid costly errors.

Updated June 2, 2025:

On Friday, May 30, President Trump stated that he plans to increase tariffs on steel and aluminum from 25% to 50%, effective Wednesday, June 4. A formal announcement, including clarification around the implementation process for in-transit shipments, is still pending.

It is currently unclear how this announcement will impact tariffs on steel and aluminum from the U.K. The recent U.S.-U.K. trade deal, negotiated last month, brought tariffs on U.K. steel and aluminum down to 0%.

Calculate and analyze tariff impacts in real time with the new Flexport Tariff Simulator. Get started here.

Updated May 30, 2025:

U.S. Customs and Border Protection (CBP) has updated its guidance regarding in-transit exceptions for the International Emergency Economic Powers Act (IEEPA) reciprocal tariffs. Originally, shipments had to be loaded and in-transit to the U.S. prior to April 5, 9, or 10, 2025 (depending on the applicable tariff), and entered into the U.S. prior to May 28, 2025, to qualify for the in-transit exemption.

As of today, CBP has revised that position: it is now generally not realistic for shipments to qualify for the in-transit exceptions unless entry is made prior to June 16, 2025.

This extension offers additional flexibility for importers navigating the evolving tariff landscape, but underscores the importance of confirming entry dates and shipment status with your customs broker or freight forwarder.

Updated May 29, 2025:

Yesterday, the Court of International Trade (CIT) invalidated four of President Trump’s executive orders on tariffs imposed under the International Emergency Economic Powers Act (IEEPA):

- 25% IEEPA tariff on Canada

- 25% IEEPA tariff on Mexico

- 20% IEEPA tariff on China

- Country-specific IEEPA reciprocal tariffs (ranging from 10-67%, and formerly 125% on China)

President Trump’s IEEPA tariffs “exceed any authority granted to the president … to regulate importation by means of tariffs,” the CIT stated in its ruling. President Trump’s usage of IEEPA was “impermissible not because it is unwise or ineffective, but because [federal law] does not allow it.”

What happens next?

The CIT has ordered Customs and Border Protection (CBP) to stop collecting duties from these tariffs within 10 days. However, the Trump administration appealed the decision, asking the U.S. Court of Appeals for the Federal Circuit to stay the order. This afternoon, the U.S. Court of Appeals granted the temporary stay, allowing the plaintiffs to respond by June 5 and the government to respond by June 9. The stay reinstates President Trump’s ability to levy tariffs under IEEPA, meaning the invalidation of the IEEPA duties will not be implemented, the current tariffs remain in effect, and IEEPA tariffs will continue to be collected.

The losing side will likely appeal to the Supreme Court, which will take one of the following courses of action: take the case themselves, leave the appellate court ruling intact, or instruct the appellate court to rehear the case with instructions.

This process will likely take months to unfold, if not longer.

Does this apply to other, non-IEEPA tariffs? What about de minimis?

Section 301 (China Trade War) and Section 232 (aluminum/steel) duties remain in place, and are not impacted by yesterday’s CIT ruling.

It’s not clear if this ruling will impact de minimis, and the CIT may clarify this later. The way the court order is written, it may very well reinstate de minimis for Chinese-origin goods. But the counterpoint is that the court order might be limited just to IEEPA tariffs because:

- The court decision made almost no mention of de minimis.

- The plaintiffs did not challenge the de minimis modifications in their lawsuits.

- None of the court’s discussion of issues addressed modifications to de minimis.

Will importers receive a refund?

The court order says customers should receive refunds for IEEPA tariffs. However, it’s not clear when and how that would happen. We expect that refunds, should they happen, will not be implemented quickly. It’s also not clear if the refunds will be automatic, or if importers of record will need to sue, protest, or follow a claim process. We also don’t know if this applies to entries that liquidated and are past the 180-day protest window. We will continue to monitor the situation and directly update customers who are impacted.

Could the Trump administration leverage other tariff tools?

If the final ruling declares the Trump administration’s IEEPA tariffs illegal, there are a number of other tools the administration may use:

- §122: Balance of payment issues up to 15% for 150 days. The president may levy duties of up to 15% for up to 150 days for “balance of payment deficits” under the Trade Act of 1974, after which U.S. Congress would have to act to extend the tariffs.

- §338: Discrimination on U.S. products up to 50%. The president could impose tariffs of up to 50% on countries that “discriminate against U.S. commerce,” per the Trade Act of 1930. These levies can be imposed without a formal investigation.

- President Trump’s proposed “Big Beautiful Bill.” The One Big Beautiful Bill, the president’s proposed budget reconciliation and tax cut bill, narrowly passed the House of Representatives last week and is awaiting a vote by the Senate. If the bill is enacted, a 10% minimum tariff may be codified by U.S. Congress as a budgetary pay-for.

We could be months away from a final decision on these tariffs, but given the national importance of this case, resolution may come sooner. Flexport’s customs and trade advisory teams are closely monitoring the situation, and will keep customers up to date with the latest developments and guidance.

Updated May 27, 2025:

President Trump has delayed levying a 50% tariff on the EU until July 9, 2025.

“I agreed to the extension—July 9, 2025—it was my privilege to do so,” President Trump wrote on Truth Social on Sunday. “The [European] Commission President said that talks will begin rapidly.”

Updated May 23, 2025:

This morning, President Trump suggested imposing a 50% tariff on the European Union beginning June 1, 2025.

“Their powerful Trade Barriers, Vat Taxes, ridiculous Corporate Penalties, Non-Monetary Trade Barriers, Monetary Manipulations, unfair and unjustified lawsuits against American Companies, and more, have led to a Trade Deficit with the U.S. of more than $250,000,000 a year,” he wrote on Truth Social. “Our discussions with them are going nowhere.”

In a separate Truth Social post this morning, President Trump also mentioned levying a 25% tariff on Apple unless iPhones are “manufactured and built in the United States, not India, or any place else.”

Updated May 12, 2025:

The U.S. and China agreed to reduce tariffs for 90 days. Details of the official executive order include:

- The U.S. will reduce its IEEPA reciprocal tariff rate on China from 125% to 10% for 90 days. After the 90-day period, the reciprocal tariff will increase to 34%.

- The IEEPA fentanyl tariff on China remains unchanged at 20%.

- These tariffs will still stack, creating an effective tariff rate of 30%.

- China will reduce its retaliatory tariff rate on the U.S. from 125% to 10%.

- For items $800 or less sent via postal services, the U.S. will reduce the tariff rate from 120% to 54%, while maintaining the option to pay a $100 flat fee per item instead.

- The flat fee increase to $200 on June 1 has been canceled.

The 90-day agreement will take effect on May 14, 2025.

- There is no retroactivity for the reduced duty rates.

- The new duty rate is for "goods entered for consumption, or withdrawn from warehouse for consumption, on or after 12:01 a.m. eastern daylight time on May 14, 2025.”

According to Treasury Secretary Scott Bessent, the U.S. and China will likely start negotiating a long-term trade agreement in the next few weeks, adding that “it would be implausible” for reciprocal tariffs on China to fall below 10%.

Updated May 9, 2025:

This morning, President Trump indicated that he was open to reducing tariffs on China from 145% to 80%—but that the ultimate decision would lie with Treasury Secretary Scott Bessent. The president’s comments come just as Bessent and U.S. Trade Representative Jamieson Greer prepare to negotiate with Chinese officials in person this weekend.

“80% tariff on China seems right,” President Trump wrote on Truth Social today. “Up to Scott B.”

Just minutes prior, President Trump also stated that China should import more goods from the United States.

“China should open up its market to the U.S.,” he posted. “Closed markets don’t work anymore.”

Updated May 8, 2025:

Earlier this morning, President Trump announced that the U.S. and U.K. have reached a trade agreement—the first deal the U.S. has struck since introducing sweeping tariffs earlier this year. Key terms of the agreement include:

- The 10% baseline reciprocal tariff will remain in place on all U.K. imports.

- U.K. auto manufacturers will be granted a lower-tariff quota. Each year, the first 100,000 U.K. vehicles imported into the U.S. will be subject to only the 10% baseline tariff, rather than the existing 27.5% tariff on U.K. autos.

- Tariffs on U.K. steel and aluminum will be reduced from 25% to 0%.

The timeline for implementing the deal is currently unclear, as U.S. and U.K. officials still need to finalize the specifics of the agreement.

Separately, U.S.-China trade negotiations are set to begin on May 9. U.S. Treasury Secretary Scott Bessent and U.S. Trade Representative (USTR) Jamieson Greer will meet with Chinese Vice Premier He Lifeng in Switzerland—the first in-person negotiations between the U.S. and China since trade tensions escalated in March. While Bessent stated that he does not expect the meeting to yield a trade deal, he noted that “we’ve got to de-escalate before we can move forward.”

Updated May 2, 2025:

Today, just after midnight, the de minimis exemption expired for imports from China and Hong Kong. Before today, the exemption allowed Chinese-origin shipments under $800 to enter the United States duty-free.

President Trump initially moved to end de minimis for Chinese imports in early February. A few days later, he announced that the exemption would remain in effect until “adequate systems are in place to fully and expediently process and collect tariff revenue.”

Today onwards, Chinese-origin shipments under $800 will now face the following fees:

- Parcel: 145% baseline tariff, plus product-specific tariffs

- Postal: 120% baseline tariff or a $100 flat fee per postal item

- The flat fee will rise to $200 on June 1, 2025

President Trump also signaled on Liberation Day that he intends to eliminate the de minimis exemption for all countries once “adequate systems are in place.”

Separately, China’s Commerce Ministry said today that China is “evaluating” U.S. requests to begin trade negotiations—but will only proceed once the U.S. removes tariffs on Chinese goods.

“If the United States does not correct its wrong unilateral tariff measures, it means that the United States has no sincerity at all and will further damage the mutual trust between the two sides,” China’s Commerce Ministry stated.

Updated April 30, 2025:

On April 29, 2025, President Trump signed an executive order aimed at reducing the compounding of multiple tariffs on the same imported goods. This move seeks to streamline tariff applications and reduce the cumulative financial burden on importers.

The executive order specifically addresses the following tariffs:

- Automobiles and Automobile Parts: Tariffs imposed under Proclamation 10908 of March 26, 2025.

- Northern Border Duties: Tariffs related to illicit drug flows across the northern border, as detailed in Executive Orders 14193, 14197, 14226, and 14231.

- Southern Border Duties: Tariffs addressing the situation at the southern border, outlined in Executive Orders 14194, 14198, 14227, and 14232.

- Aluminum Imports: Tariffs from Proclamation 9704 of March 8, 2018, and its amendments, including Proclamation 9980 and Proclamation 10895.

- Steel Imports: Tariffs from Proclamation 9705 of March 8, 2018, and its amendments, including Proclamation 9980 and Proclamation 10896.

Under the new directive, if an imported article is subject to multiple tariffs from the list above, only one tariff will apply, preventing the stacking of duties. The executive order outlined the hierarchy of tariff programs, essentially saying:

- If a good is covered by the new auto tariffs (Proclamation 10908, March 2025), that tariff takes precedence. The product cannot be charged additional duties under the other four programs listed (border-related or metal tariffs).

- If a product is not subject to auto tariffs but is covered by either the Northern or Southern border tariffs, those apply instead of the steel or aluminum duties.

- If a product is only covered by both the steel and aluminum tariffs, both can still apply—stacking is still allowed between those two, unless guidance from U.S. Customs and Border Protection (CBP) says otherwise.

However, it's important to note that this non-stacking rule does not extend to other tariffs outside the specified list, such as those imposed under Section 301 of the Trade Act of 1974, IEEPA fentanyl tariffs, or antidumping and countervailing duties.

The executive order is retroactively effective from March 4, 2025. Importers who have paid overlapping tariffs since that date may be eligible for refunds. CBP is tasked with updating guidance and systems by May 16, 2025, to reflect these changes.

In addition, CBP has clarified two open questions in the last 24 hours.

First, regarding the reciprocal in-transit exemption, CBP confirmed via updates to the IEEPA- FAQ that the exemption ONLY applies to ships—not air, truck, or rail as defined in 19 U.S. 140 and 19 CFR 4.0. This means that goods moving via another mode after April 5 will require the reciprocal tariffs to be applied. CBP is asking all importers to review and correct entries filed with 9903.01.28 that were not moved via ocean transit.

Second, Flexport received confirmation from CBP’s Trade Remedy Branch that products scoped under Section 232 for steel or aluminum derivatives but do not contain any steel or aluminum are subject to reciprocal tariffs. This has been an open question interpreted differently across the industry. This confirmation comes days after CBP clarified that products containing any percentage of steel or aluminum articles or derivatives subject to Section 232 tariffs are completely excluded from reciprocal tariffs.

We are committed to helping our clients navigate these changes seamlessly. Our customs and trade teams are analyzing the executive order's implications to ensure accurate tariff applications and identify potential refund opportunities for past shipments. We'll keep you informed about updates from CBP and provide guidance on any necessary actions to comply with the new tariff structure.

If you believe your imports may be affected by this executive order or have questions about potential refunds, please reach out to your Flexport team, or get in touch with one of our experts at postentry@flexport.com.

Updated April 29, 2025:

Early this morning, the White House issued a sharp response to reports that Amazon planned to display the costs of the Trump administration’s tariffs to customers.

“This is a hostile and political act by Amazon,” White House Press Secretary Karoline Leavitt said. “This is another reason why Americans should buy American.”

Soon after, an Amazon spokesperson clarified that they were only considering adding a tariff surcharge label to select products on Haul, the low-cost shopping section within the Amazon app.

“This was never a consideration for the main Amazon site, and nothing has been implemented on any Amazon properties,” the spokesperson said.

Separately, the White House announced that it would modify auto tariffs so that steel and aluminum tariffs do not “stack” on top of them. The administration also intends to modify its upcoming 25% tariff on auto parts, set to take effect by May 3, to enable reimbursements “up to an amount equal to 3.75% of the value of a U.S.-made car for one year,” the Wall Street Journal reported. “The reimbursement would fall to 2.5% of the car’s value in a second year, and then be phased out altogether.”

Leavitt told reporters this morning that President Trump intends to sign an executive order later today concerning the auto tariffs, but did not reveal the specifics of the order.

Updated April 28, 2025:

Today, Customs and Border Protection (CBP) clarified that for derivative steel or aluminum products, importers do not need to pay IEEPA reciprocal tariffs on the value of non-steel or -aluminum content excluded from the Section 232 tariff measures. In other words, products containing any percentage of steel or aluminum articles or derivatives subject to Section 232 tariffs are completely excluded from reciprocal tariffs. To qualify, the steel or aluminum content must fall under an HTS subject to an existing Section 232 tariff.

On March 12, 2025, the U.S. implemented 25% tariffs on steel and aluminum products and derivative products under Section 232 of the Trade Expansion Act of 1962. For derivative steel and aluminum products, except products classified in a metal Harmonized Tariff Schedule of the U.S. (“HTSUS”) chapter, e.g., Chapter 73 and Chapter 76, the value of the non-steel or -aluminum content may be deducted for purposes of calculating Section 232 tariffs owed. As clarified today, products covered by Section 232 tariff measures are excluded from IEEPA reciprocal tariffs, which took effect on April 5, 2025. Prior to CBP’s notice, it was unclear if non-steel and non-aluminum content would be subject to IEEPA reciprocal tariffs.

Because of CBP’s clarification today, importers may request refunds for any duty overpayments via CBP post entry correction procedures. Flexport customers may contact postentry@flexport.com for assistance with refund requests.

Updated April 23, 2025:

President Trump signaled yesterday that tariffs on Chinese imports “will come down substantially, but not to zero.” Today, a Wall Street Journal article citing a senior White House official stated that the Trump administration is considering bringing IEEPA tariffs on Chinese goods down to 50-65%. Additionally, a potential five-year phased-in tiered approach currently in the house features a 35% tariff on items not classified as a threat to national security, and at least a 100% tariff on “strategic items.” All indications are that bilateral discussions between the U.S. and China are in the early stages.

Updated April 12, 2025:

Smartphones, computers, and various electronic devices and components will be exempt from President Donald Trump’s reciprocal tariffs on Chinese imports, according to a new guidance from the U.S. Customs and Border Protection (CBP) released Friday.

The exemption list also includes semiconductors, solar cells, flat-panel TV displays, flash drives, memory cards, and solid-state drives used for data storage.

However, to qualify for the exemption, products must be properly classified under one of the specific Harmonized Tariff Schedule of the U.S. (HTSUS) codes listed by CBP. The exemption applies to goods that are either directly imported for use or sale in the U.S., or withdrawn from bonded warehouses for domestic use, on or after April 5, 2025.

This move is seen as a victory for tech giants like Apple, whose supply chains are deeply rooted in China. According to estimates from Evercore ISI, China produces 80% of iPads, more than half of all Mac computers, and assembles about 90% of iPhones.

According to the CBP, for qualifying products released by CBP on or after April 5, 2025, customs brokers must update entry filings to reflect the exemption under tariff code 9903.01.32 and new corrections must be submitted as soon as possible within 10 days of the cargo being released from CBP custody.

If duties have already been paid to U.S. Customs, the importer can submit a Post Summary Correction (PSC) to adjust the information and request a refund. However, if Customs has already finalized the duties, the importer may still request a refund by filing a protest—provided it is still within the protest period (usually 180 days after liquidation).

Flexport is reviewing all clients with products falling under the new exemption and will be reaching out to inform them of the applicable SKUs and make any necessary adjustments to entries filed since April 5, 2025.

Updated April 11, 2025:

On Friday, China announced it will raise tariffs on all U.S. goods from 84% to 125%, effective April 12 (Saturday), as the trade war between the world’s two largest economies continues to escalate.

“Given the current level of tariffs, U.S. goods exported to China are no longer market-viable,” China’s Ministry of Finance said in a statement. “If the U.S. continues to impose additional tariffs on Chinese exports, China will no longer respond.”

The countermeasure came after the White House raised tariffs on Chinese goods—now totaling 145%— on Thursday. China denounced the policy as “unilateral act of bullying and coercion” and has vowed to “fight to the end.”

Updated April 10, 2025:

The White House clarified on Thursday that the tariffs imposed on Chinese goods by President Donald Trump total 145%, when accounting for both IEEPA tariffs (Fentanyl and Reciprocal). The 125% tariff announced by President Trump on Wednesday is an increase in the reciprocal duty rates and will be placed on top of the 20% tariffs that had already been imposed on China for its role in supplying fentanyl to the United States.

Following the announcement of the 125% tariffs on Wednesday, China’s Ministry of Commerce stated that while the “door to dialogue is open,” Beijing is prepared to “fight to the end.” The 84% tariff on all U.S. goods entering China took effect at 12:01 a.m. ET on Thursday, which, according to the office of the U.S. Trade Representative, totaled $143.5 billion last year. Meanwhile, the European Union is suspending its retaliatory tariffs following President Trump’s reversal of the country-specific tariff policy for all other countries.

Updated April 9, 2025:

On April 9, 2025, the White House released an Executive Order titled "Restoring America's Maritime Dominance," outlining a strategy to rebuild the United States' commercial shipbuilding capacity and strengthen the maritime workforce.

This executive order aims to revitalize the United States maritime industry and workforce, citing decades of neglect and declining competitiveness compared to global rivals, especially China. It mandates the development of a comprehensive Maritime Action Plan (MAP) within 210 days, involving multiple federal agencies, to achieve the following:

- Strengthen Shipbuilding Capacity: Increase investment, including private capital and government incentives, in shipbuilding, supply chains, port infrastructure, and maritime workforce development.

- Counter China’s Influence: Address unfair practices by China through possible tariffs and enforcement actions, particularly targeting maritime logistics and shipbuilding sectors.

- Enforce Harbor Maintenance Fees: Tighten regulations to ensure foreign-origin cargo arriving through Canada or Mexico pays required U.S. customs duties and fees, preventing circumvention.

- Promote International Collaboration: Engage allies and partners to align trade policies, reduce dependence on adversaries, and incentivize allied shipbuilders to invest in the U.S.

- Financial Support: Propose a Maritime Security Trust Fund and create flexible financial incentives to encourage private investment in shipyards, vessel construction, and maritime infrastructure.

- Establish Maritime Prosperity Zones: Develop geographically diverse zones offering regulatory relief and tax incentives to stimulate domestic and allied maritime industry investments.

- Expand Workforce Development: Improve training programs, enhance merchant marine credentialing, modernize maritime academies (notably the U.S. Merchant Marine Academy), and offer scholarships for cutting-edge maritime education.

- Enhance Procurement Efficiency: Reform government vessel acquisition processes to reduce bureaucracy, cost overruns, and delays, and encourage use of standard components and commercial practices.

- Increase U.S.-Flagged Vessels: Incentivize growth in the U.S.-flagged commercial fleet for national security purposes, particularly ships capable of international trade.

- Arctic Security: Develop a strategy to secure and lead Arctic waterways amidst growing geopolitical challenges.

- Regulatory Review and Deregulation: Review and remove unnecessary regulations to foster innovation and efficiency within the maritime sector.

- Inactive Reserve Fleet: Improve management and mobilization readiness of the inactive reserve fleet.

- Tariff on ship-to-shore cranes manufactured, assembled, or made using components of Chinese origin or manufactured anywhere in the world by a company owned, controlled, or influenced by a Chinese national. As well as, tariffs on other cargo handling equipment.

One of the most notable and immediate provisions in the Executive Order focuses on closing a long-standing loophole related to the Harbor Maintenance Fee (HMF). The fee, intended to fund the maintenance of U.S. ports and waterways, has often been avoided by shippers offloading cargo in Canadian or Mexican ports and transporting goods into the U.S. by land.

To address this, the order directs the Department of Homeland Security to take steps ensuring:

- All foreign-origin cargo arriving by vessel must clear U.S. Customs and Border Protection (CBP) at a U.S. port of entry for full assessment of duties, taxes, and fees, including the HMF.

- Any foreign cargo first arriving in North America via Canada or Mexico, then entering the U.S. by land without substantial transformation, will be assessed the same charges plus a 10 percent service fee to cover additional CBP costs.

- Although no exact timeline is provided, this move is intended to level the playing field for U.S. ports and prevent revenue losses linked to cross-border cargo diversion.

Federal agencies have been given specific timelines to submit plans, reports, and legislative proposals to support the goals outlined in the order. These will be consolidated into the Maritime Action Plan in the coming months.

Updated April 9, 2025:

President Trump has announced a 90-day pause on country-specific reciprocal tariffs for all trade partners except China—less than a day after they took effect. China will now face a 125% tariff rate—up from the 104% rate that took effect at midnight today. During the 90-day pause, all other country-specific reciprocal tariffs will drop down to the universal baseline 10% tariff that took effect on April 5. These updates await official confirmation via an executive order, at which point we will provide an update.

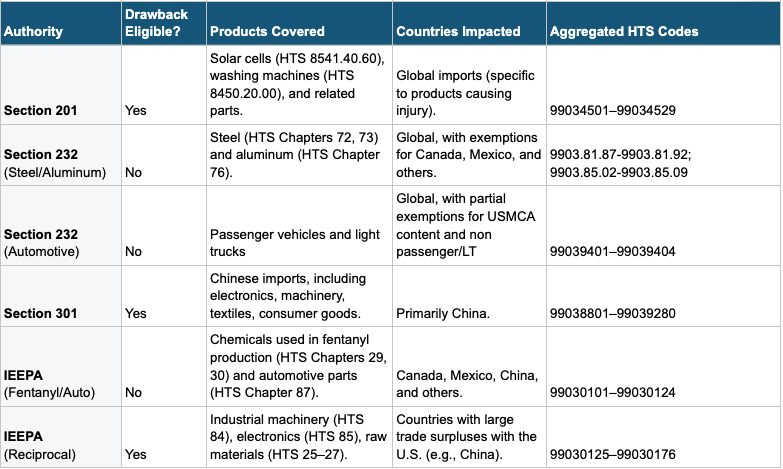

Additionally, as a follow-up to our duty-drawback-related update on April 4, here are more details on eligibility for existing and upcoming tariffs:

Tariffs that are eligible for duty drawback:

- Regular tariffs: The standard duties applied to imported goods under Harmonized Tariff Schedule (HTS) Chapters 01–97.

- Section 201 tariffs: Safeguard tariffs on products like solar cells and washing machines are eligible for drawback recovery when exported or destroyed under customs supervision.

- Section 301 tariffs: Tariffs imposed on Chinese goods addressing unfair trade practices are eligible for drawback recovery.

- IEEPA reciprocal tariffs: Duties imposed to rectify trade imbalances are eligible for drawback recovery.

Tariffs that are not eligible for duty drawback:

- Section 232 tariffs: National security tariffs on steel and aluminum imports are not eligible for drawback recovery, regardless of export activity.

- IEEPA tariffs: Duties targeting fentanyl precursors and automotive sectors are not eligible for drawback.

- Antidumping and countervailing duties (AD/CVD): Trade remedy duties designed to counteract unfair pricing or subsidies are always excluded from drawback eligibility.

- Agricultural over-quota duties: Duties applied to agricultural products exceeding quota limits cannot be recovered.

For more details, refer to this chart:

Flexport can help you get started on your own drawback. Our experts can help you identify eligible imports and exports, gather required documentation like import/export records and invoices, file claims through U.S. Customs using accurate data and timelines, and more.

Updated April 7, 2025:

President Trump announced that he would impose an additional 50% tariff on China on April 9 if the nation “does not withdraw its 34% [upcoming retaliatory tariff] above their already-long-term trading abuses by tomorrow, April 8.”

While Trump stated that “all talks with China concerning their requested meetings with us will be terminated,” he indicated that negotiations with other trade partners would proceed immediately. According to Treasury Secretary Scott Bessent, more than 50 countries have requested negotiation meetings with the White House since last Wednesday’s Liberation Day announcement.

Updated April 4, 2025:

A recent update from U.S. Customs and Border Protection (CSMS #64649265) clarifies the rules regarding exemptions to the new reciprocal tariffs, which take effect April 5, 2025.

Businesses may claim an exemption from the 10% reciprocal duty if both of the following conditions are met:

- Departure Date: Goods must have been loaded onto a vessel and in transit on the final mode of transport before 12:01 a.m. ET on April 5, 2025.

- Arrival/Entry Date: Goods must be entered for consumption (or withdrawn from warehouse) between 12:01 a.m. EDT on April 5 and 12:01 a.m. ET on May 27, 2025.

This means that goods which departed their origin before April 5, 2025, but do not arrive in the U.S. by May 27, 2025, will be required to pay the additional 10% reciprocal duties. CBP created this cutoff date to “prevent abuse of the exemption".

Additionally, drawback is available for the 10% IEEPA Reciprocal tariff. However, it will not be available for the previously announced IEEPA Fentanyl or Section 232 (steel and aluminum) tariffs.

If your company imports merchandise subject to the 10% IEEPA Reciprocal Tariff and also exports from the U.S., don’t leave money on the table - get your duties back! This refund opportunity can offset costs, boost margins, and support your global competitiveness. Reach out to ensure you’re maximizing this benefit.

After May 27, 2025, CBP will no longer accept the exemption. That means all goods—regardless of when they departed—will be subject to the 10% tariff if entered on or after this date.

Updated April 2, 2025:

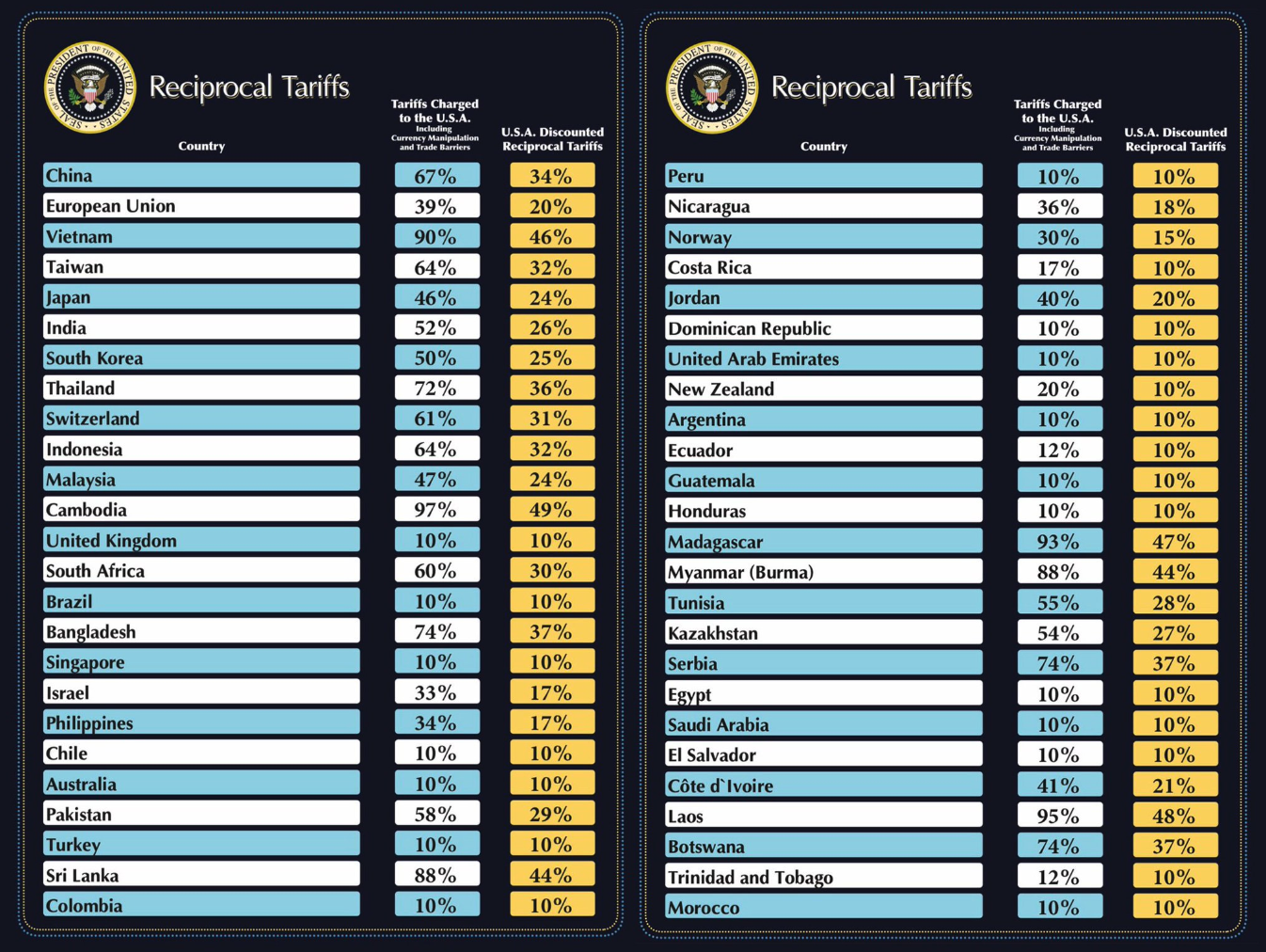

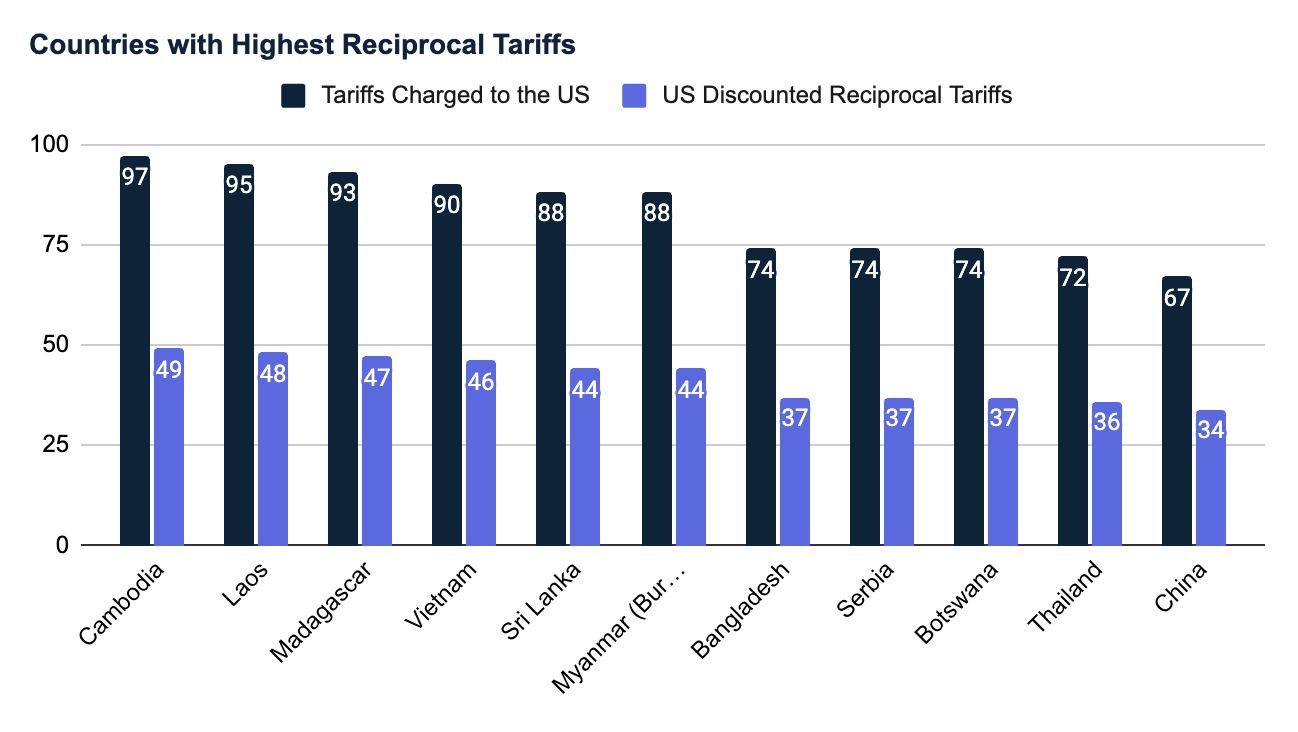

Today, on “Liberation Day,” President Trump made a number of new tariff and trade policy announcements. Shortly after his press conference this afternoon, he also issued an executive order. Details are as follows:

- Reciprocal tariffs, effective April 9, 2025

- Most reciprocal tariffs will be levied at roughly half the rate the Trump administration contends is charged to the United States. Some trade partners (like the United Kingdom and Australia) will face a reciprocal tariff equivalent to what they charge the United States.

It is currently unclear whether these reciprocal tariffs will be imposed on all imports from these countries, or only goods these countries impose tariffs on against the United States.

Note that reciprocal tariffs will not apply to goods subject to existing or future Section 232 tariffs (like steel and aluminum articles and automobiles and auto parts), nor will they apply to minerals, timber, copper, pharmaceuticals, or semiconductors.

Cumulatively, China will be subject to some of the steepest tariffs: a new 34% reciprocal tariff, on top of Section 301 tariffs, the 20% IEEPA tariff implemented in early March, and baseline U.S. tariffs.

- A 10% universal baseline tariff on all trade partners, effective April 5, 2025

- The elimination of de minimis treatment for imports from China and Hong Kong, effective May 2, 2025

- President Trump had previously announced in early February that he would eliminate de minimis for Chinese imports. A few days later, he announced that de minimis would remain in effect until “adequate systems are in place to fully and expediently process and collect tariff revenue.”

- Per today's executive order, adequate systems are now in place to collect tariff revenue.

- A 25% tariff on automobiles, effective April 3, 2025

- The tariff will apply to imported passenger vehicles, SUVs, minivans, cargo vans, and light trucks.

- For automobiles that comply with the U.S.-Mexico-Canada Agreement (USMCA), the 25% tariff will apply only to non-U.S. content (i.e., parts not significantly produced or transformed in the U.S.). Importers must proactively submit documentation at the time of importation proving U.S. content to Customs (CBP).

- If importers cannot satisfactorily document U.S. content, the full value of the vehicle will be subject to the 25% tariff. This penalty can apply retroactively, potentially resulting in additional costs even after entry.

- A 25% tariff on automobile parts, effective by May 3, 2025

- The tariff will apply to an extensive range of imported automobile parts, including but not limited to: tires; wheels; filters; seat belts; speedometers; rubber gaskets; hoses; automotive glass; springs; door mountings; bumpers; fenders; air filters; catalytic converters; car air conditioners; computers used in automobiles; lead-acid and lithium batteries; and even speed guns used by police. Note that this list extends well beyond the engines, transmissions, and electrical components indicated by earlier announcements.

- 90 days from now (or sooner), the Secretary of Commerce must establish a process for adding additional items to the list of automobile parts subject to this tariff.

- Automobile parts that comply with USMCA (excluding knock-down kits and parts compilations) will not be subject to the new tariff until the Secretary of Commerce establishes a method for taxing importers’ non-U.S. content.

- Auto parts that are clearly unrelated to passenger vehicles (cars, SUVs, minivans, and cargo vans) or light trucks will also be eligible for an exemption from the tariff.

- A 25% tariff on empty aluminum cans and beer, effective April 4, 2025

- The latest revision to the Harmonized Tariff Schedule (with regard to the Aluminum Presidential Proclamation) now contains two additional aluminum derivative products: beer and empty aluminum cans. For beer, the levy will be imposed on the value of the aluminum can.

Updated March 27, 2025:

Yesterday, President Trump signed a proclamation imposing a 25% tariff on all imports of automobiles and auto parts. The tariff, which will take effect on April 3 at 12:01 a.m. ET, will apply to both finished automobiles shipped into the U.S. and imported parts assembled into automobiles at American auto plants.

Importers of automobiles that comply with the United States-Mexico-Canada Agreement (USMCA) will be given the opportunity to certify their U.S. content, so that the 25% tariff will only apply to their non-U.S. content. Additionally, USMCA-compliant auto parts will not be subject to the new tariff until the Secretary of Commerce and CBP finalize a process for applying tariffs to importers’ non-U.S. content.

About half of all U.S. auto imports come from Mexico and Canada; other top suppliers include Japan, South Korea, and Germany. Some American brands—including major manufacturers like General Motors, Ford, and Stellantis—will also be significantly impacted, with supply chains that cross North American borders several times and major operations in the U.S., Mexico, and Canada.

Updated March 25, 2025:

President Trump issued an executive order yesterday imposing a 25% tariff on all countries that buy oil or gas from Venezuela, effective April 2. This tariff will be added on top of existing tariffs.

According to the executive order, officials from the Trump administration—the Secretaries of State, the Treasury, Commerce, and Homeland Security, along with the U.S. Trade Representative—may determine specific tariffs to levy. The executive order also stipulates that the tariffs will expire one year after Venezuelan oil is last imported, or possibly earlier, depending on decisions from Trump administration officials.

China and the U.S. are among the biggest buyers of Venezuelan oil. Of the 921,000 barrels of crude oil Venezuela produced per day in 2024, 351,000 barrels per day were shipped to China, while 228,000 barrels per day were shipped to the United States. Other regular importers of Venezuelan oil include India, Spain, Brazil, and Turkey.

About the Author

March 27, 2025

Related content

![White House GettyImages-603224136 (1)]()

Blog

Live Updates: Trump administration tariffs, trade policy changes, and impacts on global supply chains

![GettyImages-94467555 (1)]()

Blog

The Future of Ocean Carrier Alliances: How Network Redesigns Will Transform The Global Ocean Freight Market in 2025

More from Flexport

![GettyImages-723523781 1199x800]()

Blog

The End of the EU’s Duty-Free Exemption for Low-Value Goods: Timelines, Upcoming Changes, and Impacts on Ecommerce Brands