March 22, 2023

Four Winning Strategies for a Successful Transpacific Ocean Freight RFP Season 2023

Four Winning Strategies for a Successful Transpacific Ocean Freight RFP Season 2023

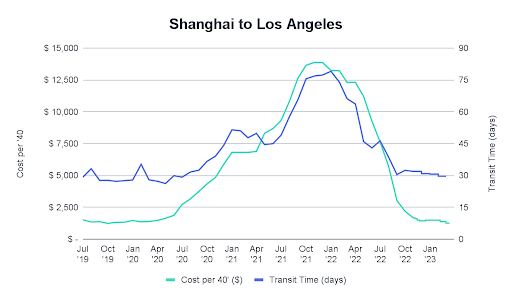

Against the backdrop of falling spot rates and the previous year’s historic high fixed ocean freight contract rates, the 2023 transpacific RFP (Request For Proposal) season has hit full stride. And with rates and transit times looking nearly identical to pre-pandemic 2019 numbers (as seen in the below chart), many shippers are feeling the squeeze between wanting to lock in the reliability of a fixed contract with the savings of playing on the spot market. Here are our thoughts on this year’s RFP season and our suggestions for how to come out ahead this year.

*Flexport analysis of Xeneta data

Key Trends to Watch for RFP ‘23

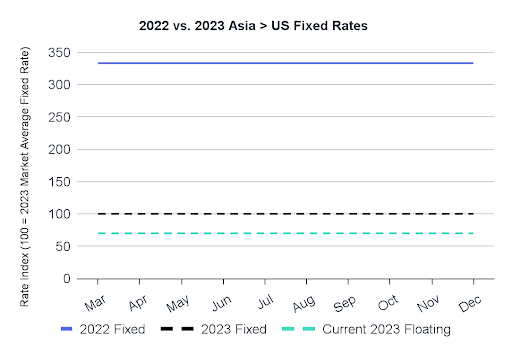

*Flexport analysis

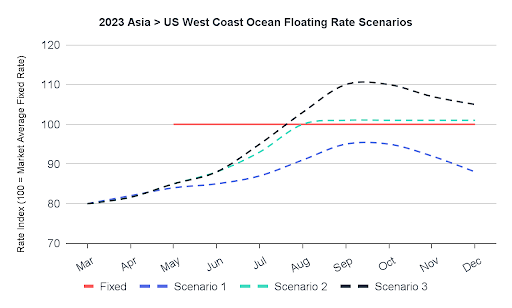

Overall, we expect fixed rates to settle around 30% higher than current floating rates, but 70% lower than last year. We see three likely scenarios that may materialize, which one comes to pass is going to be down to the market conditions that we see in Q2.

*Flexport analysis

Scenario 1 – Floating rates remain well below fixed rates. In this scenario, we’re likely to see a rash of service cancellations and reductions in capacity as carriers try to close the gap between fixed and floating rates.

Scenario 2 – Floating rates, on average, line up with fixed rates (including fluctuations). This is the closest scenario to pre-pandemic, with a rough equilibrium between supply and demand.

Scenario 3 – Floating rates steadily increase and climb slightly above fixed rates later in the year. Carriers may pull capacity as a result of spot rates dropping too low, and if they pull too much, this is the likely scenario.

Another key trend we’re seeing take shape is that freight forwarders are gaining market share again, and for good reason. With a growing number of importers changing their suppliers, and many shipments being routed to new destination ports, freight forwarders are well-positioned to find the best routing options and consistent weekly sailings across carriers.

There is a lot more to it than rates, contract terms, and routing though. A successful RFP should evaluate the full package.

Winning Strategies from our Experts

1. Take advantage of lower spot rates and wait for market rates to settle before signing.

“Details will vary lane by lane, but by mid-April expect the market to settle around 30% higher than current floating rates.”

- Anders Schulze, Global Head of Ocean, Flexport

2. Consider fixed rate levels, seasonality of your product lines, peak season expectations, and commodity type when building your strategy for the year.

3. Diversify strategy across fixed and floating contracts.

“Consider putting some portion of your volume, if it stays consistent week to week, on a fixed contract. Take the other portion that is less certain and bring that to the floating market. Customers are telling me they’re going with anywhere from a 50/50 split to a 70/30 or 30/70 split. This strategy depends heavily on your supply chain and what makes the most sense for your business and your plans for the year.”

- Kaitlyn Glancy, VP, North America, Flexport

4. Determine the rate that would hit your financial goals and if the market gets there, sign. If it doesn’t, then decide how to hedge your bets.

“Your service level is going to be considerably better if you’re paying [contract rates] that are basically the average of what carriers load on a vessel. If you’re paying under that, guess what happens? Your cargo is probably going to leave on the next sailing. If you’re paying $50 or $100 [per FEU] more, your cargo will be treated better.”

- Nerijus Poskus, VP of Ocean Strategy & Carrier Development, Flexport

To hear our full thoughts on these topics and more, please view our recent Logistics Rewired Webinar on navigating the '23 RFP season.

For more information on how Flexport can help you create a successful RFP this year, please get in touch with our team of experts.