September 15, 2021

Transpacific Shifts: Import Demand Is Changing the World’s Busiest Trade Lane

Transpacific Shifts: Import Demand Is Changing the World’s Busiest Trade Lane

Nerijus Poskus is Vice President of Global Ocean at Flexport, where he leads long-term ocean strategy. Since 2015, he has scaled up Flexport’s global ocean carrier partnerships, trade lane coverage, and fulfilment operations. Stay current with Nerijus on the blog and LinkedIn.

We’ve entered a new phase of the Covid pandemic. Carrier trends are emerging from the initial shock to the ocean market. US imports are so strong that American consumer demand is pulling available capacity away from other trade lanes, disrupting global supply chains.

By tracking the impacts, we can begin to understand the future of the Transpacific.

Three Trends Worth Tracking

Most companies know import demand is swallowing available ocean capacity. Right now, I see three major trends worth tracking:

- Southeast Asia rose in importance due to various factors, including regional responses to Covid. Carrier routes and deployed capacity reflect this shift.

- Smaller carriers are gaining in number, momentum, and market share.

- Many carriers are expanding into new premium service offerings and dedicated strings outside of the three dominant container shipping alliances.

One thing the past year has proven: Where there’s demand, supply will follow.

The Rise of Southeast Asia Reshuffles Carrier Rankings

Carriers that invested in Southeast Asia have been able to gain significant market share in 2020 and 2021.

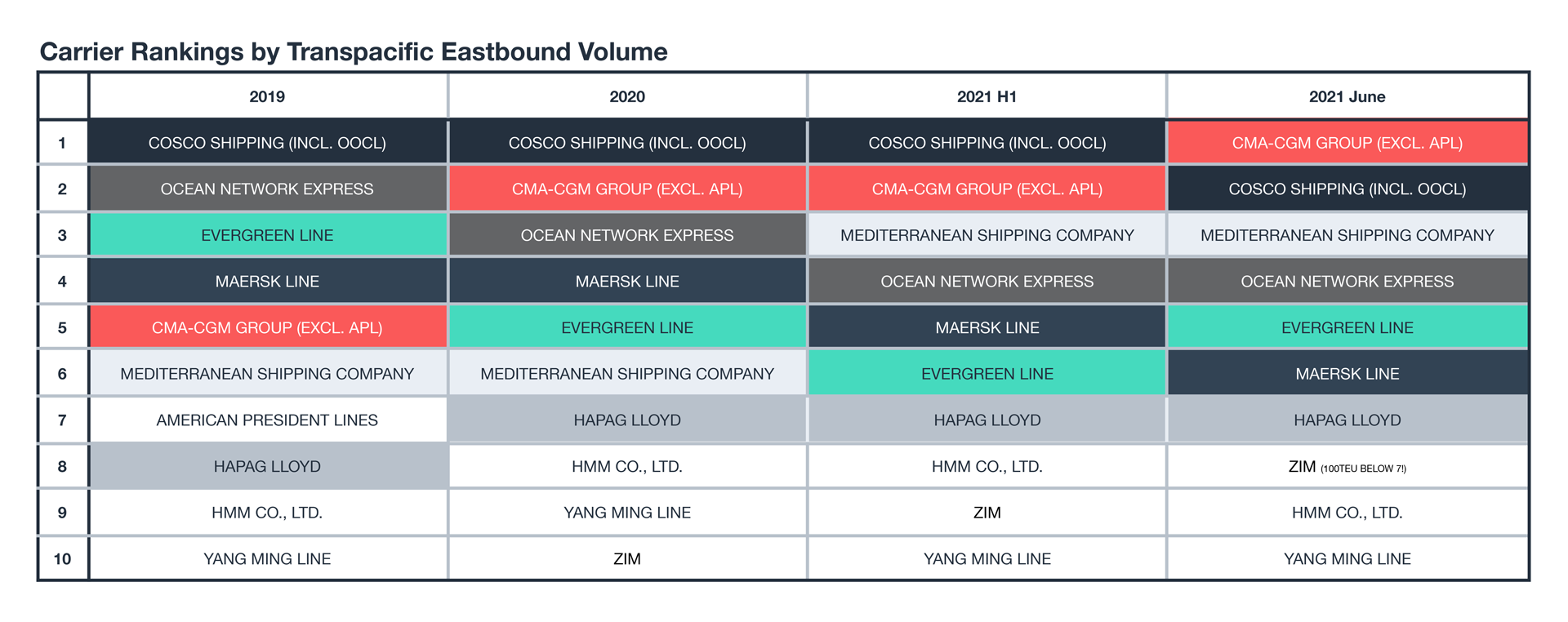

This table illustrates the shifts in carrier rankings by Transpacific Eastbound volume that have taken place since 2019:

There’s a world of background here: A decade ago, supply chain decisions were less complex than they are today. Companies could choose the ease of outsourcing everything to one supplier, often in China, and be mostly done.

Now, decisions are layered. Before Covid, a US-China tariff war contributed to companies diversifying their suppliers. Then, Covid triggered an extraordinary level of goods demand with no end in sight.

Read More: New Post-Covid Indicator Predicts Goods Demand Rising High by Fall

Impacts cascade from there: Factory workforces are scaled down or staggered as a public health precaution. Shipping capacity is under great pressure everywhere.

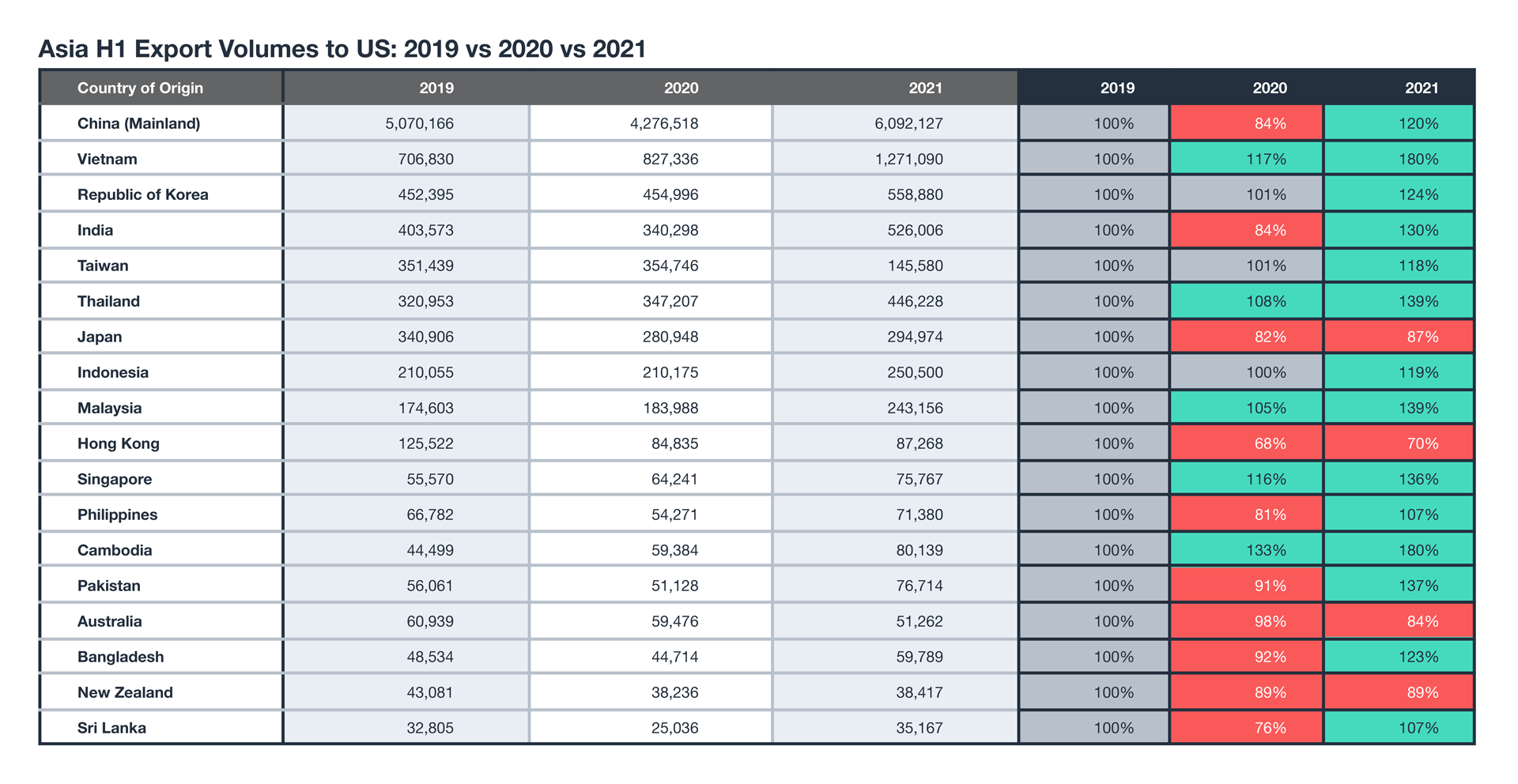

Countries like Vietnam, Cambodia, and Malaysia have capitalized on these factors and seen immense growth in exports to the US in the past few years.

We see the same type of growth following in the ocean market. CMA CGM Group and Mediterranean Shipping Company (MSC) each grew their Transpacific volumes in the Southeast Asia region by approximately three times since early 2019.

These leaps position CMA as the top Transpacific carrier by volume as of June 2021, overtaking a two-year run in the lead by Chinese Cosco Group, including OOCL. MSC is now in the top three, up from sixth in 2020.

Will Southeast Asia Keep Performing?

Since June a new rash of Covid outbreaks has overwhelmed supply chains once more. Southeast Asia has been particularly hard-hit. Restrictions especially threaten factory production in Vietnam.

Regional Covid restrictions in Southeast Asia mean we can expect more blank sailings in the near term. When the situation improves, container shortages in that area will follow because empty equipment is not being brought in. With less effective capacity, we can expect Southeast Asia share to drop temporarily in the months to come.

When restrictions are lifted, the larger trends in the region are likely to hold: Carriers will remain growing in Southeast Asia.

Read More: A Field Guide to Southeast Asia Supply Chain Options

A Bigger Chunk for Smaller Carriers

High Transpacific market pricing is attracting new capacity. Smaller niche shipping lines, such as BAL, CU Lines, Translink, and now T.S. Lines have all deployed new Transpacific services.

Existing smaller or niche carriers are also adding a lot of extra capacity. Taiwanese Wan Hai, for example, carried 12 times more cargo in June 2021 than it did in June 2020. Matson has tripled its volume in the last 2 years. ZIM almost doubled its Transpacific volumes from June 2020 to June 2021. It now moves as much volume as German Hapag LLoyd and Korean HMM, at least on the TPEB.

The success of these smaller, rapid-growth carriers makes sense. Some are simply adding Transpacific capacity at a time when it’s desperately needed. Others provide unique premium offerings to reduce lead times and avoid congestion at major port terminals.

At Flexport, we expect this trend to continue into 2022. As capacity demand changes with time, only the carriers that create real value for clients—via price or premium quality—are likely to stay in the Transpacific market in the long run.

New Service Offerings

The need for greater value is driving carriers to introduce new services.

Carriers including CMA CGM, Matson, and ZIM have successfully launched multiple premium services, like fast boats, priority discharge, and priority rail service to inland destinations. Each of these services features their own benefits, depending on the specifics of your transit needs—a topic worth an entire post of its own, for another day.

Follow Nerijus Poskus on LinkedIn to stay current on ocean freight.

These premium services now make up a sizable portion of the ocean market with approximately 30,000 TEU of dedicated capacity each week, equivalent to roughly 5% to 6% of all Transpacific capacity. If you add loading and equipment guarantees, that portion of the market shoots up to around 20% or more of the entire trade lane.

In my opinion, real premium services are the ones that offer competitive advantage to a client—for example, reduced lead times.

Hence, once supply and demand balance improves, these are the services that will continue gaining share in the market. Other premium offerings are good temporary solutions to keep your cargo moving in a capacity (and equipment) constrained market.

These new premium services are also how ocean freight, with its relatively lower cost when compared to air freight, can support product launches, just-in-time replenishment, or shorter product cycles. In some instances, the speed gained in transit allows for additional product cycles, leading to greater opportunities for profit or growth.

With the visibility offered in the Flexport Platform, it’s easier to make efficient decisions about which goods are worth transporting via premium services. When you can track down to the SKU level, you can manage delays with focused responses.