August 8, 2022

Revisiting Section 301 Tariffs - The State of Trade

What’s the future for U.S. Section 301 tariffs on imports from China? What impact have they had on supply chains? The Biden administration may have limited opportunities and appetite to remove the tariffs. Supply chains may already be adapting to a tariffs-for-longer scenario.

Flexport’s State of Trade Webinar on July 27, 2022 took a deep dive into the history of U.S. Section 301 duties on imports from China. The discussion considered the policy’s impact on supply chains and the future for the tariffs under the Biden administration and beyond.

Strategic Competitors - How We Got Here

The Trump administration applied a set of tariffs on imports from China after conducting a Section 301 tariff review into China’s intellectual property practices.

Waves of tariffs were applied—enumerated in a set of lists from 1 to 4A—and adjusted during a series of tit-for-tat exchanges between the U.S. and China. The initial duties were applied in July 2018 with a series of increments through 2018 and 2019 before a final adjustment in February 2020 as part of the “Phase 1 trade deal” between the two countries.

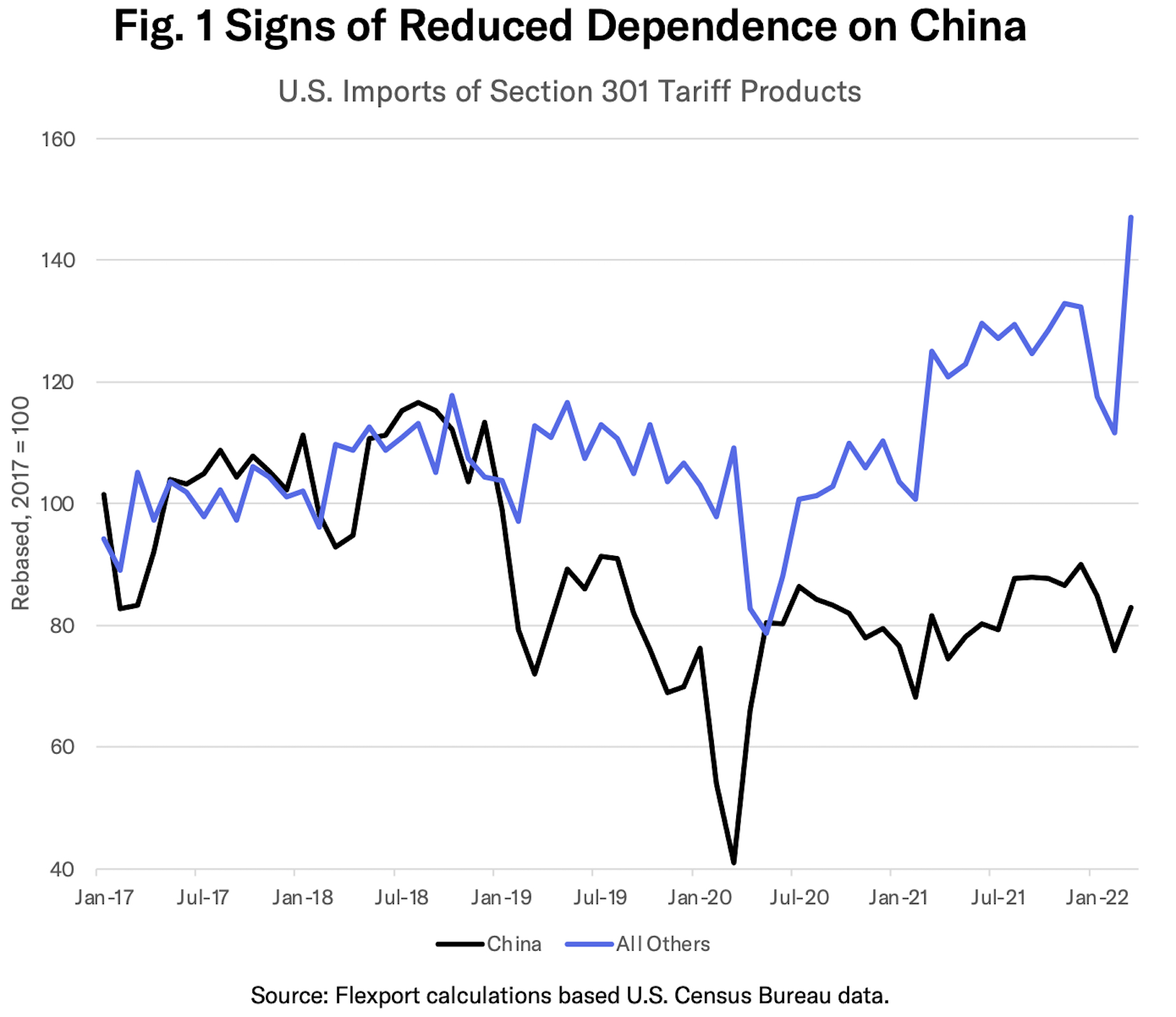

The black line in Figure 1 shows U.S. imports from China. More specifically, it indicates that the products covered by the Section 301 tariffs fell by around one-fifth in the 12 months to March 31, 2022 compared to the level applying in 2017. At the same time imports from the rest of the world of the same products (purple line) increased by around one-third.

That’s come at the same time as disruptions from the pandemic, logistics challenges, and escalating inflation, but may nonetheless be indicative of sourcing realignments in response to the tariffs.

An audience poll from the webinar showed that 80% believe the principal impact of the tariffs was to “impose costs on American consumers and businesses”.

Before exemptions in the 12 months to March 31, 2022, the value of tariffs was an estimated $50 billion. List 1, 2 and 3 cover a mix of supply-chain and finished industrial goods and have a rate of 25% applied. Meanwhile, list 4A focuses on consumer goods with a rate of 7.5%.

Retaining Leverage, Hitting Windows - Future for Tariffs

Another audience poll showed that two-thirds see the Biden administration’s actions on the duties being either “as expected” or “less tough than expected”.

Thus far, the only formal move made regarding the duties by the Biden administration has been an extension of exemptions from the tariffs. That’s covered just 19% of the original exemptions made by the Trump administration. Of those, one-fifth relate to medical goods needed in the fight against COVID-19.

It’s worth noting that the U.S. Trade Representative is in the midst of a compulsory four-year review of the Section 301 tariffs. A report from that review is due by spring 2023.

The administration may consider reducing the tariffs in the fight against elevated inflation. The tariffs may have contributed to inflation by directly raising the tariff-inclusive price paid by consumers, or by reducing competition in affected products.

The inflation impact of duty removal would depend on how extensive such a move might be:

- Reports suggest the administration may only exempt a small group of products from tariffs.

- The consumer goods covered by the tariffs are mostly in List 4A where duties are just 7.5%.

- The higher tariff rate of 25% applies to products in intermediate supply chains where tariff reductions could take time to work through to consumer prices.

From a political perspective, relations between the U.S. and China have soured for a variety of non-trade related reasons. The Biden administration may therefore have an incentive to look “strong on China” heading into both the 2022 mid-term elections as well as the 2024 general elections.

Furthermore, the U.S. Trade Representative has indicated a preference to maintain the economic leverage represented by the tariffs. There’s even the possibility that the Biden administration may launch another Section 301 review, this time focused on the activity of state-owned enterprises. The administration is also pursuing multilateral activities, such as the Indo-Pacific Economic Framework, which include geopolitical goals.

From a practical perspective, that may mean there are limited windows for the tariffs to be altered depending on the outcome of the elections: after the midterm elections but before year end; after the USTR review is complete but before the general election cycle gets underway; under the next administration or beyond.

In a third poll of the webinar’s audience, one-quarter expect the tariffs to only be removed by the next presidential administration while half believe that the tariffs are here to stay.

In conclusion: Section 301 tariffs should be viewed against the backdrop of wider tension between the U.S. and China. Supply chains appear to have realigned around the Section 301 tariffs, which may stay in place for years to come.

Disclaimer: The contents of this report are made available for informational purposes only and should not be relied upon for any legal, business, or financial decisions. Flexport does not guarantee, represent, or warrant any of the contents of this report because they are based on our current beliefs, expectations, and assumptions, about which there can be no assurance due to various anticipated and unanticipated events that may occur. This report has been prepared to the best of our knowledge and research; however, the information presented herein may not reflect the most current regulatory or industry developments. Neither Flexport nor its advisors or affiliates shall be liable for any losses that arise in any way due to the reliance on the contents contained in this report.

About the Author

Related content

![Nordstream 1 natural gas pumping in Germany]()

Economic Insights

Down, But Not Out - Commodity Price Inflation Drivers Revisited

July 28th, 2022

![2022-05 China US S301 Masthead]()

Economic Insights

Inflation Today, Geopolitics Tomorrow - U.S. Tariffs on China

May 18th, 2022

More from Flexport

![GettyImages-723523781 1199x800]()

Blog

The End of the EU’s Duty-Free Exemption for Low-Value Goods: Timelines, Upcoming Changes, and Impacts on Ecommerce Brands