April 27, 2023

Neither Ship nor Shore – The Rise of Landlocked Laredo

Container throughput at Laredo on the U.S. - Mexico border reached a new monthly high in March, jumping by more than 30,000 twenty-foot equivalent units (TEUs) from February to reach nearly 235,000. To date, the evidence for near-shoring has been murky. Here we look at how it is perhaps coming into clearer view.

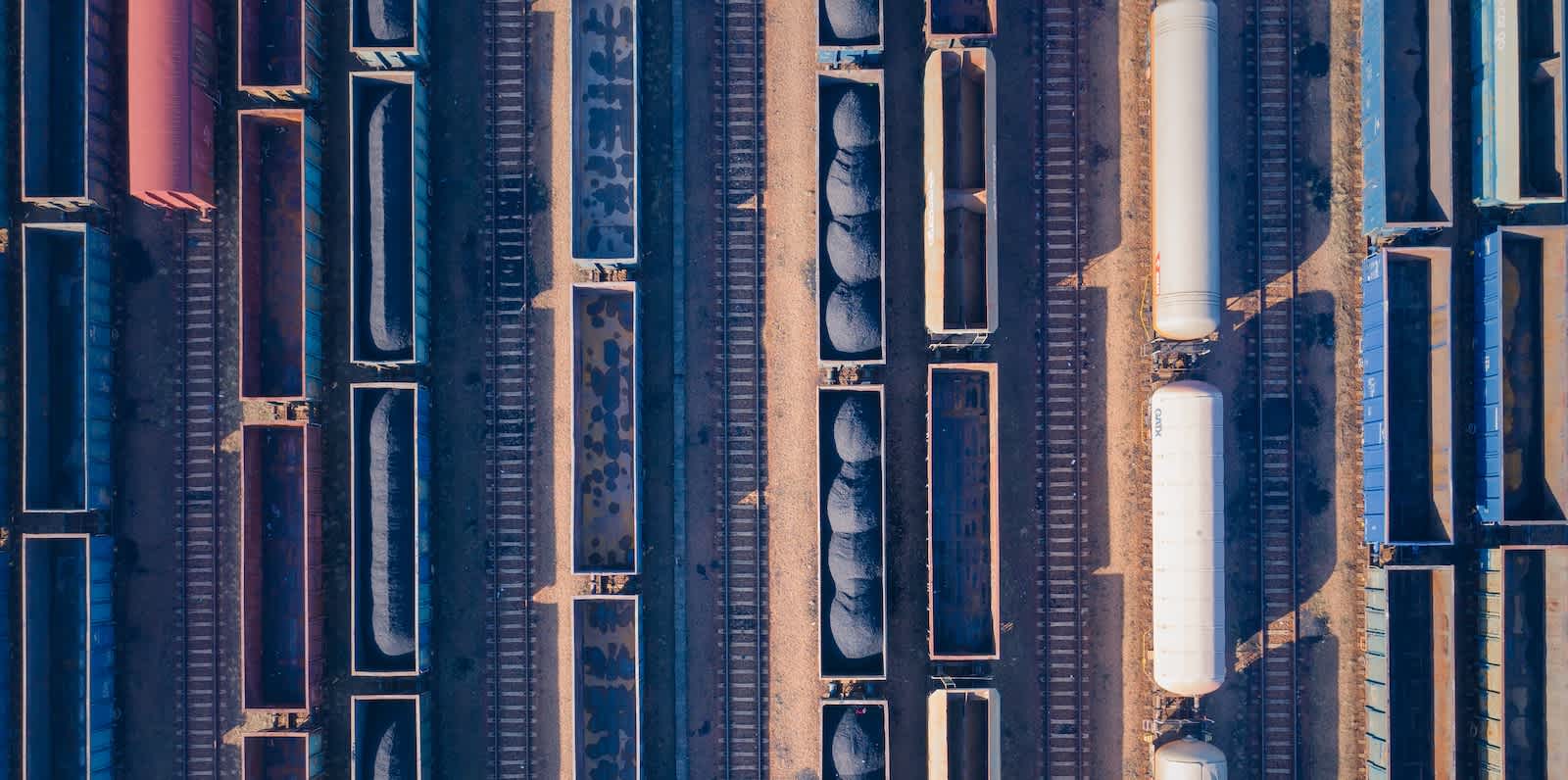

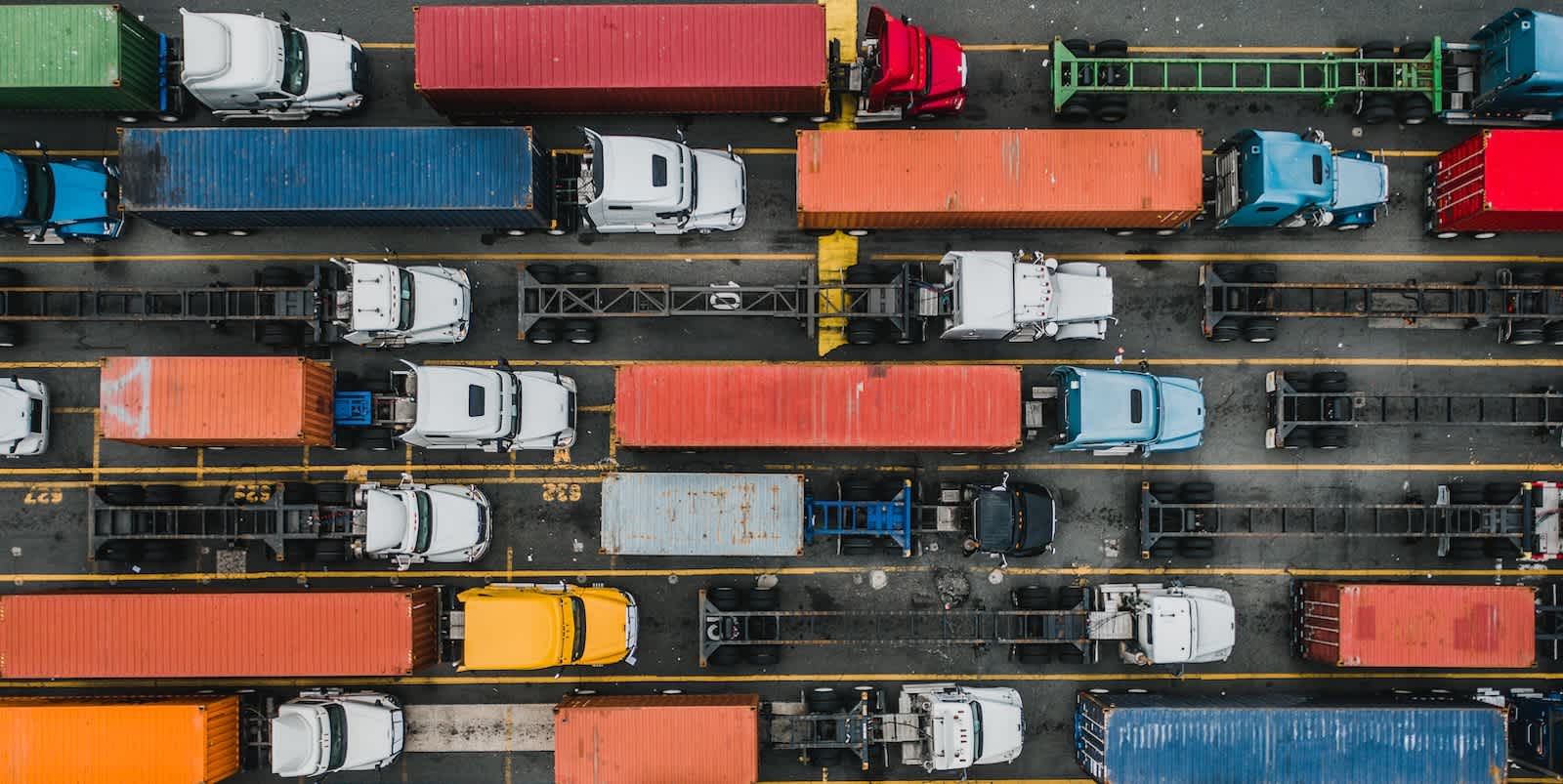

After Long Beach and Newark, the third busiest port in the United States in March is not a ‘port,’ or at least not the kind with waves lapping against docks. It is landlocked, more than one hundred miles from the sea and the majority of ‘shipments’ pass through on the back of semis and atop long, winding trains without being offloaded.

It is Laredo, Texas, or Nuevo Laredo, Tamaulipas, depending on which side of the border you sit on. And it is one of the major indicators suggesting a potential shift in US trade flows.

The chart below compares monthly loaded TEUs through Laredo against the 2019 pre-pandemic average of around 165,000 per month (the straight dotted blue line). Recall that in 2019, U.S. real imports were trending downwards and that after the initial drop caused by the onset of the pandemic, we then started seeing considerable growth.

Turning back to Laredo, with the exception of a likely-seasonal drop in the May of 2022, volumes have remained well-above that average for the past twelve months, culminating in the March spike, which represented a 14.8% month-on-month increase and 17.5% increase year-on-year. By contrast, total seaborne TEUs into the U.S. were only up 6.6% month-on-month and still 24.9% lower than March 2022.

What makes that spike – and the volumes in the months preceding it – all the more intriguing is that it came at a time when there was an apparent disconnect between tumultuous U.S. seaborne imports, resilient consumer spending and wholesale and retail inventory levels.

The rise in activity at Laredo may provide one piece of the puzzle. It could turn out to be just a temporary surge, however, and volumes will eventually settle back at historical levels. Indeed, if the past few years have taught us anything, it’s that seeming trends can be anything but.

Let’s consider two factors that suggest this one could endure. First, but not necessarily foremost, is that firms are more concerned than ever about the integrity of their supply chains, particularly as regards proximity to end demand. Most supply chains held up reasonably well during the pandemic, regardless of distance and in some sectors, because of it. That hasn’t assuaged concerns, apparently. To cite just one example, a recent survey of US small and medium-sized businesses (SMBs) found that 88% of respondents plan to source either in the U.S. or nearby.

Second, and related, is the global policy environment. Nearshoring or onshoring have been among the main areas of focus for policymakers in the U.S. and elsewhere for some time now. It’s debatable whether or not this is appropriate for achieving their specific aims. That’s not for us to address here. It’s not debatable, however, that it is at least being attempted through various measures, including trade agreements, tariffs, and subsidies and tax breaks attached to content requirements.

Supply chains are difficult to adjust. But most firms will take advantage of opportunities presented to them and when it comes to Mexico, they appear to see opportunities.

Finally, if we’re looking for another sign of potential endurance, foreign direct investment (FDI) into Mexico may provide one. FDI has been shown to increase trade. In 2022, Mexico’s nominal inflows totaled $35.3 billion, the highest figure since 2015. $15 billion of that came from the US, long the largest foreign investor in the country and by far the largest market for its exports. The rest was accounted for by countries like Canada, Argentina, Japan, and South Korea. Chinese firms, too, are building a stronger presence in Mexico, with a focus on regions near the U.S. - Mexico border.

With all the uncertainty surrounding the U.S. economy at the moment, the rest of the year will be an interesting test for Mexico’s export potential. We will be watching Laredo closely to see if it trucks on or gets derailed. The spikes may be occasional, as in the chart, but the proof will be in the continuation of the upward trend.

Disclaimer: The contents of this report are made available for informational purposes only and should not be relied upon for any legal, business, or financial decisions. Flexport does not guarantee, represent, or warrant any of the contents of this report because they are based on our current beliefs, expectations, and assumptions, about which there can be no assurance due to various anticipated and unanticipated events that may occur. This report has been prepared to the best of our knowledge and research; however, the information presented herein may not reflect the most current regulatory or industry developments. Neither Flexport nor its advisors or affiliates shall be liable for any losses that arise in any way due to the reliance on the contents contained in this report.