Sign Up With Flexport

Join Thousands of Leading Brands on Flexport

91% of Flexport customers agree that the Flexport Platform allows for clear and fast communication and collaboration with suppliers, partners, and their team.* Learn how medical technology company Qardio puts data at the heart of its business with Flexport.

Our current customers save 4 hours a week on average using Flexport over other freight forwarders.* *Based on 2020 TechValidate survey of 200+ current Flexport customers.

On average, Flexport customers onboard 55 users at their company onto the Platform across supply chain, customer support, finance, and sales.

Access

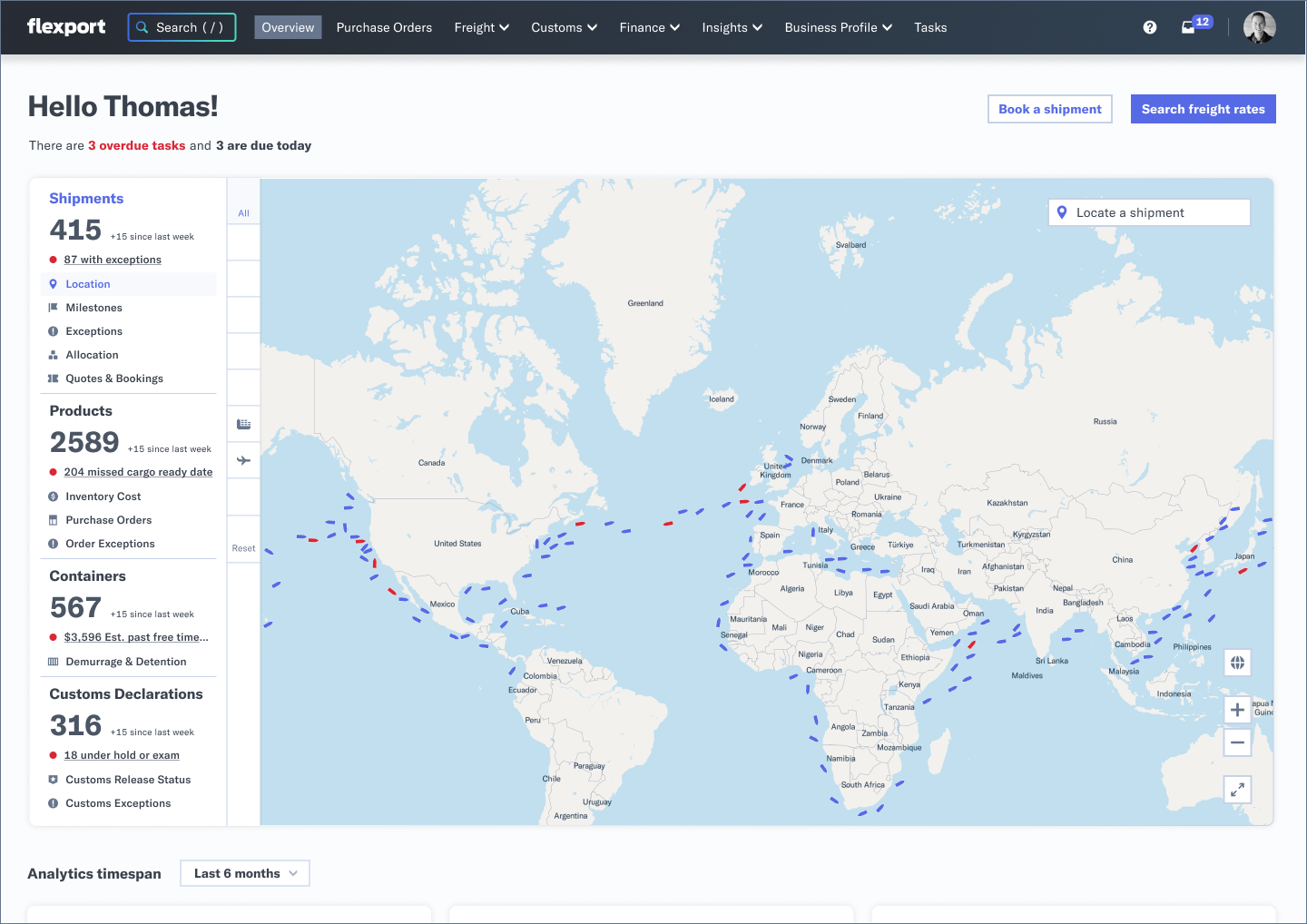

Cruise at 10,000 Feet. Then Dive into Action.

Surfaces what matters most and see your supply chain how it matters to you. Surface active shipments, purchase orders, exceptions, and declarations, enabling fast response to live issues and bottlenecks.

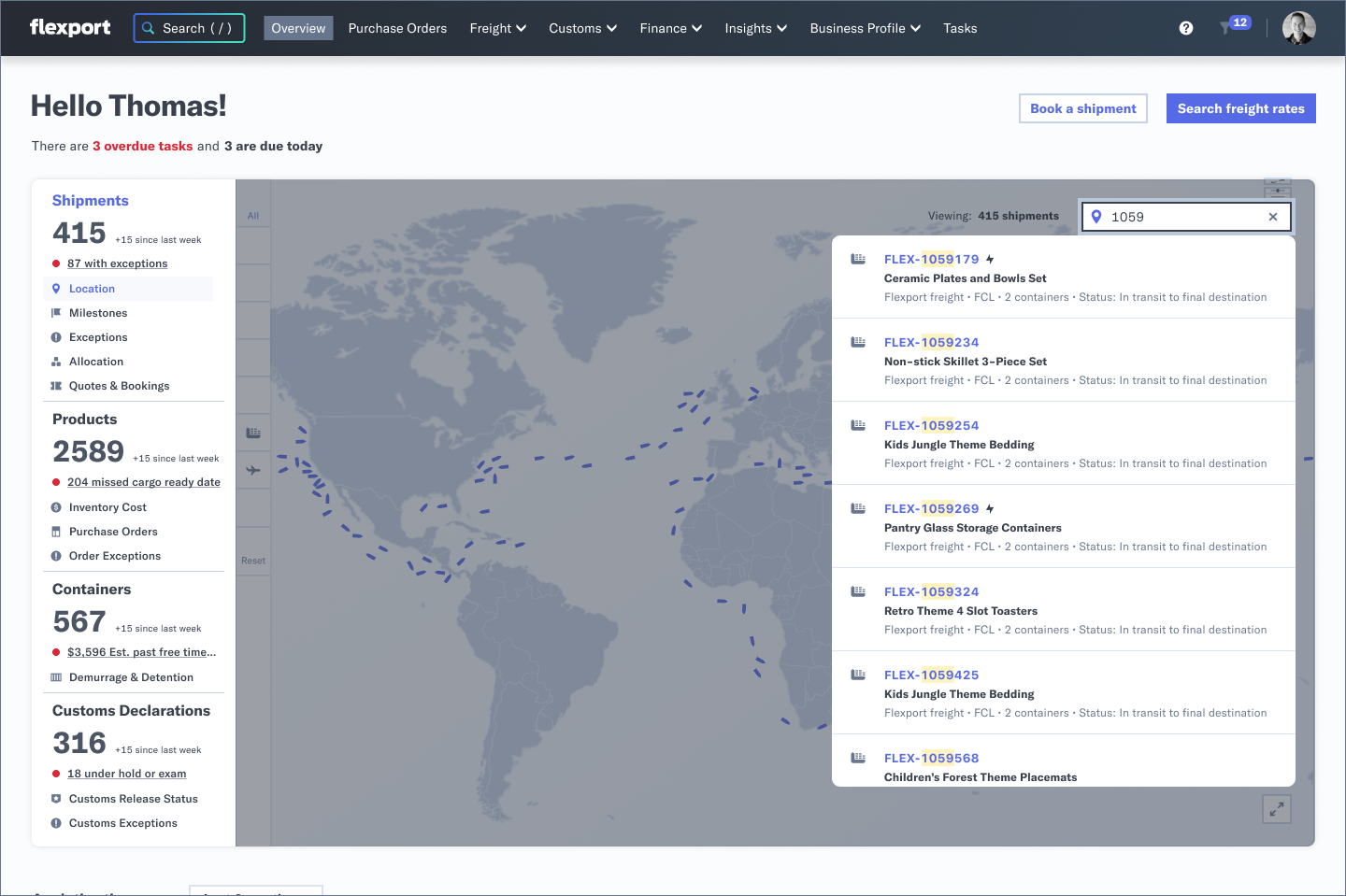

Visibility

One Place to Manage It All

Show 90-day trends across cost, supplier performance, container utilization, etc. to support strategic decision-making.

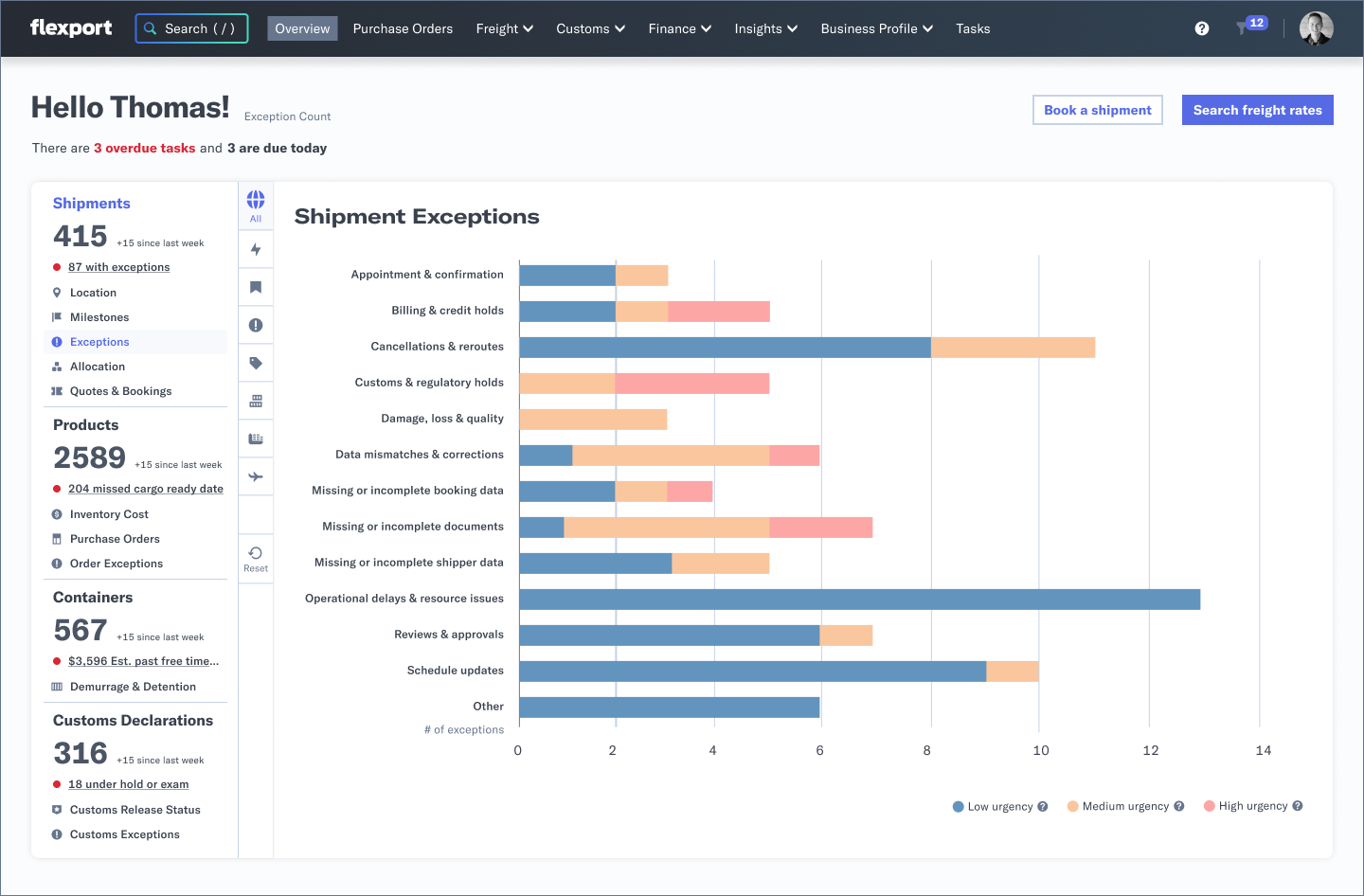

Control

Immediate Exception Management

With access to over 600 exceptions organized by category and classified by priority, we make it easy for you to fix what needs your attention most.

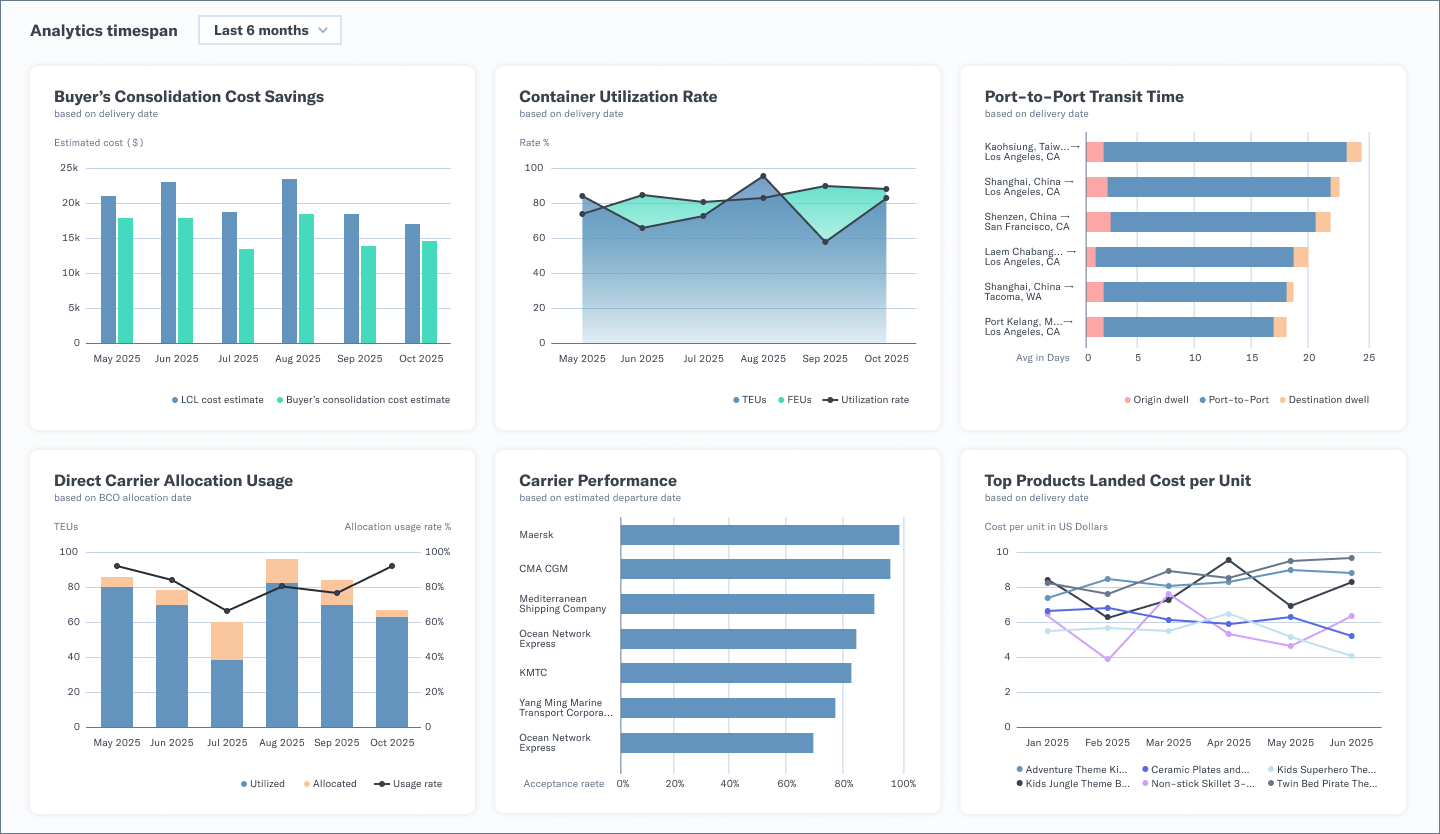

Insights

Access Data Without the Effort

Integrated live shipment data, product milestones, purchase metrics, transit times, landed costs and more to help you act decisively and track outcomes over time.

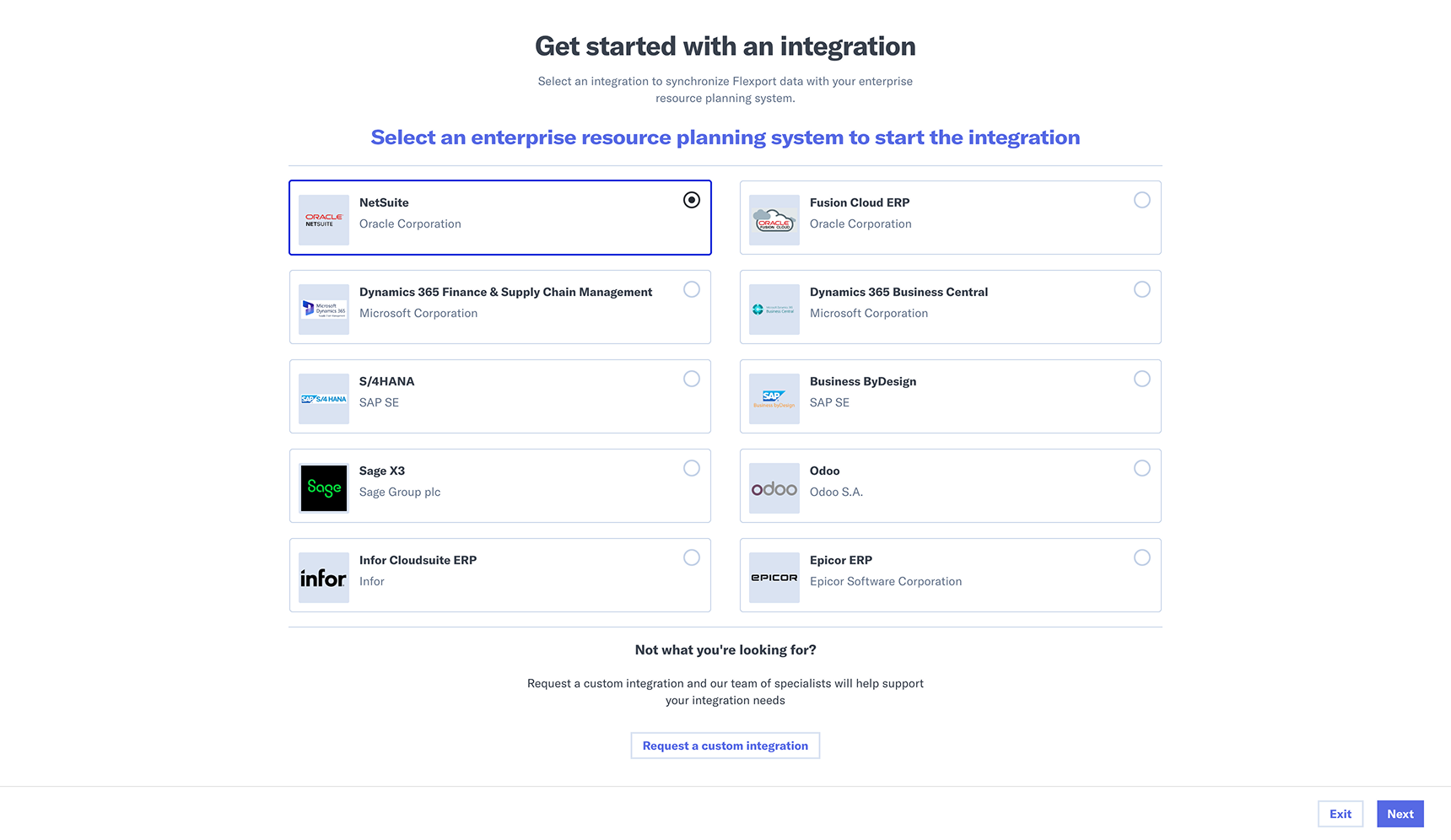

Integrations

Unlock the Power of Our Netsuite Integration

With an out-of-box, native integration solution with Netsuite, easily connect your supply chain systems to enable a seamless purchase order and shipment management experience. Operate from your system of choice and make quicker decisions.

Instant Freight Quotes

Search, compare, and book freight in a few clicks across a vast catalog of air, ocean and multi-modal services, complete with end-to-end pricing that eliminates surprises, and enables you to find the lowest cost or fastest transit depending on your needs.

The Flexport Platform allows our company constant visibility to our supply chain. From shipment consolidation options, booking alternatives and data analytics, we have been able to lower freight costs and receive goods in a timely manner.

Operations Director, Small Business Industrial Manufacturing Company

The Flexport Platform has made it easy for anyone in the organization to follow the status of a shipment which allows us to work better as a team and provide better support to our customers.

Jenny Bremer

Finance Manager, Linstol USA, LLC

We have a well-managed and attentive account team. Platform visibility and milestones are key and Flexport does a great job of tracking each one for real-time decision making.

Mark Riskowitz

Head of Operations, Caraway Home

Manage Your Supply Chain End-to-End

Stay in Step with Suppliers. Do a Happy Dance.

Collaborate with suppliers as they fulfill your orders and meet milestones like must-book-by and cargo -ready dates. When your supply chain starts with highly accurate data, it never misses a beat.

Take Your Digital Flow Further

Frequently Asked Questions

How much does it cost to use the Flexport Platform and is there a maximum number of users I can add?

Does Flexport only work with certain carriers?

What type of integrations do you support?

What is the Flexport Platform?

Who is the Flexport Platform designed for?

What features does the Flexport Platform offer?

Can the Flexport Platform integrate with my existing systems?

How much does the Flexport Platform cost?

Sign Up for Global Logistics Update

Why search for updates when we can send them to you?