Help Center Article

A Quick Guide to Incoterms®

Tags:

Incoterms® are used to specify which party arranges for the payment and handling of goods during shipping, from origin to destination.

A Quick Guide to Incoterms®

Incoterms® are used to specify which party arranges for the payment and handling of goods during shipping, from origin to destination.

Incoterms® are terms of sale that define who arranges for the payment and handling of the goods during shipping, from the moment the goods leave the seller’s (the manufacturer’s) door up until their arrival at the buyer’s final destination.

“Incoterms®” is shorthand for “International Commercial Terms” as defined by the International Chamber of Commerce.

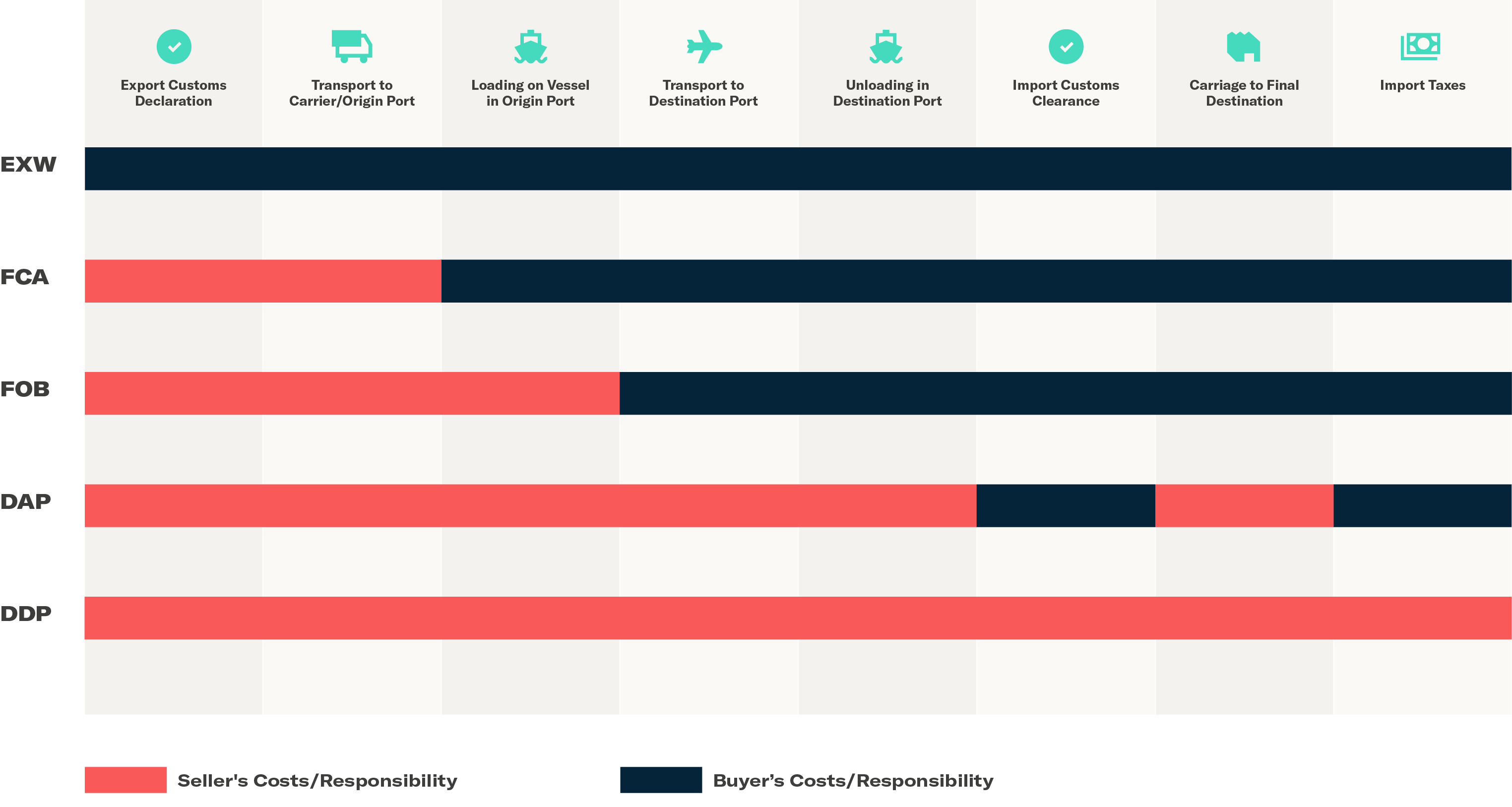

Below is a chart summarizing 5 of the most commonly used Incoterms®.

For more information about Incoterms®, see Incoterms®.

Incoterms® do:

- Define the obligations and costs between the seller and the buyer. Incoterms® create common and relatively precise understanding of the respective operational obligations and costs between a seller and a buyer relating to the delivery of the buyer’s goods.

- Define the point of passage of risk between the buyer and seller regarding cargo loss or damage.

- Provide instructions to carriers, forwarders, customs brokers, and others involved in shipping your goods, as well as banks and others involved in financing.

Incoterms® don’t:

- Cover ownership/passage of title. Passage of title should be separately defined via a “retention of title” clause within the sales contract.

- Cover payment. Terms of payment for the goods are negotiated separately.

- Cover insurance. Only CIF (Cost, Insurance and Freight) and CIP (Carriage and Insurance Paid) specifically outline insurance as the seller’s responsibility. Other terms do not outline who has this responsibility.

What are the most common Incoterms®?

FCA (Free Carrier) / FOB (Free on Board)

The seller is responsible for delivering the goods to the port or the buyer's nominated premises and loading them on board the ship or buyer's transportation, and the seller is responsible for all costs associated with those duties, including the terminal handling charges, export clearance and meeting security requirements. With FOB, risk is transferred from the seller to the buyer as soon as the goods pass the ship’s railing. In FCA, risk is transferred once the goods are loaded on the buyer's transportation. These terms are often used interchangeably; however, technically the FCA term is the correct term for containerized sea freight.

FAS (Free Alongside Ship)

The seller is responsible for delivering the goods alongside the buyer's vessel at the named port of shipment. Buyer bears responsibility for costs and risk loss or damage from that moment. Under Incoterms® 2020 the FAS term does require the seller to clear the goods for export (under previous Incoterms® the buyer arranges export clearance)

EXW (Ex Works)

The seller is responsible for making the goods available at the seller’s premises. The buyer bears the full responsibility, cost, and risk from the seller’s premises.

Buyers and sellers typically reference Incoterms® 2010 or Incoterms® 2020 in their contracts. There are differences! An example is an extra provision brought by Incoterms® 2020 to the FCA incoterm: By use of this 2020 Incoterm®, parties can now agree that the buyer must instruct the carrier to issue to the seller, at the buyer’s cost and risk, a transport document stating that the goods have been loaded. Then, the seller is obligated to provide such transaction document to the buyer.

Flexport will begin handling the shipment at the point where the buyer takes responsibility of the shipment according to your Incoterms®.

You will note your Incoterms® in Flexport’s app when you submit a quote request.