May 15, 2023

Supply Chain Snapshots - News of the Week (May 15, 2023)

Tags:

Monday, May 15, 2023

Softer Peak Season Import Forecast Trending Toward Pre-Pandemic Levels: US Retailers

(Read more on Journal of Commerce)

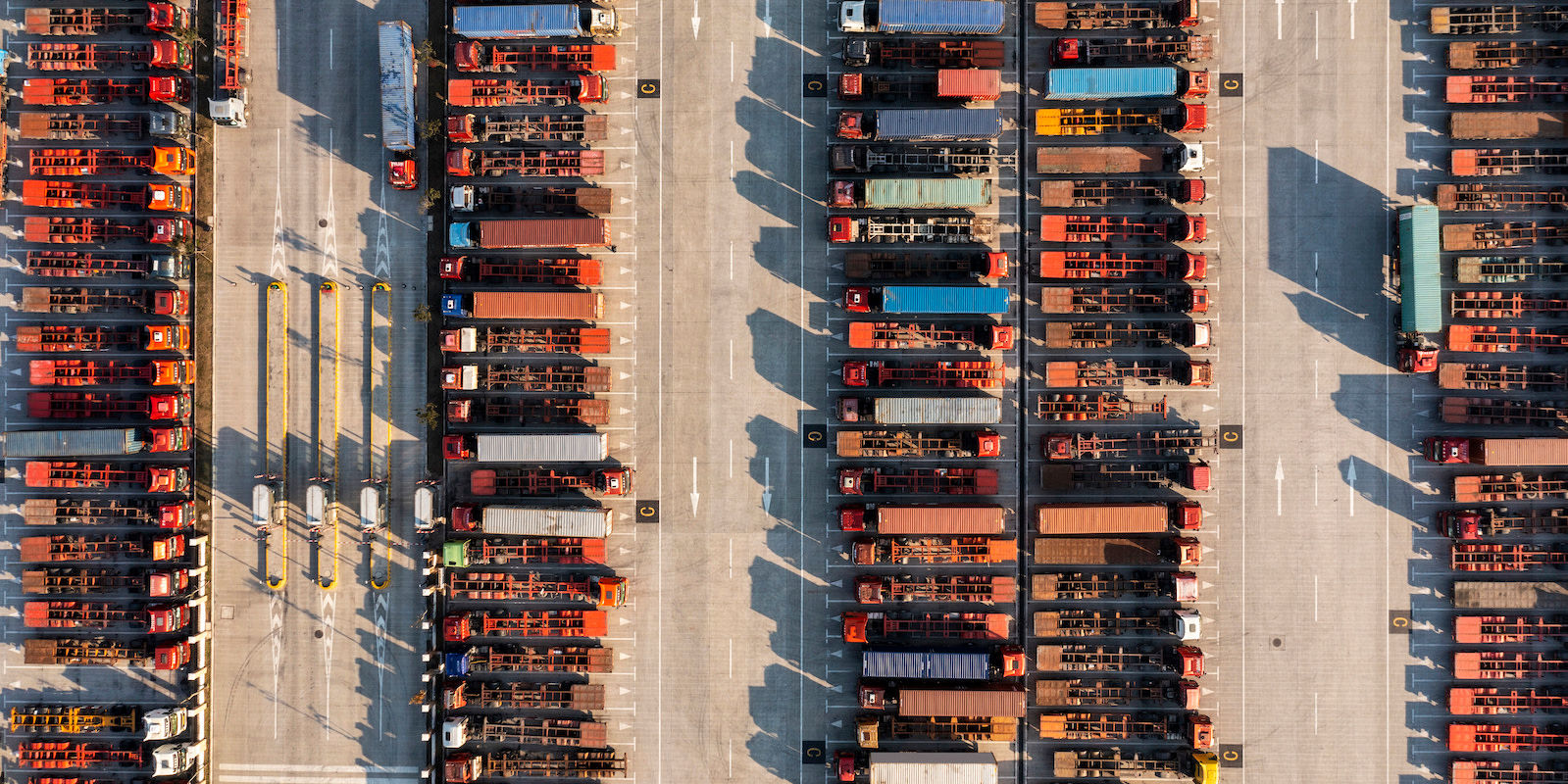

Peak season ‘23 is shaping up to be on par with pre-pandemic years, according to the latest Global Port Tracker (GPT) released by Hackett Associates in conjunction with the National Retail Foundation (NRF). Import volumes will be down from 2022, due in part to the current level of inflation and in part to how many retailers are still sitting on inventory overages. Other factors include trucker shortages and ongoing uncertainty around labor talks at U.S. west coast ports.

Flexport Makes the CNBC Disruptor 50 List for the Third Year in a Row

(Read more on CNBC)

For the past 11 years, CNBC has named 50 startups to its Disruptor 50 list. These companies are selected for their ambition and cutting-edge technology, sure, but they’re also picked because they’re chasing the biggest opportunities in their respective industries. For the third year in a row, Flexport is proud to be among them at number 10 after topping the list in 2022.

Labor Deal at West Coast Ports Comes Into View

(Read more at The Wall Street Journal)

The contract talks between representatives of longshore workers and port operators that have stretched to nearly a year from their starting point in May 2022 appear to be approaching a conclusion. With an early agreement on healthcare benefits, plus the recent announcement of an agreement being reached around the use of automation at ports, the main issues remaining to be addressed are wages and pension benefits.

West Coast Ports Lost Market Share. Will They Get It Back?

(Hear more at Marketplace)

Flexport’s own Nerijus Poskus, VP & Global Head of Ocean Freight, was recently featured in a segment on NPR’s Marketplace about the shifting of nearly 1 million TEUs of cargo from U.S. west coast ports to those on the Gulf Coast and east coast. Factors in this shift include the pandemic-caused logjams (at one point there were more than 100 ships at anchor off the Los Angeles coast), of course, but as Poskus points out this trend started years ago with a move of manufacturing from Asia to India and Latin America.

Trucking Could — Maybe — Become Less Volatile

(Read more on Freightwaves)

Shippers, tired of the ongoing volatility in the trucking industry over the last few years, are starting to push back. They’re getting aggressive, but not by going with the lowest bidder as many might expect. Rather, they’re going for service-level metrics like “on-time, in-full.” Drawing on their own Sonar data, Freightwaves looks at how this, combined with a move to a more constant, year-round request for proposal (RFP) season is shifting the trucking tide in shipper’s favor.