Help Center Article

Importing into the EU: Customs Duties

Tags:

The EU classifies products using HS codes, the CN, and TARIC. See below for step-by-step instructions on how to estimate customs duties for EU imports.

Importing into the EU: Customs Duties

Importers to the European Union (EU) will be responsible for paying customs duties determined by the imported product’s classification code. See below for more information on EU classification codes, how to determine your product’s classification code, and how to estimate customs duties.

For US customs information, see What are HS and HTS Codes, and How Do I Estimate Customs Duties?

What are HS codes?

HS (Harmonized Commodity Description and Coding System) codes are 6-digit product classification codes used by all members of the World Customs Organization (WCO) to classify goods for customs purposes.

HS codes can be broken down into three parts: the first two digits identify the chapter the goods are classified in, the next two digits identify the headings within that chapter, and the last two digits identify the sub-headings within that chapter.

What is the CN?

The Combined Nomenclature (CN) is a tool for classifying goods, set up to meet the requirements both of the Common Customs Tariff and of the EU's external trade statistics. The CN is also used in intra-EU trade statistics.

CN codes are eight digits, consisting of the six-digit HS code and the two-digit CN subheadings.

What is TARIC?

The integrated Tariff of the European Union (TARIC) is a database that provides information on trade policy and tariff measures that apply to specific goods in the EU. TARIC codes integrate all measures relating to EU customs tariff, commercial and agricultural legislation.

TARIC codes provide additional classification for some products and are a minimum of ten digits, consisting of the eight-digit CN code and the two-digit TARIC subheadings.

The TARIC database can be found on the European Commission’s website.

How do I know the CN code of my product?

Your supplier may have provided you with the CN code, but if you don’t know the CN code of your product, you can try to determine the CN code using the EU Tariffs Database (http://madb.europa.eu/madb/euTariffs.htm) and selecting “Find my product code.”

Be aware that the many rules and exclusions make correct classification difficult, but your customs broker may help correctly classify your product.

Note that the importer is ultimately responsible for correctly classifying products.

How do I know the TARIC code of my product?

If you don’t know the TARIC code of your product, you can try to determine the TARIC code using the EU Tariffs Database and selecting “Find my product code.” Your supplier may have provided you with the 6 digit HS code which can sometimes help to determine the TARIC code. If you are still unsure of the TARIC code Flexport offers classification services for all EU countries.

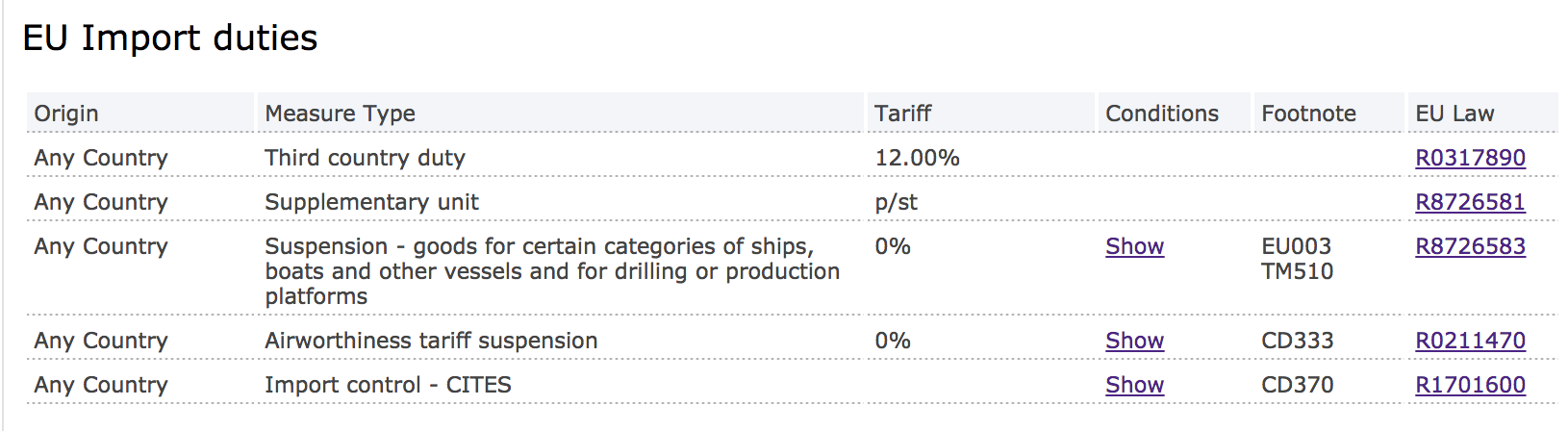

How do I estimate EU customs duties?

Import customs duties are not included in your Flexport quote, but you can estimate them using your product’s classification code (HS code, CN code, or TARIC code).

1. Enter the product code in EU Tariffs Database:

2. Multiply the duty rate by the value of your product (found on the commercial invoice*) by the number of products for an estimation of what you will need to pay in customs duties.

Anti-dumping or countervailing duties could also apply.

*Note that for EU shipments, the customs value may include additional costs such as freight costs to the EU border, insurance costs, etc.*