Global Logistics Update

Freight Market Update: February 6th, 2019

Ocean and air freight rates and trends; trucking and customs news for the week of February 6th, 2019.

Freight Market Update: February 6th, 2019

Want to receive our weekly Market Update via email? Subscribe here!

⚠️Reminder Notices ⚠️

Extreme Winter Conditions Causing Midwest and Canada Rail Delays

Rail movement in the Midwest and Canada is delayed as temperatures drop. Railcars are shortened and trains are slowed in an effort to not ruin the tracks or brakes when the temperature falls below -25℃. This causes longer transit times, idling rail cars, and congestion at ocean ports because containers can't be loaded onto the rail. For more information, see CN's video on cold rail conditions.

LA and NY Trucking Experiencing Congestion

We’re seeing extreme congestion at Los Angeles/Long Beach and New York ports, as a result of the influx of import volume in advance of the tariff hikes, peak season, and Chinese New Year preparations. The large import volume is causing a chassis shortage and long pickup times, so you may experience some shipment delays in the next few weeks. New York’s Newark terminal is particularly crowded, and because NY terminals are not open after hours or on weekends (unlike LA/LB), we expect the NY backlog to take longer to clear.

UK Ports Remain Extremely Congested

UK ports are very congested, which is causing tight trucking capacity and a decline in port productivity. This congestion is expected to continue through late January. Quay side operations have improved, but shortage of haulage capacity restricts movement. Trucking currently needs to be booked 14 days in advance.

Haulage capacity in Germany and the Benelux remains a challenge, impacted by low water in the river Rhine, reducing intake of barges and increasing moves via rail and truck.

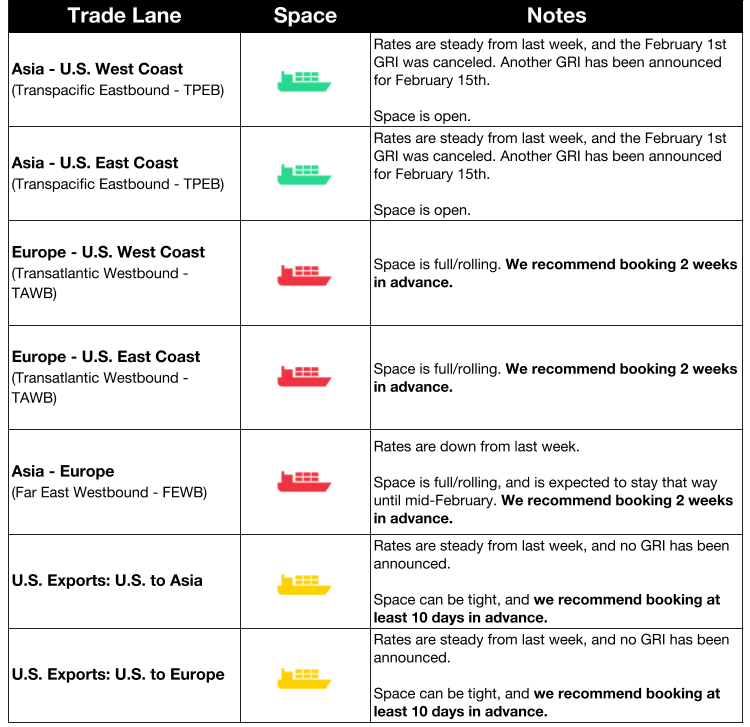

Ocean Freight Market Updates

Chinese New Year Blank Sailings Announced

A number of blank sailings have been announced around Chinese New Year. More information and a list of the affected ports and strings is available on our blog.

APL Vessel Catches Fire

APL Vancouver caught fire on January 31st, and general average will likely be declared. However, more than half of the containers are estimated to not be covered under insurance, so the goods will have to be auctioned off to pay for the damages. 4,500 containers were onboard, and 100 of them were loaded with hazardous materials.

Impact of New IMO ECA Regulations

The International Maritime Organization (IMO) has mandated under new Emission Control Area regulations that by 2020, all merchant vessels must reduce their sulfur emissions from 3.5% to 0.5%.

Whether they install scrubbers, build new vessels, or use higher-quality fuel, carriers will need to make significant changes to comply with the new regulations, and those changes will come at a cost to shippers. Freight rates may climb between now and 2020 as a result.

For an in-depth look at the regulation and how to prepare, read our blog post: IMO 2020: What Shippers Need to Know Now

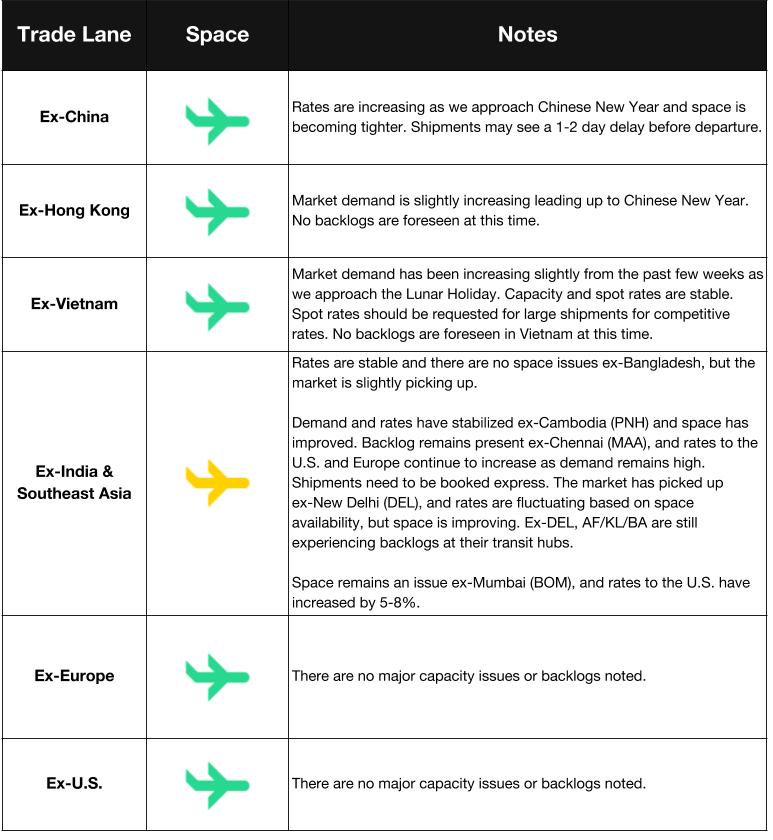

Air Freight Market Updates

Government Shutdown Will Have Lasting Effects

The partial government shutdown may have finally been put on pause after 35 days, but that doesn’t mean the air market will return to normal. The lack of paychecks put stress on air traffic controllers, which has resulted in more errors made on the job, and threatens an increased rate in retirement. The shutdown also impacted training for new air traffic controllers, putting the field at risk for underemployment.

Trucking Market Updates

January Truck Orders Decline

New truck orders are down 26% from December of 2018, leading to beliefs that 2018’s record highs weren’t as indicative of a high volume of physical deliveries in 2019 as had been hoped. Order cancellations grew from 5% at the beginning of 2018 to 20% by the end of the quarter.

Amazon Advising UK Sellers to Prepare for Brexit

Amazon is advising its FBA sellers to stock up with at least four weeks worth of inventory in case the UK leaves the EU in March without a trade deal in place. Delays in trucking and customs clearance are expected in the event of a no-deal Brexit, and the resulting longer shipping times may make UK products less competitive. Sellers are advised to have additional stock imported by March 17th.

Customs and Trade Updates

Cosmetic Importer Settles on North Korea Sanctions Violations

e.l.f cosmetics Inc. (ELF) agreed to pay $996,080 to settle a civil liability suit where OFAC (Office of Foreign Assets Control) found them liable for 156 violations of the North Korean Sanctions Regulations. They imported 156 shipments of eyelash kits from China between 4/2012 to 1/2017, and 80% of the eyelash kits contained North Korean materials. ELF was found to have an inadequate or non-existent compliance program in place during that time period and the very limited oversight to quality assurance pertaining to the production process, raw materials, and end-product which resulted in the violations. The violations were submitted with a prior disclosure and the company worked with OFAC throughout the process and were able to mitigate the fine from a possible $2.2M. OFAC was satisfied with the compliance programs and supply chain changes they put in place since verifying country of origin and supplier auditing.

Country of Origin Determination for Ethernet Devices

ALE USA Inc. received a response from CBP on their ruling request to determine the origin of their group of products that entailed ethernet switches, routers, and network cards. The metal fabrication was made in Taiwan, and their hardware was assembled in China. Other components were added such as resistors, diodes, integrated circuits, circuit cards, etc. from various Asian origin countries. ALE wrote that the programming/testing done in China was merely to verify the correct assembly of the product and the hardware was still missing the major portion of its programming leaving the item not capable of functioning as an Ethernet router. They were imported into the US where the memory capabilities, data management, and operating systems were programmed in. The company argued that because the item would not function until the devices were programmed in the US, it should be counted as US origin. Final tests and quality assurance was done, and then it was packaged for retail. CBP agreed with ALE and stated in the ruling "it is only after the installation of US-origin software that the devices obtain their essence and functionality as switches and routers."

FCPA (Foreign Corrupt Practices Act) Top 10 List

Yearly, Corporate Compliance Insights puts out a list of interesting court cases that were settled during the year. This is a good read to find out what companies got caught violating international laws along with the circumstances that got them in trouble.

For a roundup of tariff-related news, subscribe to our Tariff Insider_. _