September 19, 2022

More Discounts, More Shipping - Apparel Inventory Strategies

Why have apparel inventories increased? How are firms adapting to the changes? Inventory-to-sales ratios for apparel firms are well above historic averages. Around half of firms blame lower sales, while a third have deliberately built up inventories to deal with supply chain challenges. Looking ahead, around a quarter of firms plan to cut prices to reduce inventories. Trade data indicate less airfreight is being used, while ocean freight imports to the U.S. have hit a record high.

Well-Filled Wardrobes - Inventory Ratios Rise

The fashion industry provides a useful case study for inventory management in businesses that have a mixture of seasonal and long-term trends to deal with. Yet, it’s something of a misnomer to refer to a single “apparel supply chain.” There are significant production, distribution, and sales differences by price point (budget vs. luxury), style (basics or couture), seasonality (year round vs. winter), use (sports vs. formal) and type (footwear vs. undergarments).

There has nonetheless been a widespread breakdown in normal supply chain patterns over the past two years.

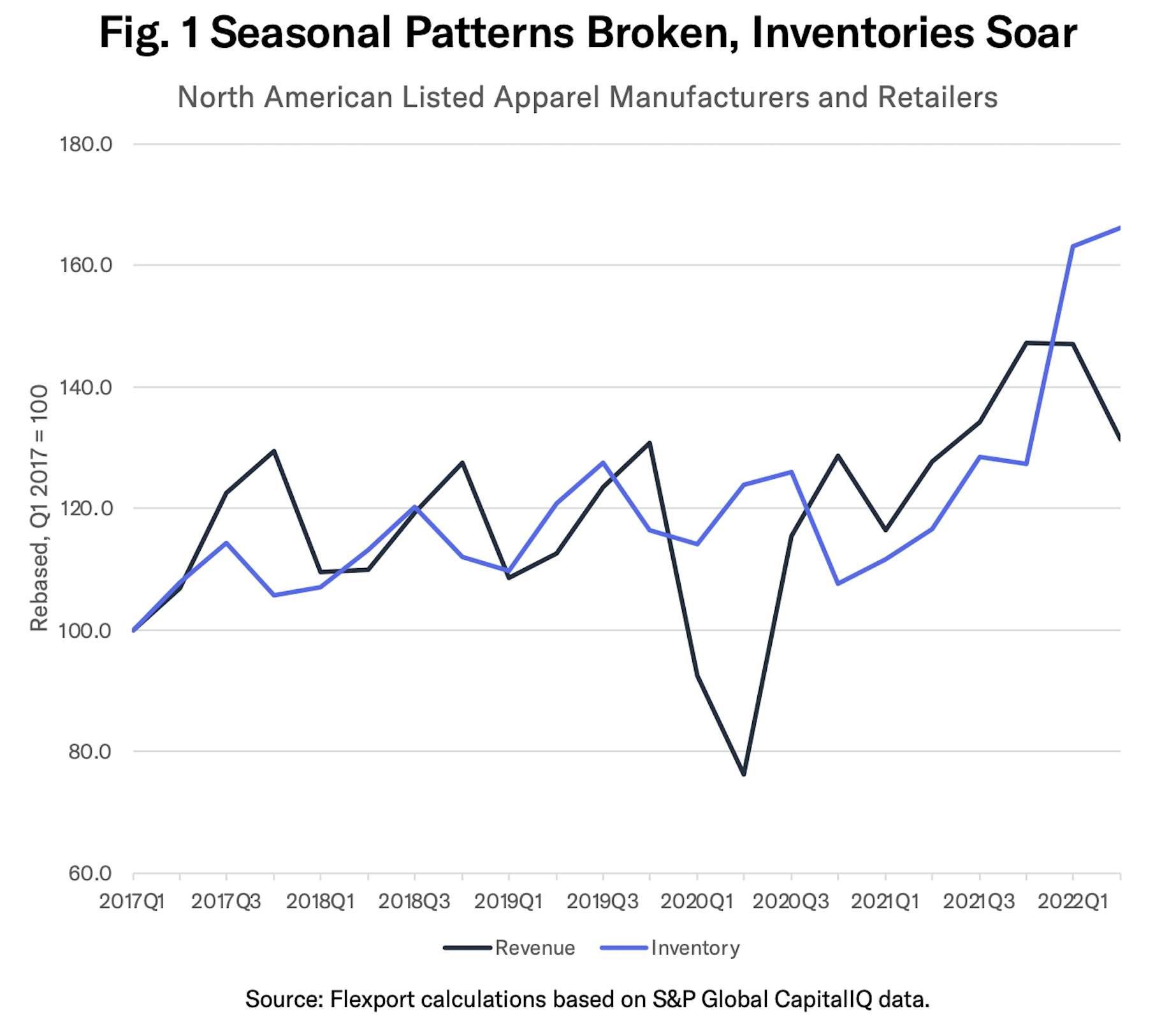

Figure 1 shows revenues and inventories for the apparel sector, using the corporate financial statements of 51 companies traded on North American stock exchanges. The black line shows revenues, where a seasonality in sales applied before 2020. Higher revenues in Q3 each year corresponded to back-to-school sales, while Q4 reflected winter clothing sales. Inventories preceded the increase in sales.

In 2020, the seasonality broke, potentially reflecting (a) initial store closures during COVID-19 lockdowns and (b) a shift to work-from-home practices for many service sector employees.

Revenues in Q2’22 rose by just 2.8% year over year, in nominal terms. Consumer price inflation for apparel in the U.S. reached 5.2% in June 2022 versus a year earlier, suggesting that real sales of apparel have fallen year over year in Q2’22.

At the same time, inventories soared 35.6% higher year over year in Q2’22, in real terms. The resulting inventory-to-sales ratio of 0.82x in Q2’22 compares to an average 0.67x in 2011 to 2019.

By comparison, retail sales for all stores saw inventories increase by 18.9% and sales by just 1.0%. The resulting 0.48x inventory-to-sales ratio in Q2’22, matched the 0.48x the historic average. That would suggest that the apparel industry has faced more challenges than other consumer-focused sectors in controlling inventories.

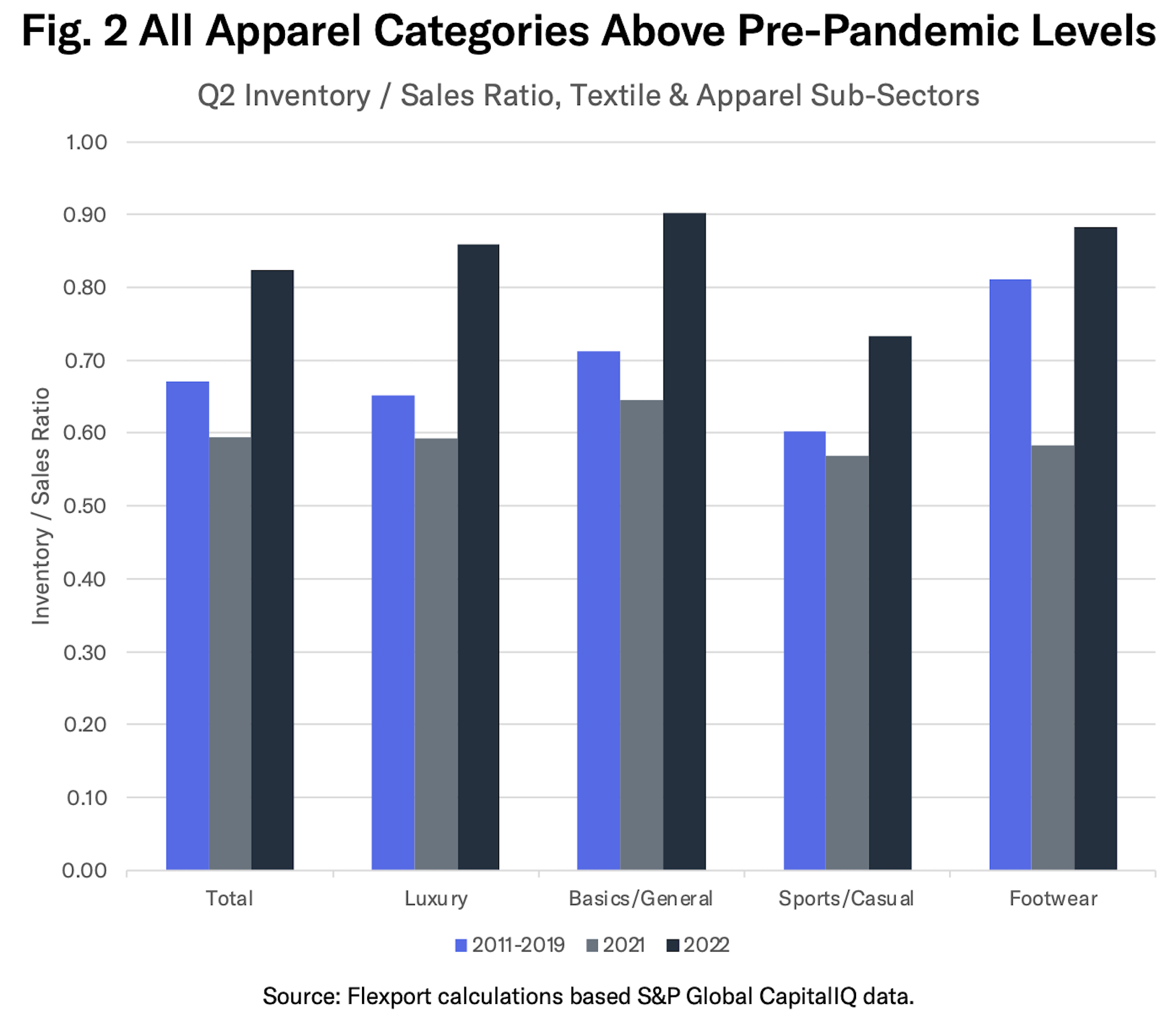

The elevated inventory-to-sales ratio appears to be industry wide. Figure 2 segments the inventory-to-sales ratio into four subsectors.

The widest gap in Q2’22 versus the 2011-2019 period is in luxury apparel. A ratio of 0.86x in Q2’22 (black bar) compares to 0.65x historically (indigo bar). Footwear has the narrowest gap.

Time for Enticements - Inventory Reduction Tactics

What are firms doing to control their expanded inventory balances?

A review of earnings conference call transcripts for 37 firms, covering calls held in the July 1, 2022 to September 6, 2022 period, shows 51% of firms blamed their higher inventories on sales that were below expectations. Most, in turn, cite elevated inflation and poor consumer sentiment as reasons for falling sales.

Looking ahead, 32% of firms have stated that they have deliberately built their inventories above historic levels, as part of an effort to avoid previous supply chain-related shortages. Almost all of that group expect inventories to return to historic levels, as supply chains normalize.

A quarter of the firms expect to use significant price reductions (discounting) to reduce their inventory in the remainder of 2022. A further 24% of firms (mostly selling luxury goods) are happy with their current inventory levels.

Less Use of Air, More Ocean Deliveries Arriving - Apparel Trade Data

What can we learn from logistics data for the apparel firms?

The use of airfreight became more prevalent in 2021 as firms sought to deal with ocean freight delays.

While the value of apparel imports has increased, rising by 41% year over year in Q2’22, the share of air freight has fallen. The black line in Figure 3 shows that air freight accounted for 12.5% of total U.S. apparel imports, on a trailing three-month average basis, in Q2’22. That compared to a peak of 18.0% in Q4’21 and 14.5% in Q2’21, as well as a five year average pre-pandemic of 14.1%.

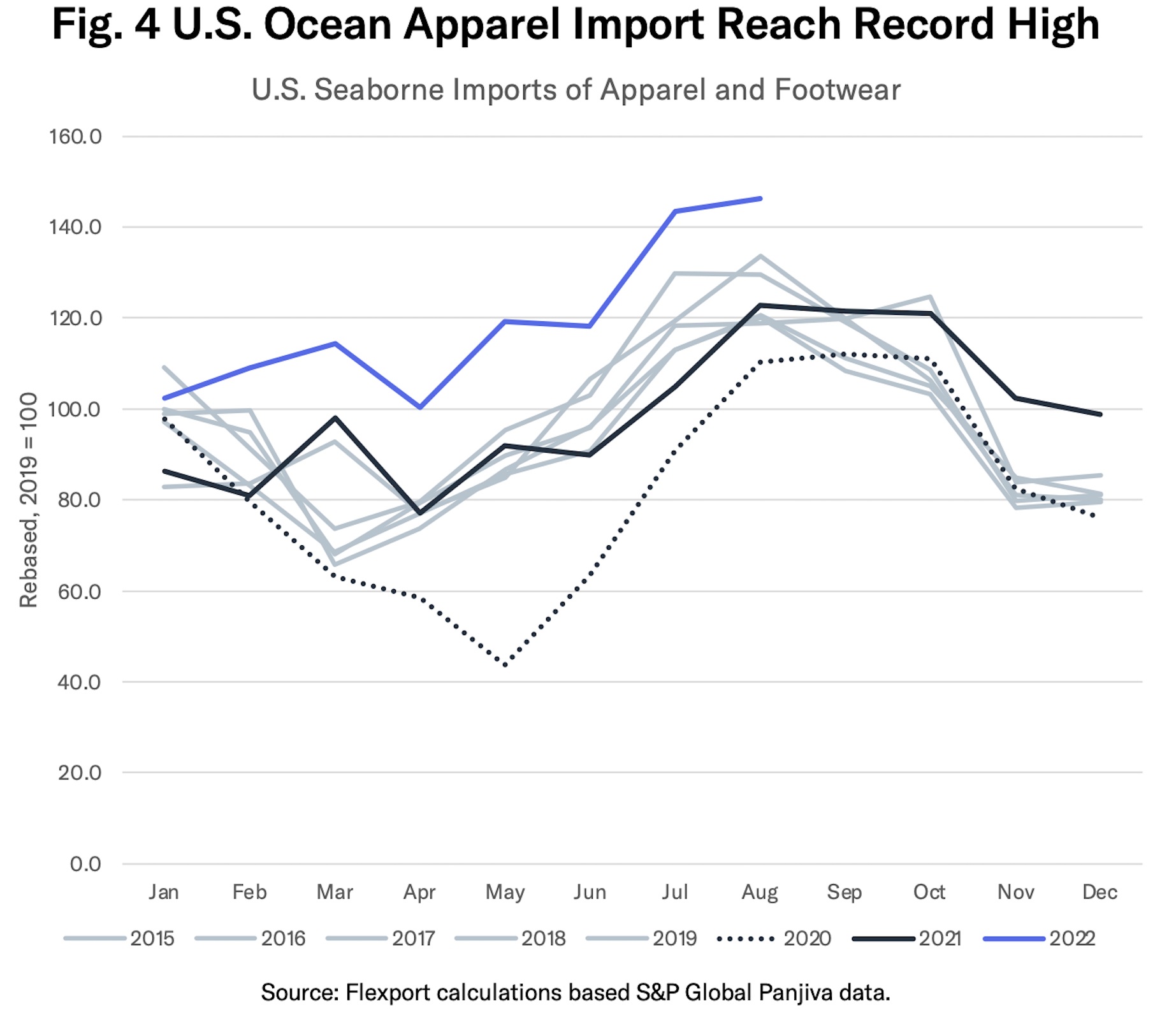

Ocean shipping of apparel and footwear appears to be accelerating, on both a sequential and year-over-year basis. Figure 4 shows U.S. seaborne imports of apparel and footwear rose by 19% year over year in August, reaching the highest level since at least 2015.

That likely reflects a mixture of (a) earlier orders finally being delivered (b) the continued impact of demand over-assessments and (c) the apparent return of normal seasonality (winter clothes are bulkier than spring/summer collections).

Until deliveries slow, logistics networks normalize and discounting strategies take effect, it’s likely that apparel inventories will remain elevated above historic levels.

In conclusion: Fashion supply chains have experienced a surge in inventories relative to sales. Half of companies have blamed faulty demand forecasting, while a third have indicated they have done so deliberately. Ocean shipping data suggests there has been little slowdown in the volumes of apparel arriving in the U.S.

Disclaimer: The contents of this report are made available for informational purposes only and should not be relied upon for any legal, business, or financial decisions. Flexport does not guarantee, represent, or warrant any of the contents of this report because they are based on our current beliefs, expectations, and assumptions, about which there can be no assurance due to various anticipated and unanticipated events that may occur. This report has been prepared to the best of our knowledge and research; however, the information presented herein may not reflect the most current regulatory or industry developments. Neither Flexport nor its advisors or affiliates shall be liable for any losses that arise in any way due to the reliance on the contents contained in this report.

About the Author

Related content

![2022-09 Inventory Toys Masthead]()

Economic Insights

Santa Claus is Coming to Town Early - Toy Inventory Strategies

September 14th, 2022

More from Flexport

![GettyImages-723523781 1199x800]()

Blog

The End of the EU’s Duty-Free Exemption for Low-Value Goods: Timelines, Upcoming Changes, and Impacts on Ecommerce Brands