January 20, 2023

Supply Chain Snapshots - News of the Week (Jan. 20, 2023)

Tags:

Friday, January 20, 2023

Looking for a quick summary of the top supply chain and logistics news making waves this week? Read our weekly "Supply Chain Snapshots" for summaries and commentary to get you up-to-speed.

1. Covid Broke Supply Chains. Now on the Mend, Can They Withstand Another Shock?

(Read on CNN)

The global supply chain is showing signs of returning to a new, post-COVID version of normal. What that means, exactly, is still being discussed—with some erring on the side of caution while others are more bullish. One thing that is agreed on is that the supply chain of 2023 is indeed more resilient than that of 2019, thanks to factors like increasing reliance on advanced technology, expansion of supply chains to incorporate nearshoring and other alternative sourcing tactics, and a releveling of consumer demand.

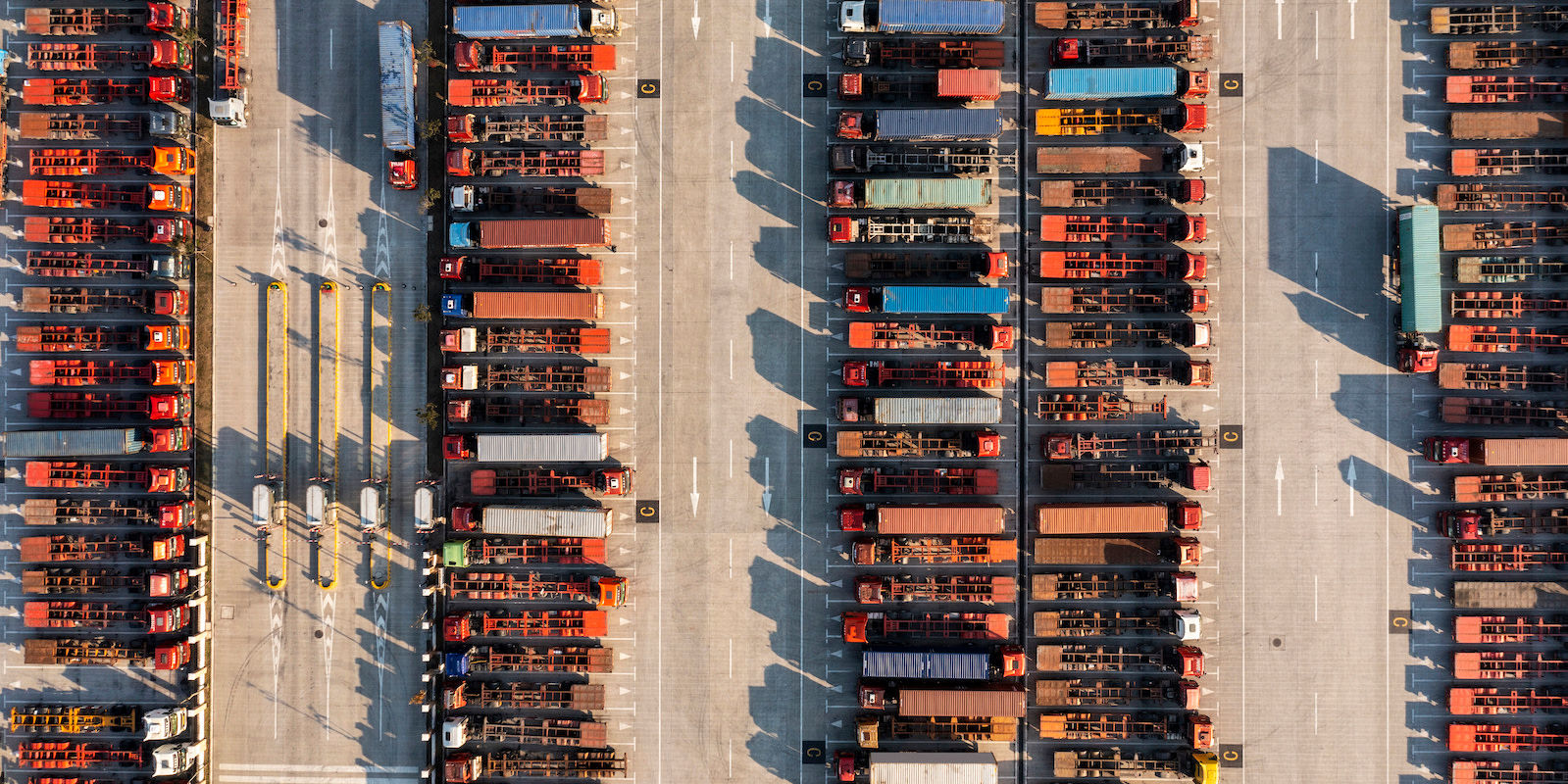

2. Holiday Retail Sales Tanked, but Trucking Data Shows E-Commerce Wasn’t the Issue

(Read on CNBC)

According to data from global freight hauler DHL, the 2022 holiday season was disappointing overall yet showed that e-commerce was going strong. Backing up their data, the National Retail Federation released numbers showing that despite overall sales being low, e-commerce and other non-store sales jumped 9.5% during the holiday season. Jim Monkmeyer, president of transportation for DHL Supply Chain, North America sees things turning around in mid- to late-Q2 thanks to a variety of factors already in motion.

3. Relationship Between Imports and Trucking Is Dynamic but Telling

(Read on FreightWaves)

This week’s Chart of the Week from FreightWaves Sonar shows that the correlation between import levels and truckload tenders has become stronger through the pandemic and raises interesting new questions as we enter 2023.

4. More Than 50 Sailings From Asia to Europe Blanked in First Seven Weeks

(Read on The Loadstar)

While specific percentages vary between the alliances, the total number of blanked sailings comes to an average of 27% of initially scheduled capacity, according to an Alphaliner analysis. The combination of Lunar New Year and potential economic recessions have led to many shipper cancellations as well as carriers cutting capacity, leading Maersk to warn shippers about potential “whiplashes in stocks and supply chains before stock levels normalize.”

5. We’re About To Learn All About the Fortune 500’s Secret Cash Flow Weapon

(Read on FreightWaves)

Supply chain finance is hardly new, it’s been around some three decades already. What is new is reporting rules as of December 15, 2022. The Financial Accounting Standards Board now requires companies to disclose if, and how, they use this form of financing. Supply chain financing began picking up steam early in the pandemic when companies were struggling to keep up with consumer demand, and has only gotten more popular as inventory balancing became more difficult, and costly, with fluctuations in that demand.

Here’s an E-Guide from Flexport with more information on flexible logistics funding options.

We’ll be back next week for another edition of Supply Chain Snapshots.