Global Logistics Update

President Trump Asks Supreme Court to Uphold IEEPA Tariffs; FEWB and TAWB Spot Rates Decline

Updates from the global supply chain and logistics world | September 4, 2025

Global Logistics Update: September 4, 2025

September 4, 2025

Trends to Watch

Talking Tariffs

- International Emergency Economic Powers Act (IEEPA) Tariff Litigation Developments: On September 3, President Trump asked the Supreme Court for an “expedited ruling” on a recent federal appeals court decision that found the Trump administration’s IEEPA tariffs illegal.

- Impacted duties include IEEPA “fentanyl” tariffs on Canada, Mexico, and China, as well as IEEPA reciprocal duties on the rest of the world. The case does not impact the Trump administration’s non-IEEPA tariffs, such as steel and aluminum tariffs.

- President Trump’s request comes after last Friday’s decision by the U.S. Court of Appeals for the Federal Circuit, which upheld the Court of International Trade (CIT)’s initial ruling that invalidated President Trump’s IEEPA duties. The federal appeals court’s ruling did not issue an injunction, meaning duties currently remain in place.

- If the Supreme Court upholds the federal appeals court’s ruling, CBP would halt all collection of IEEPA tariffs and many businesses would potentially qualify for duty refunds. Some duties would be proactively refunded by CBP, while others would require importers to file post summary corrections and protests. For more details, check out our live blog update.

- U.S. Trade Representative (USTR) Extends Exclusions from Section 301 Tariffs: On August 28, the USTR announced that existing exclusions from Section 301 tariffs would remain in place through November 29, 2025. These product exclusions were originally scheduled to expire on August 31, 2025.

- Other Recent Developments:

- Last Friday (August 29), the de minimis exemption expired for all U.S. trade partners, after first being eliminated for Chinese-origin goods in May. As of last Friday, all low-value shipments are subject to applicable duties based on their country of origin. Visit our live blog for detailed insight into how these duties are being assessed.

- On August 25, President Trump announced plans to impose “substantial additional tariffs” on nations that do not remove digital service taxes and regulations. These nations would also face restrictions on U.S. chip exports, he added.

- On August 25, President Trump also suggested potential new tariffs on China over tensions involving rare earth magnet exports to the United States. China produces 90% of the world’s rare earth magnets, which are critical to producing semiconductor chips, MRI machines, aerospace systems, and more.

- On August 22, President Trump announced a “major tariff investigation on furniture” that would conclude within 50 days, laying the groundwork for potential new tariffs on furniture.

- On August 21, the U.S. and the EU published a framework agreement on “reciprocal, fair, and balanced trade.” Terms include a 15% duty on most EU goods imported into the U.S.; a maximum duty of 15% on EU pharmaceuticals, semiconductors, and lumber; a reduction in tariffs on EU automobiles and auto parts; and more.

Calculate and analyze your real-time tariff and landed cost impacts using the Flexport Tariff Simulator.

Ocean

TRANS-PACIFIC EASTBOUND (TPEB)

- Capacity and Demand:

- As Golden Week approaches, demand is not projected to see a significant increase. Some reports indicate that a “pull forward” of shipments earlier this year to beat potential tariffs has resulted in a quiet summer and may lead to a subdued fall. Overall, the market is not seeing a big upsurge in volume.

- Volumes may be impacted by potential furniture tariffs, after President Trump recently announced an investigation into furniture imports that will conclude in the coming months.

- Overall September capacity remains at 80%. Blank sailings may increase as Golden Week draws closer. Carriers are unlikely to announce any capacity reductions until very close to the scheduled departure date, which may cause shipping schedules to slide.

- Equipment:

- Equipment availability has improved slightly since late July. Equipment shortages remain a primary concern for carriers like CMA and HMM, while other carriers are experiencing better conditions.

- Freight Rates:

- Carriers have announced a September 15 Peak Season Surcharge (PSS), but it is uncertain if market demand is sufficient to support it.

- Carriers announced a September 1 General Rate Increase (GRI), with an $800-900 increase from August’s rate levels. However, we are already seeing carriers slowly mitigate their rates post-Labor-Day-weekend.

FAR EAST WESTBOUND (FEWB)

- Capacity and Demand:

- Carriers have announced updated blank sailing plans for October, with six Premier Alliance voyages and one OA vessel to be blanked in Weeks 40 and 41.

- Demand is gradually decreasing, and space in the second half of September remains wide open.

- Congestion at destination ports continues. Le Havre, Rotterdam, and Hamburg are experiencing high yard utilization rates, which is further impacting import transportation efficiency.

- Freight Rates:

- The Shanghai Containerized Freight Index (SCFI) decreased by another $186/TEU in Week 36, landing at $1,481/TEU. Compared to the index’s peak in July, rate levels have declined by approximately 27%.

- A pre-Golden-Week surge has not yet been observed. Given flat September volumes, the Freight All Kinds (FAK) market is likely to maintain current rate levels until the Golden Week period.

TRANS-ATLANTIC WESTBOUND (TAWB)

- Capacity and Demand:

- Antwerp: Heavy congestion continues. Yard utilization still exceeds 90%, and dwell times are at seven to eight days.

- Rotterdam, Hamburg, Bremerhaven: Ports continue to see 75–95% yard utilization, along with vessel delays of two to three days.

- South Mediterranean (Piraeus, Genoa, Valencia): Heavy congestion continues, with vessel delays of three to six days.

- Equipment:

- Shortages persist in Austria, Slovakia, Hungary, Southern/Eastern Germany, and Portugal.

- Freight Rates:

- Overall capacity is stable. Spot rates from North Europe to the U.S. East Coast are averaging $1,911/FEU as of August 20, 2025, according to Xeneta. This represents a ~5% decline since June 1, and a more significant drop of ~25% compared to January 1, 2025.

INDIAN SUBCONTINENT TO NORTH AMERICA

- Capacity and Demand:

- Capacity to the U.S. East Coast: The tariff escalation on India on August 27 continues to drive softening demand. Supply is outstripping demand, and we are seeing capacity management in full effect through September. Although the tariff escalation is specific to India, countries like Pakistan, Sri Lanka, and Bangladesh rely on services specific to the Indian subcontinent to U.S. East Coast route for weekly capacity. Demand will likely remain status quo from those countries, but capacity will be reduced.

- Capacity to the U.S. West Coast: Capacity is widely available, given continued oversupply impacting major TPEB services that move cargo from the Indian subcontinent to the U.S. West Coast.

- Freight Rates:

- Cargo moving to the U.S. East Coast: As we enter September, the market is softening due to the drop in demand from India in response to the tariff escalation. Rates are beginning to soften, but with carriers enacting capacity management strategies and as the tariff situation evolves, it remains uncertain how much market rate levels will drop in the coming weeks.

- Cargo moving to the U.S. West Coast: Oversupply on core TPEB lanes has continued to keep the market soft.

Air

- Northern China:

- This week, the TPEB air freight market is expected to face further downward pressure as capacity expands significantly across key U.S. gateways.

- Lufthansa has added service into Los Angeles (LAX), Air China has boosted operations to Chicago (ORD), and China Southern has increased capacity into New York (JFK), injecting additional supply into an already-oversaturated market.

- South China: Both ecommerce and traditional cargo demand are similar to last week’s levels, with rates at the same level or slightly lower.

- Taiwan (TW): The market to the U.S. West Coast remains similar to last week.

- Vietnam (VN):

- Demand into LAX is elevated both before and after the holiday, supporting an upward trend in rates and tightening space availability.

- Apple has commenced its New Product Introduction (NPI) season, with charters beginning September 9. This is placing further pressure on capacity.

- Both demand and rates remain high ahead of the holiday season. Space is extremely constrained, and bookings must be placed at least seven days in advance to secure uplift.

- South Korea (KR): Despite a soft market, carriers are attempting to raise TPEB rates.

- Malaysia (MY): Local demand has picked up slightly in response to the public holidays on August 31 (National Day) and September 1 (Awal Muharram), particularly on TPEB lanes. This has resulted in a modest rate increase, though space remains generally available across most carriers.

- FEWB lanes remain stable, with no changes in rates or capacity. Shippers are advised to book early to avoid potential delays caused by the shortened work week.

- India: Rates to the U.S. have risen sharply as shippers rushed to move cargo ahead of the new 25% tariff implemented on August 27. Backlogs are developing at Indian airports, though the situation is expected to ease within the next two weeks.

- Pakistan: Intercity movements are facing delays due to severe urban flooding and ongoing monsoon rains. Most factories have been impacted, with operations halted as roughly 90% of the workforce in Sialkot and Karachi is unable to reach production sites. Local communication disruptions are adding to the delays.

- This situation is expected to persist for the next two to three weeks. In Sialkot, factories have been closed for the past two days, but are expected to resume operations this week. Lahore remains unaffected and continues to operate as normal.

- Indonesia: Jakarta and several other cities across Indonesia are experiencing unrest due to widespread protests. This may affect transportation and operational activities.

- At this point, this is no impact on airport operations.

(Source: Flexport)

Please reach out to your account representative for details on any impacts to your shipments.

North America Vessel Dwell Times

Webinars

North America Freight Market Update Live

Thursday, September 11 @ 9:00 am PT / 12:00 pm ET

European Freight Market Update Live

Tuesday, September 16 @ 15:00 BST / 16:00 CEST

Tariff Trends 2025: Navigating the End of De Minimis

Watch On-Demand

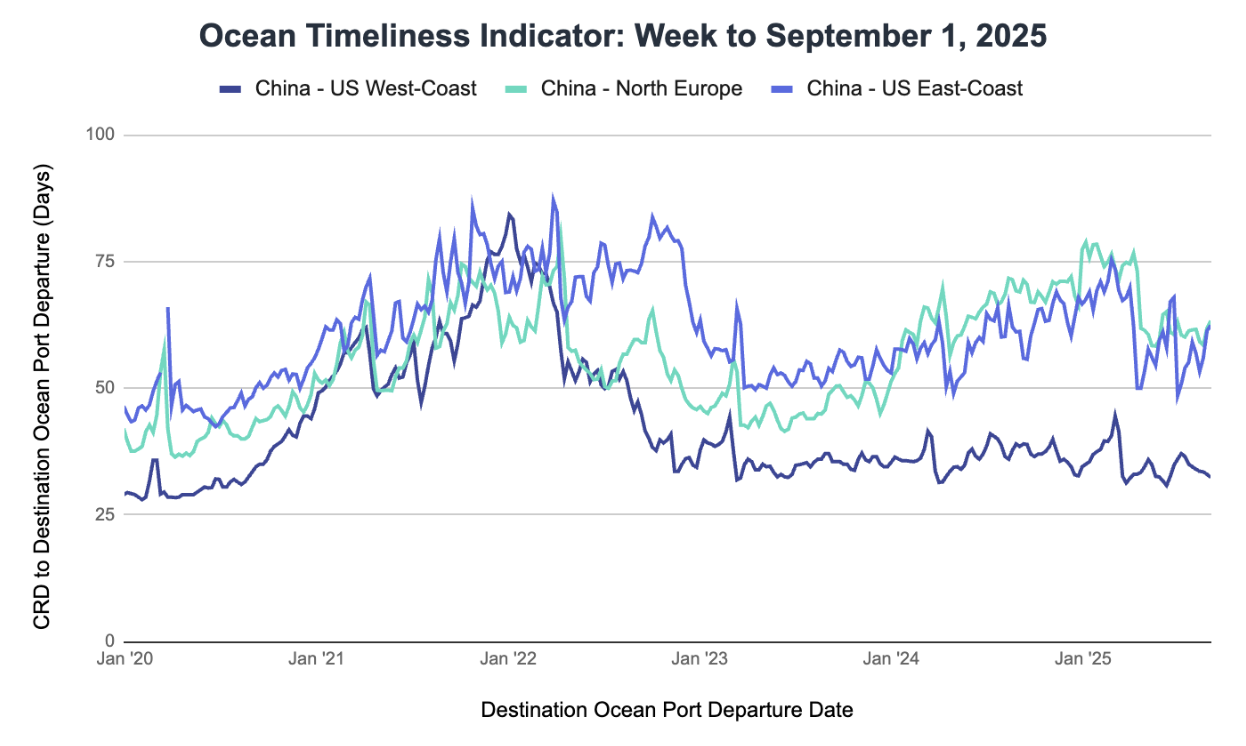

Ocean Timeliness Indicator

Transit times from China to the U.S. East Coast and China to North Europe both experienced modest increases, while the route from China to the U.S. West Coast saw a slight decrease.

Week to September 1, 2025

Transit time from China to the U.S. West Coast decreased by 0.6 days, falling from 33 to 32.4 days. China to the U.S. East Coast increased from 61.3 to 62.4 days. Meanwhile, the China to North Europe route saw a 1.5-day increase, moving from 61.8 to 63.3 days.

See the full report and read about our methodology here.

About the Author

September 4, 2025

Related content

![White House GettyImages-603224136 (1)]()

Blog

Live Updates: Trump Administration Tariffs, Trade Policy Changes, and Impacts on Global Supply Chains

![GettyImages-1411182583 1199x800]()

Blog

CBP’s Latest Guidance on Reporting Country of Smelt and Cast for Section 232 Aluminum Tariffs

More from Flexport

![GettyImages-1295614211]()

Global Logistics Update

Prepare for Potential IEEPA Tariff Refunds; U.S. Blizzards Disrupt Europe and North America Air Freight Operations

![WarehouseGettyImages-535667233]()

Global Logistics Update

U.S. and Taiwan Finalize Trade Deal; FEWB Spot Rates Soften Amid Lunar New Year Lull

![Ocean Port GettyImages-1083936322 (1)]()

Global Logistics Update

EU to Vote on Modified U.S. Trade Deal; Ex-Asia Demand Tapers Off Ahead of Lunar New Year

Ready to get started?

Learn how Flexport’s supply chain solutions can help you capture greater opportunities.