Global Logistics Update

Port Fees on Chinese Vessels Loom Ahead; Golden Week Drives Blank Sailings on TPEB and FEWB

Updates from the global supply chain and logistics world | October 9, 2025

Global Logistics Update: October 9, 2025

October 9, 2025

Trends to Watch

Talking Tariffs

- President Trump Announces Upcoming Tariffs on Trucks: In an October 6 Truth Social post, President Trump announced plans to impose a 25% tariff on medium- and heavy-duty trucks on November 1. Its implementation awaits official confirmation via executive order or Federal Register notice.

- President Trump had previously indicated that tariffs on heavy trucks would take effect on October 1, but did not provide any further details on implementation by that date.

- Currently, completed vehicles and vehicle parts for passenger and light trucks are subject to Section 232 duties. Until now, heavy trucks and parts have been exempt.

- USMCA exemptions: For medium- and heavy-duty trucks that fall under the USMCA, it is currently unclear whether these tariffs would apply only to trucks’ non-U.S. content, as is the case with USMCA-compliant automobiles. In general, to qualify for partial duty relief under USMCA rules of origin, the following content must originate from North America: at least 64% of the truck’s value; at least 75% of its engines, axles, transmissions, and other core components; and at least 70% of the manufacturer’s annual steel and aluminum procurement.

- If these tariffs take effect, USMCA partners would bear the brunt of the impact: Mexico supplied about 74% of the $20.9 billion’s worth of medium- and heavy-duty trucks imported into the U.S. last year. Canada was the second-largest source, supplying just over 20% of these imports.

- Upcoming Fees on Chinese Vessels: Fees on Chinese-built and Chinese-operated vessels will take effect on October 14.

- Chinese vessel owners and operators calling at a U.S. port will face a fee of $50 per net ton. Chinese-built ships will be subject to a fee of $18 per net ton or $120 per container, whichever is higher. Visit our blog for a detailed fee breakdown, including scheduled increases and potential exemptions.

- Per recently issued guidance from the U.S. Trade Representative (USTR), the vessel operator must determine whether their vessel owes a fee, rather than U.S. Customs and Border Protection (CBP). Fees will be paid directly to the Department of the Treasury, not at the port of entry, and should be paid at least three business days before vessel arrival to ensure lading/unlading and clearance.

- U.S. Government Shutdown Developments: On an October 6 trade outreach call, CBP confirmed that it will not issue any refunds during the government shutdown. This includes both ACH and check refunds, as well as drawback claim payments, protests, post-summary corrections, and any other payment involving a check from the Treasury Department.

- For protests that have already been approved, importers do not need to take any further action during the shutdown.

- In the meantime, CBP will continue to process duty refunds, entry summaries, protests, and liquidations. The shutdown does not impact any liquidation dates.

- CBP is continuing to collect tariff revenue throughout the shutdown. CBP will also implement all upcoming tariffs as planned, including those set to take effect on October 14.

- While CBP and the USTR are exempt from furloughs, the International Trade Administration—the agency responsible for reviewing antidumping and countervailing duty (ADCVD) cases—has furloughed the majority of its employees. As a result, ADCVD investigations have slowed considerably.

- For detailed impacts on federal agencies and duty refunds, check out our blog.

- Other Recent Updates:

- The following duties will take effect on October 14: 10% on softwood timber and lumber, 25% on certain upholstered furniture (except for a 15% cap on the EU and Japan and a 10% cap on the U.K.), and 25% on certain kitchen cabinets and bathroom vanities (except for a 15% cap on the EU and Japan and a 10% cap on the U.K.). On January 1, 2026, countries without a trade agreement in place with the U.S. will see cabinet and vanity tariffs increase to 50%, and upholstered furniture tariffs to 30%.

- If the U.S. and China fail to reach a new trade agreement by the November 10 deadline, tariffs on Chinese goods will rise to a combined 54%. President Trump and President Xi are due to meet in person near the end of October, while Treasury Secretary Scott Bessent will continue talks with Chinese Vice Premier He Lifeng sometime before November 10.

- President Trump also recently announced plans to impose “substantial tariffs on any country that does not make its furniture in the United States,” a 100% tariff on movies made outside the U.S., and a tariff of up to 100% on branded or patented pharmaceuticals. He did not provide an implementation timeline for any of these suggested tariffs.

- Find the latest tariff and trade developments on our live blog.

Calculate your tariff and landed cost impacts in real time with the Flexport Tariff Simulator.

Ocean

TRANS-PACIFIC EASTBOUND (TPEB)

- Capacity and Demand:

- Blank sailings in Weeks 41 and 42 are a direct, planned response to the Golden Week holiday in Asia, and will result in a significant capacity reduction to 62-69% of planned.

- Capacity is expected to bounce back to 83% in Week 43, which is expected to result in an oversupply situation as demand remains low-to-flat.

- Freight Rates:

- Ocean carriers have announced a General Rate Increase (GRI) for October 15 to curb the rate drops. The next Shanghai Containerized Freight Index (SCFI) is expected on October 10.

- Carriers have postponed Peak Season Surcharges (PSSs) to November 1, given the weak outlook for the floating market.

FAR EAST WESTBOUND (FEWB)

- Capacity and Demand:

- The market remains flat due to recent holidays in China. Liners prepared roll pools by overbooking by 20-50% before the holidays to optimize vessel utilization, in case demand is slow to recover like in previous years.

- Capacity-wise, the existing blank sailing program for October will continue to impact supply, with a 10% weekly capacity cut in Weeks 42 and 43. Carriers have announced a blank sailing program that will primarily take place in the first half of November (-20% in Week 45 and -4% in Week 46). If the market reacts reluctantly to rate increases in the second half of October, carriers are expected to announce more blank sailings.

- Freight Rates:

- The Shanghai Containerized Freight Index (SCFI) is frozen this week due to China’s Golden Week holiday. The next index update will be released on October 10.

- Carriers have announced their first round of General Rate Increases (GRIs) for the second half of October to prevent freight volumes from dropping further.

- Currently, there is little indication in the market that bookings will increase. If the increase in the second half of October is not implemented, we expect another round in the first half of November, along with more blank sailing announcements.

TRANS-ATLANTIC WESTBOUND (TAWB)

- Capacity and Demand:

- Antwerp: Yard utilization is at 90%, with berth delays of two to four days.

- Rotterdam: Yard utilization is at 70-83%, with berth delays of two to eight days.

- Hamburg: Yard utilization is at 75%, with berth delays of five to seven days.

- Bremerhaven: Yard utilization is at 75-85%, with berth delays of one to three days.

- South Mediterranean (Piraeus, Genoa, Valencia): Ports continue to see significant yard congestion, with vessel wait times of three to seven days.

- Equipment:

- Equipment challenges in Europe this month persist, with ongoing container and chassis shortages concentrated in Austria, Slovakia, Hungary, Southern and Eastern Germany, and Portugal.

- Freight Rates:

- As of early October, spot rates have stabilized around $1,800 to $1,900/FEU.

INDIAN SUBCONTINENT TO NORTH AMERICA

- Capacity and Demand:

- Capacity to the U.S. East Coast: August’s tariff escalation continues to drive soft demand from India. Supply continues to outstrip demand, resulting in full capacity management into October for Indian-subcontinent-specific services.

- Capacity to the U.S. West Coast: Capacity remains widely available after a short-lived uptick. Capacity management is increasing on the corridor connecting the Indian subcontinent to the U.S. West Coast as demand across Asia remains soft.

- Freight Rates:

- Cargo moving to the U.S. East Coast: Following further decreases resulting from August’s tariff escalation, rate levels are holding steady. Carriers are enacting capacity management strategies and driving more balanced supply in the market.

- Cargo moving to the U.S. West Coast: Recent tariff increases and oversupply on core TPEB lanes continue to keep rate levels low.

Air

- North China:

- A series of flight cancellations during China’s national holiday period has reduced available air freight capacity, resulting in continued upward pressure on rates.

- Demand remains strong across key sectors, particularly electronics and ecommerce, driving sustained volumes to major U.S. gateways like Chicago (ORD) and New York (JFK).

- Looking ahead, market conditions are expected to begin stabilizing around October 10, as flight schedules normalize and capacity returns to regular levels following the holiday period.

- South China:

- Overall, air freight demand has strengthened compared to the previous week, supported by traditional cargo movements ahead of China’s Golden Week holiday.

- Capacity remains constrained across key origins due to a temporary reduction in flight frequency during the holiday period, particularly out of Southern China. This is continuing to drive upward pressure on space availability.

- On Trans-Pacific routes, shipments to major U.S. gateways are experiencing tight capacity conditions. Meanwhile, on Europe‑bound services, the market is seeing modest recovery, despite relatively soft overall demand.

- Flight operations on most westbound routes are expected to continue without major disruption through the holiday. We anticipate a gradual normalization of schedules from mid‑October onwards as additional capacity returns to the market.

- Vietnam:

- Air freight demand remains elevated nationwide. Particularly strong volumes out of Hanoi continue to limit available capacity on both Trans-Pacific and westbound trade lanes.

- Market conditions are tighter than in recent weeks, and advance bookings are required to secure space. In contrast, Ho Chi Minh City remains relatively stable, though some shipments may still experience extended transit time due to connection dependencies. Shippers are advised to maintain flexibility in scheduling and plan shipments well in advance during this high‑demand period.

- Cambodia:

- In Cambodia, air freight capacity remains under pressure amid strong export activity and limited available space. Factories continue to move backlog cargo from recent weeks, contributing to ongoing tight conditions.

- Booking in advance—ideally several days to a week prior to departure—remains essential to secure uplift. Market conditions are expected to gradually improve as backlog volumes clear and flight schedules return to normal levels.

- South Korea:

- The air freight market continues to experience congestion following the end‑of‑month surge, leading to backlogs that are likely to persist into October.

- Demand remains steady across major trade lanes. Shippers should anticipate longer transit times while capacity clears in the coming weeks.

- Malaysia:

- Air freight volumes from Malaysia are trending upward on Europe‑bound routes, supported by stronger export activity. Capacity remains tight on these lanes as some carriers report limited space through mid‑October, contributing to ongoing booking challenges into key European gateways. Conversely, Trans-Pacific volumes have slightly softened, with lighter booking activity noted for early October.

- Shippers are encouraged to plan ahead and confirm bookings in advance to minimize the risk of delays during this period of uneven capacity.

- Thailand:

- Air freight demand from Bangkok is seeing a modest increase, leading to tighter capacity on major lanes to the United States and Europe. While market levels remain generally stable week over week, securing uplift has become more challenging as volumes rise.

- Shippers are advised to book shipments well in advance—ideally five to seven days ahead—to ensure space availability during this period of increasing demand.

(Source: Flexport)

Please reach out to your account representative for details on any impacts to your shipments.

North America Vessel Dwell Times

Webinars

Flexport Fall Technology Release Live Broadcast

Tuesday, October 14 @ 9:00am PT / 12:00pm ET / 17:00 BST / 18:00 CEST

Understanding DDP: Managing Duties, Taxes & Trade Compliance

Available On-Demand

Eliminating Air Freight from Your Supply Chain

Available On-Demand

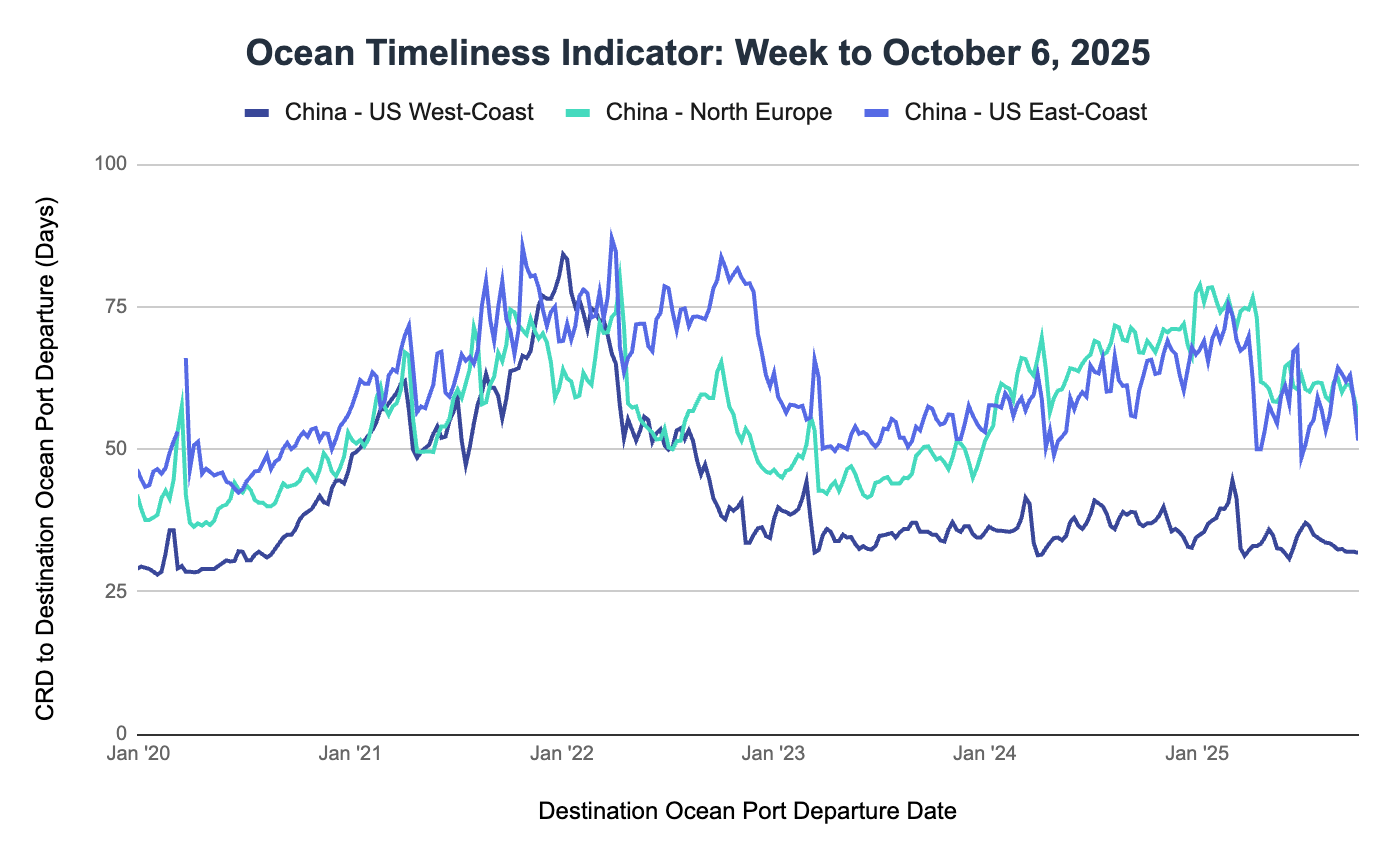

Ocean Timeliness Indicator

Transit time from China to the U.S. West Coast remained near-constant, while transit times on the China to U.S. East Coast and China to North Europe routes both declined.

Week to October 6, 2025

This week, transit time from China to the U.S. West Coast remained near-constant, dropping just 0.2 days from 32 to 31.8 days. Meanwhile, China to the U.S. East Coast decreased significantly, falling from 58.3 to 51.5 days. Transit time from China to North Europe also declined, dropping by 3.4 days from 59 to 55.6 days.

See the full report and read about our methodology here.

About the Author

October 9, 2025

Related content

![White House GettyImages-603224136 (1)]()

Blog

Live Updates: Trump Administration Tariffs, Trade Policy Changes, and Impacts on Global Supply Chains

![GettyImages-1411182583 1199x800]()

Blog

CBP’s Latest Guidance on Reporting Country of Smelt and Cast for Section 232 Aluminum Tariffs

More from Flexport

![GettyImages-1295614211]()

Global Logistics Update

Prepare for Potential IEEPA Tariff Refunds; U.S. Blizzards Disrupt Europe and North America Air Freight Operations

![WarehouseGettyImages-535667233]()

Global Logistics Update

U.S. and Taiwan Finalize Trade Deal; FEWB Spot Rates Soften Amid Lunar New Year Lull

![Ocean Port GettyImages-1083936322 (1)]()

Global Logistics Update

EU to Vote on Modified U.S. Trade Deal; Ex-Asia Demand Tapers Off Ahead of Lunar New Year

Ready to get started?

Learn how Flexport’s supply chain solutions can help you capture greater opportunities.