March 28, 2025

Early Updates on the Trump Administration’s Tariff and Trade Policies, Part III

March 28, 2025

This page contains some of Flexport’s older updates (late June - mid-October of 2025) on the Trump administration’s tariffs and trade policies. Find early updates from mid-March - mid-June of 2025 here, and even older updates (including our original blog on the 2024 election) here.

For Flexport’s most up-to-date developments and guidance, check out our live tariff and trade blog.

Calculate and analyze tariff impacts in real time with the Flexport Tariff Simulator.

Updated October 15, 2025:

At a press conference earlier today, U.S. Treasury Secretary Scott Bessent suggested a potential extension of the 90-day U.S.-China tariff truce, which is set to conclude on November 10. If President Trump proceeds with implementing a 100% tariff on China on November 1, however, the two nations will face a tighter timeline for reaching an agreement. According to Bessent, a deciding factor is whether China delays or scraps upcoming export controls on rare earth metals, which remain a long-standing point of contention in U.S.-China trade talks.

On Sunday (October 12), two days after initially announcing the potential 100% tariff on China, President Trump appeared to soften his stance: “Don’t worry about China,” he wrote on Truth Social. “Highly respected President Xi just had a bad moment.” It is currently unclear whether President Trump and President Xi will meet as planned in South Korea at the end of October. While President Trump stated on October 10 that “there seems to be no reason” to proceed with the meeting, Bessent indicated a few days later that these plans are still in place.

Additionally, per a recent U.S. Trade Representative (USTR) notice, the U.S. will impose a 100% duty on certain Chinese ship-to-shore cranes and cargo handling equipment on November 9.

Finally, U.S. port fees on Chinese vessels went into effect on October 14. The USTR has indicated that vessels subject to fee modifications, including Liquified Gas Carriers and roll-on/roll-off vessels, may defer fee payments until December 10.

Updated October 10, 2025:

President Trump announced on Truth Social today that he intends to impose a 100% tariff on China beginning November 1, “over and above any tariff that they are currently paying.” The U.S. will also impose export controls on critical software, President Trump added.

Earlier today, President Trump had suggested a “massive increase” in tariffs on China, citing China’s export controls on rare earth metals and “other elements that they have quietly amassed into somewhat of a monopoly position.”

Today’s announcement comes exactly one month before the U.S.-China tariff truce concludes on November 10. Ahead of that deadline, President Trump and President Xi were due to meet in person at South Korea’s Asia-Pacific Economic Cooperation (APEC) Forum at the end of October. However, President Trump indicated today that “now there seems to be no reason to do so.”

Separately, China has announced countermeasures against upcoming U.S. port fees on Chinese vessels. American-owned or American-operated vessels, along with any vessels built in the U.S., will face a fee of CN¥400 (~$56) per net ton when berthing at a Chinese port. These fees will take effect on October 14—the same day U.S. fees on Chinese vessels take effect—and will increase in line with the U.S.’s fee schedule.

Updated October 7, 2025:

CBP confirmed yesterday on a trade outreach call that it will not issue any refunds, whether by check or ACH, during the government shutdown. That includes any payment involving a check from the Treasury Department, such as drawback claim payments, protests, and post-summary corrections. Read more about government shutdown impacts on federal agency operations and duty refunds here.

Updated October 6, 2025:

Today, President Trump announced on Truth Social that medium- and heavy-duty trucks will face a 25% tariff beginning November 1, 2025. President Trump had previously indicated that heavy truck tariffs would take effect on October 1, but did not provide further details on implementation by that date.

According to data from the International Trade Administration, the U.S. imported nearly $21 billion’s worth of medium- and heavy-duty trucks in 2024 alone. If these tariffs take effect, USMCA partners would bear the brunt of the impact: Mexico was the biggest supplier (about 74%) of last year's imports, followed by Canada (just over 20%).

- USMCA exemptions: For medium- and heavy-duty trucks that fall under the USMCA, it is currently unclear whether these tariffs would apply only to trucks’ non-U.S. content, as is the case with USMCA-compliant automobiles. In general, to qualify for partial duty relief under USMCA rules of origin, the following content must originate from North America: at least 64% of the truck’s value; at least 75% of its engines, axles, transmissions, and other core components; and at least 70% of the manufacturer’s annual steel and aluminum procurement.

Separately, the U.S. Trade Representative (USTR) has outlined payment procedures for upcoming fees on Chinese-built and operated vessels, which are set to be implemented on October 14, 2025. Guidance is as follows:

- The burden is on the vessel operator (rather than U.S. Customs and Border Protection (CBP)) to determine if the vessel owes a fee.

- Upcoming fees will be paid directly to the Department of the Treasury, not at the port of entry.

- Vessels without proof of payment may be denied lading/unlading or clearance. The USTR strongly encourages responsible parties to pay fees at least three business days before vessel arrival.

Beginning October 14, Chinese vessel owners/operators calling at a U.S. port will face a fee of $50 per net ton. Chinese-built ships will be subject to a fee of $18 per net ton or $120 per container, whichever is higher. For a complete breakdown of upcoming Chinese vessel fees and exemptions, visit our blog.

Updated September 30, 2025:

Last night, President Trump issued an executive order that will implement tariffs on lumber, upholstered furniture, kitchen cabinets, and bathroom vanities. These duties will take effect on October 14, not October 1. Duty rates stipulated in the order include:

- Softwood timber and lumber: 10%

- Certain upholstered furniture: 25%, except the EU and Japan (15% cap) and the U.K. (10% cap)

- Applicable HTS codes: 9401.61.4011, 9401.61.4031, 9401.61.6011, and 9401.61.6031

- Certain kitchen cabinets and bathroom vanities: 25%, except the EU and Japan (15% cap) and the U.K. (10% cap)

- Applicable HTS codes: 9403.40.9060, 9403.60.8093, and 9403.91.0080

Note that these rates differ from those mentioned in President Trump’s Truth Social posts yesterday. However, per the order, the rates President Trump indicated on Truth Social (30% on upholstered furniture and 50% on kitchen cabinets and vanities) will take effect on January 1, 2026, and will apply to any country that does not have a trade agreement in place with the U.S.

Additionally:

- These tariffs will be eligible for duty drawback, unlike other Section 232 tariffs.

- Tariff stacking: Goods subject to these tariffs will be exempt from IEEPA reciprocal tariffs, the 40% IEEPA tariff on Brazil, and the 25% IEEPA “oil” tariff on India. This is similar to other Section 232 tariffs.

- Depending on the shipment’s country of origin and date of entry for consumption, this may result in an effective duty savings between October 14 and December 31.

- Chapter 44 HTS codes will be removed from the IEEPA reciprocal exemption list (Annex II) for all goods entered or withdrawn for consumption on or after October 14.

Finally, the order suggests the possibility of upcoming duties on hardwood timber and lumber, pending an investigation that will conclude by October 1, 2026.

Calculate these duty and landed cost impacts in real time with the Flexport Tariff Simulator.

Updated September 29, 2025:

This morning, President Trump indicated on Truth Social that he intends to impose “substantial tariffs on any country that does not make its furniture in the United States,” citing the loss of North Carolina’s furniture business to China and other nations. It is unclear exactly which furniture imports would be impacted, or when these potential new tariffs would take effect.

President Trump had previously announced a 30% tariff on upholstered furniture beginning October 1, pending confirmation via executive order or Federal Register notice. Additionally, President Trump has yet to confirm specifics on tariff stacking for all potential new duties on October 1, including those applicable to upholstered furniture, heavy trucks, pharmaceuticals, kitchen cabinets, and bathroom vanities.

In a separate Truth Social post this morning, President Trump also announced plans to levy a 100% tariff on “any and all movies that are made outside of the United States.” How and when this tariff would be imposed remains unclear.

Updated September 26, 2025:

The Trump administration announced plans for sweeping new tariffs going into effect on October 1, 2025, targeting a wide range of imported goods, including heavy trucks, upholstered furniture, home fixtures and cabinetry, and pharmaceuticals. No executive order has been issued, and no notice has been published in the Federal Register at this time.

Should these tariffs take effect, heavy trucks will face a 25% tariff, kitchen cabinets and bathroom vanities 50%, upholstered furniture 30%, and branded or patented pharmaceuticals up to 100%. The pharmaceutical tariff would not apply for companies that are “building U.S. manufacturing plants,” defined as “breaking ground” or “under construction." The move is being framed as a national security measure under Section 232 of the Trade Expansion Act, positioning the tariffs as a way to protect domestic manufacturing and reduce reliance on foreign supply chains.

Overall, the tariff hikes could place immediate financial and operational pressure on importers while creating long-term incentives for shifting production to the U.S. or diversifying suppliers.

Updated September 16, 2025:

Effective September 16, 2025 (retroactive to August 7), the U.S. is rolling out new tariff rules to the U.S.–Japan Agreement. The latest includes a 15% baseline tariff on most Japanese imports. If the existing duty on affected goods is below 15%, an additional duty will be applied to bring it up to that threshold; if the rate is already 15% or higher, no extra duty applies. Some categories, like generic pharmaceuticals, certain natural resources, and civil aircraft, are exempt. Raw materials already affected by Section 232 duties, like steel, aluminum, and copper, are unaffected.

Automobiles and auto parts also shift into this framework: instead of being subject to 25% duties under Section 232, they now follow the 15% baseline rule. This is also effective as of September 16.

U.S. importers should immediately review shipments from Japan since August 7 to identify refund opportunities and assess cost impacts under the 15% baseline structure. For sectors like car manufacturers and pharmaceuticals, the carve-outs could ease pressure compared to broader tariff hikes, but origin rules and classification will be critical. Strategically, the deal ties tariff relief to economic commitments from Japan, primarily via large purchases of U.S. agricultural goods and energy and over $500 billion in investments in the U.S. This means future tariff stability depends on Japan delivering its commitments, creating both new opportunities and compliance risks for companies operating in U.S.–Japan trade flows.

Updated September 9, 2025:

The Supreme Court has agreed to hear arguments on the legality of President Trump’s IEEPA tariffs, with oral arguments scheduled to take place in early November. IEEPA tariffs will remain in place for the time being.

Today’s announcement comes less than a week after President Trump petitioned the Supreme Court for an expedited ruling on a federal appeals court decision that found his IEEPA duties illegal.

If the Supreme Court upholds the federal appeals court’s ruling, many businesses would potentially qualify for refunds.

Updated September 8, 2025:

Effective today (September 8), President Trump has modified the scope of Annex II, a list of products exempt from IEEPA reciprocal tariffs. The executive order impacts pharmaceuticals, semiconductors, energy products, and other goods. Per the order:

- 52 new HTS codes have been added to Annex II.

- 131 HTS codes have been removed from Annex II.

- Nearly all copper products have been removed from Annex II, presumably because they are now tariffed under Section 232.

Additionally, Annex III to the executive order contains 1,908 HTS subheadings that potentially qualify for a reciprocal tariff exemption, provided that the country of origin has finalized an agreement on reciprocal trade with the United States.

Analyze these tariff and landed cost impacts in real time with the Flexport Tariff Simulator.

Updated September 5, 2025:

Yesterday, President Trump published an executive order that will implement a trade deal between the U.S. and Japan. The order outlines the following:

- The U.S. will impose a baseline tariff of 15% on most Japanese imports.

- Goods with a most-favored-nation (MFN) tariff of less than 15% will be subject to a duty of 15%.

- Goods with an MFN tariff that exceeds 15% will only be subject to that MFN tariff rate.

- The U.S. will also impose separate sector-specific duties on Japanese autos and auto parts, aerospace products, generic pharmaceuticals, and natural resources that are not available or not produced in the United States. Goods subject to any of these sector-specific duties are exempt from reciprocal duties.

- Duties on autos and auto parts will be reduced from 25% to 15%.

- Japan will invest $550 billion in the United States and ramp up purchases of American agricultural goods.

- Japan will expand market access for American manufacturers across key sectors, including aerospace, agriculture, and energy.

The modified tariff structure will take effect within seven days of the order’s publication in the Federal Register, and will apply retroactively to Japanese goods that are “entered for consumption or withdrawn from warehouse for consumption” on or after August 7, 2025.

Updated September 4, 2025:

Last night, President Trump asked the Supreme Court for an “expedited ruling” on overturning last Friday’s federal appeals court decision, which found President Trump’s IEEPA tariffs illegal.

What happens if the Supreme Court upholds the U.S. Court of Appeals for the Federal Circuit’s ruling?

- U.S. Customs and Border Protection (CBP) would halt all collection of IEEPA tariffs.

- Many businesses would potentially qualify for refunds: some duties would be proactively refunded by CBP, while others would require importers to file post summary corrections and protests.

- Should the Supreme Court take a long time to reach a ruling—i.e., next June or beyond—the window for post summary corrections and protests may begin closing on early entry filings.

- Importers can file protests on liquidated entries. Given pending litigation, the protests would remain in “open” status.

- Protests not filed in a timely manner may be denied automatically.

For specific guidance on your situation, reach out to your account manager or our trade advisory team.

Updated August 29, 2025:

This afternoon, the U.S. Court of Appeals for the Federal Circuit ruled President Trump’s IEEPA tariffs illegal, upholding the Court of International Trade (CIT)’s initial ruling in May. Today’s ruling does not issue an injunction on the tariffs, meaning duties will continue to be collected until October 14. Duties affected by this ruling include the IEEPA fentanyl tariffs on Canada, Mexico, and China, as well as the IEEPA reciprocal tariffs placed on the rest of the world.

President Trump indicated on Truth Social that the ruling will be appealed to the Supreme Court. Today’s decision does not impact President Trump’s non-IEEPA tariffs, such as steel and aluminum tariffs.

Updated August 17, 2025:

On August 14, 2025, the Department of Commerce’s Bureau of Industry and Security (BIS) published a notice expanding the scope of Section 232 tariffs on steel and aluminum. The update adds 407 Harmonized Tariff Schedule (HTS) codes to the list of covered “derivative” products, meaning additional duties will now apply based on the steel or aluminum content of those goods.

The new duties will take effect at 12:01 a.m. ET on August 18, 2025, applying to goods entered for consumption, or withdrawn from warehouse for consumption, on or after that date. Importantly, the tariffs will be assessed only on the value of the steel or aluminum content within the covered products, while any non-steel or non-aluminum components will remain subject to reciprocal or other applicable tariffs.

Key product categories impacted:

Consumer Packaged Goods

- Aluminum packaging—everything from condensed milk and shampoo to deodorants and disinfectants in aluminum containers is covered.

- This builds on earlier inclusions like beer.

Household and Industrial Products

- Tools, knives, blades, and cutlery

- Furniture: seats, office furniture, metal shelving

- Air conditioners, filters, pumps, gear boxes

Heavy Industry and Transport

- Bulldozers, cranes, industrial robots

- Rail cars, rolling stock, locomotive

- Heavy semi-trucks and buses

Chemicals & Coatings

- Cleaning products, soaps, surface-active agents, lubricants

- Paints, varnishes, mastics, caulking compounds

- Adhesives and glues

- Disinfectants and sanitizers

Energy & Infrastructure

- Nuclear reactor parts

- Wind turbine towers, blades, and hubs

- Transformers, generators, extension cords

Special Callouts:

- Overlap with automotive tariffs: Some products also fall under the Section 232 automotive category. As of today, automotive duties are assessed at 25% on the full value of the good, whereas steel/aluminum duties apply only to the metal content, but at higher rates. Importers will need to carefully evaluate classification to avoid overpaying.

- Dual-flagged products: Of the new additions, 124 codes are flagged as both aluminum and steel derivatives. Importers must now declare which material is present, even if the product contains only one. This will increase complexity in supplier data collection and customs documentation.

- More detail required: For many brands, this means chasing suppliers for detailed data: aluminum weight, percentage of customs value, and country of cast/smelt. The compliance burden is significant.

The Impact:

The expansion is sweeping: BIS estimates that the 673 steel derivatives and 188 aluminum derivatives represent about 3.5% of all HTSUS codes. Many of these items are everyday consumer or industrial products, not just raw materials.

For companies, the implications are two-fold:

- Higher landed costs: Duties on steel/aluminum content add a new layer of expense to products that previously may have escaped Section 232. To see how these changes could affect your landed costs, try the Flexport Tariff Simulator and get a clearer picture of your potential duty exposure.

- Operational complexity: Gathering and reporting the required steel/aluminum data from global suppliers will slow down workflows and complicate compliance.

What’s Next:

- Effective August 18, 2025, importers must ensure compliance on all newly listed HTSUS codes.

- Companies in FMCG, automotive, heavy industry, and consumer goods should immediately audit product lines for exposure.

- Expect additional scrutiny from CBP on country of smelt/cast declarations for aluminum, following recent enforcement patterns.

- The next round for 232 inclusion requests opens in September, so expect this to continue to expand.

Updated August 11, 2025:

This afternoon, President Trump signed an executive order that will extend the existing tariff agreement between the U.S. and China for another 90 days. Until November 10, 2025, the U.S. will continue to impose a 30% tariff on Chinese goods, while China will continue to levy a 10% tariff on U.S. goods.

The existing agreement, which went into effect on May 14, was initially due to expire tomorrow (August 12). Today’s order comes approximately two weeks after the latest round of U.S.-China trade negotiations, and will prevent duties on Chinese goods from surging back to 145%—at least until November.

Updated August 6, 2025:

President Trump published an executive order today that will impose an additional 25% blanket tariff on India, just days after imposing a 25% reciprocal tariff scheduled for August 1. The second 25% tariff—which the executive order attributes to India’s “direct or indirect imports of Russian oil” into the United States—will take effect on August 27, 2025.

Exemptions from the additional (oil-related) 25% tariff: Goods that are loaded onto a vessel and in transit on their final mode of transport before August 27, 2025, and “entered for consumption, or withdrawn from warehouse for consumption” before September 17, 2025.

Depending on shipment departure and arrival dates (detailed in the table below), some Indian-origin imports will face an effective duty rate of 50%.

IEEPA duties applicable to Indian-origin goods:

| Departure Date | Arrival Date | Reciprocal Tariff | Oil-Related Tariff |

|---|---|---|---|

| Before August 7 | Before September 17 | 10% | 0% |

| Before August 7 | September 17 - October 4 | 10% | 25% |

| Before August 7 | On or after October 5 | 25% | 25% |

| August 7 - August 26 | Before September 17 | 25% | 0% |

| August 7 - August 26 | On or after September 17 | 25% | 25% |

| On or after August 27 | -- | 25% | 25% |

Updated August 5, 2025:

Yesterday, the EU announced that it plans to delay its countermeasures against U.S. tariffs for six months. These countermeasures, which included tariffs of up to 30% on a range of U.S. goods, were originally set to be implemented on August 7, 2025.

The announcement comes just over a week after the U.S. and the EU announced a preliminary trade agreement, under which most EU goods would face a 15% tariff.

Separately, President Trump indicated today that he may announce tariffs on semiconductors and pharmaceuticals as soon as next week. The U.S. Department of Commerce commenced its Section 232 investigation into semiconductors in April, and is expected to release results early this month.

As for pharmaceuticals, President Trump told CNBC that tariffs will be “initially small,” but “in one year—one and a half years, maximum—it’s going to go to 150%, and then it’s going to go to 250%.”

Finally, in an August 4 Truth Social post, President Trump stated he intends to “substantially [raise] the tariff paid by India to the U.S.,” given India’s ongoing purchases of “massive amounts of Russian oil.” Per last week’s executive order, India is currently set to face a 25% reciprocal tariff on August 7.

Updated August 1, 2025:

Last night, on July 31, President Trump published an executive order modifying tariffs on Canada:

- The tariff rate on Canadian imports to the U.S. has increased from 25% to 35%, effective August 1 at 12:01 a.m. ET.

- Exemptions for goods compliant with the United States-Mexico-Canada Agreement (USMCA) remain unchanged.

- The current tariff stacking order also remains unchanged.

- Goods determined to have been transshipped to evade duties will be subject to a tariff rate of 40% in lieu of the 35%, along with applicable fines or penalties.

President Trump also published an executive order last night detailing modified reciprocal tariff rates for nearly 70 trade partners, set to take effect on August 7 at 12:01 a.m. ET.

- Any nation not listed in the executive order will be subject to a 10% baseline reciprocal tariff (with the exception of China and Canada).

- Goods determined to have been transshipped to evade duties will be subject to a 40% tariff.

- To qualify for the reciprocal in-transit exception, goods must be loaded onto a vessel at the port of loading and in transit on their final mode of transportation before August 7 at 12:01 a.m. ET, and arrive before October 5 at 12:01 a.m. ET.

- EU goods: Imports with an HTSUS Column 1 duty rate of 15% or higher will face a 0% tariff. Meanwhile, imports with a Column 1 duty rate of less than 15% will face a tariff determined as follows: 15% minus the Column 1 duty rate.

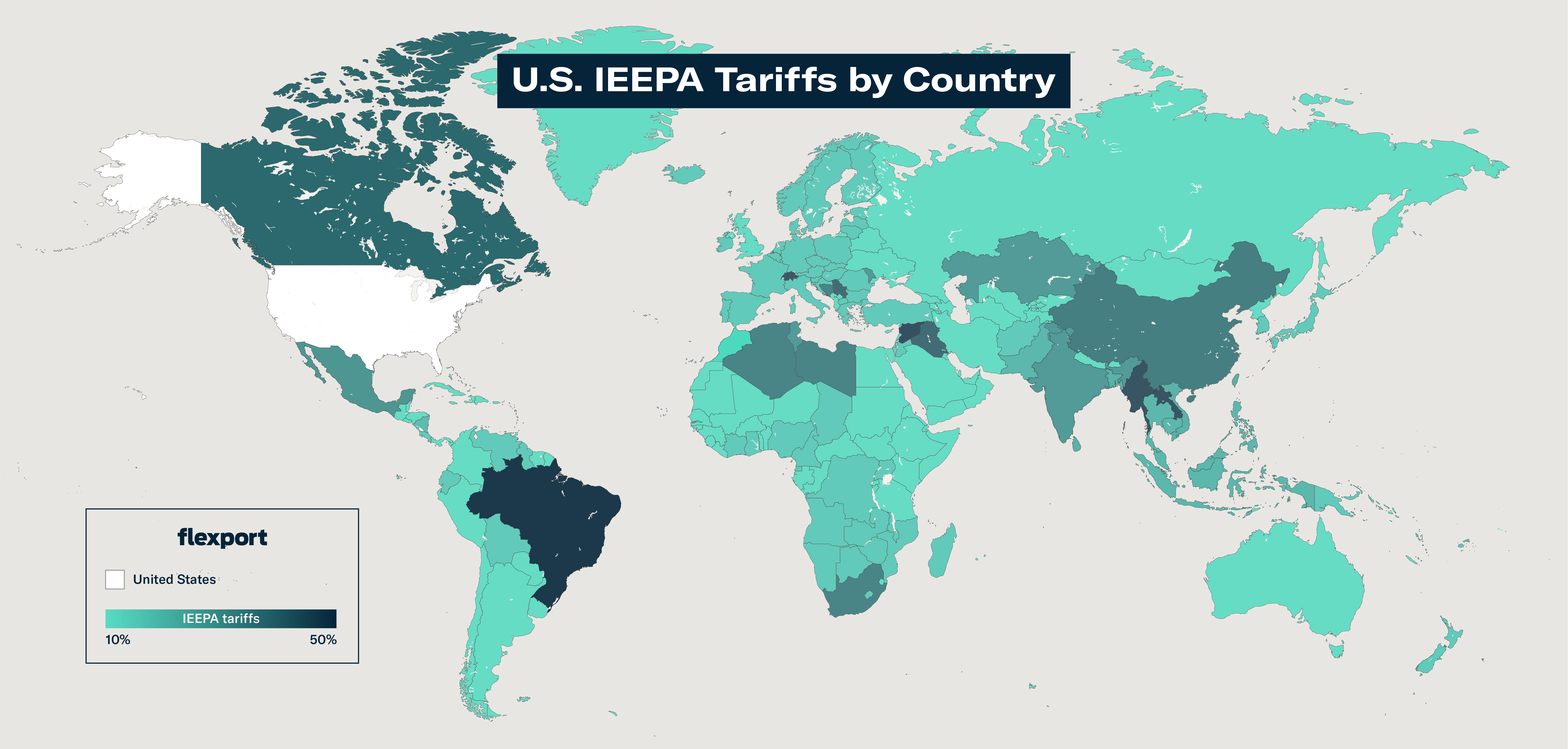

Per the order, upcoming reciprocal tariff rates are as follows:

| Trade Partner | Adjusted Reciprocal Tariff |

|---|---|

| Afghanistan | 15% |

| Algeria | 30% |

| Angola | 15% |

| Bangladesh | 20% |

| Bolivia | 15% |

| Bosnia | 30% |

| Botswana | 15% |

| Brazil | 10% |

| Brunei | 25% |

| Cambodia | 19% |

| Cameroon | 15% |

| Chad | 15% |

| Costa Rica | 15% |

| Côte d'Ivoire | 15% |

| Democratic Republic of the Congo | 15% |

| Ecuador | 15% |

| Equatorial Guinea | 15% |

| EU: Goods with ≥ 15% Column 1 duty rate | 0% |

| EU: Goods with < 15% Column 1 duty rate | 15% minus Column 1 duty rate |

| Falkland Islands | 10% |

| Fiji | 15% |

| Ghana | 15% |

| Guyana | 15% |

| Iceland | 15% |

| India | 25% |

| Indonesia | 19% |

| Iraq | 35% |

| Israel | 15% |

| Japan | 15% |

| Jordan | 15% |

| Kazakhstan | 25% |

| Laos | 40% |

| Lesotho | 15% |

| Libya | 30% |

| Liechtenstein | 15% |

| Madagascar | 15% |

| Malawi | 15% |

| Malaysia | 19% |

| Mauritius | 15% |

| Moldova | 25% |

| Mozambique | 15% |

| Myanmar | 40% |

| Namibia | 15% |

| Nauru | 15% |

| New Zealand | 15% |

| Nicaragua | 18% |

| Nigeria | 15% |

| North Macedonia | 15% |

| Norway | 15% |

| Pakistan | 19% |

| Papua New Guinea | 15% |

| Philippines | 19% |

| Serbia | 35% |

| South Africa | 30% |

| South Korea | 15% |

| Sri Lanka | 20% |

| Switzerland | 39% |

| Syria | 41% |

| Taiwan | 20% |

| Thailand | 19% |

| Trinidad and Tobago | 15% |

| Tunisia | 25% |

| Turkey | 15% |

| Uganda | 15% |

| United Kingdom | 10% |

| Vanuatu | 15% |

| Venezuela | 15% |

| Vietnam | 20% |

| Zambia | 15% |

| Zimbabwe | 15% |

Updated July 30, 2025:

Today, President Trump signed an executive order that will suspend the de minimis exemption for low-value shipments (i.e., valued at or under $800) beginning August 29, 2025, for all countries of origin.

- For low-value goods shipped via the international postal system: For the first six months following the August 29 implementation date, these goods will face a duty ranging from $80 to $200 per item, depending on the IEEPA tariff rate that applies to the product’s country of origin. After six months, all low-value shipments will be subject to the ad valorem IEEPA tariff applicable to the product’s country of origin, without any minimum or maximum duty per item.

- For low-value goods shipped through means other than the international postal system: These goods will be subject to all applicable duties.

- American travelers will still be able to bring up to $200 in personal items back to the U.S. duty-free, and Americans can continue to receive up to $100 in bona fide gifts duty-free.

The U.S. previously ended de minimis treatment for Chinese-origin goods on May 2, 2025. Additionally, earlier this month, President Trump signed the One Big Beautiful Bill Act (OBBBA), which will permanently repeal the statutory basis for the de minimis exemption on July 1, 2027. Today’s executive order will suspend de minimis treatment “more quickly than the OBBBA requires … to save American lives and businesses now.”

President Trump also signed an executive order today that will increase tariffs on Brazilian imports by 40%, bringing the total effective duty rate on Brazil to 50%.

- The new tariff rate will take effect seven days from today—i.e., on August 6, 2025.

- Goods loaded onto a vessel and in transit on their final mode of transit before August 6 and “entered for consumption, or withdrawn from warehouse for consumption” before October 5, 2025, will be exempted from the new duty rate. These goods will remain subject to the current 10% tariff rate.

Additionally, President Trump also signed a proclamation today on new copper tariffs, which he had originally announced on July 9.

- Effective August 1, semi-finished copper products and copper-intensive derivative products will face a 50% Section 232 tariff.

- The copper tariff will apply to products’ copper content, while non-copper content will remain subject to reciprocal tariffs or other applicable duties. These tariffs will not stack.

- Section 232 auto tariffs and copper tariffs will not stack. Products subject to auto tariffs will be exempt from copper tariffs.

President Trump also announced on Truth Social today that the U.S. will impose a 25% tariff on India, effective August 1. India will also face an unspecified penalty for buying military equipment and energy products from Russia.

Finally, the latest round of U.S.-China trade negotiations concluded on July 29—just two weeks before the nations’ August 12 deadline for finalizing a trade deal. U.S. and Chinese officials have agreed to push for an extension of the temporary 90-day agreement that took effect in May, though U.S. Treasury Secretary Scott Bessent indicated that the final decision would lie with President Trump.

Updated July 28, 2025:

Yesterday (July 27), the U.S. and the EU reached a preliminary trade agreement. Terms are as follows:

- The U.S. will impose a 15% tariff on EU imports, including pharmaceuticals, automobiles, and semiconductors.

- The EU will purchase $750 billion in U.S. energy products and invest an additional $600 billion in the U.S., all by 2028.

- The EU will work with the U.S. to eliminate various tariffs, and will establish quotas for certain products.

- The EU will work with the U.S. to address certain non-tariff barriers, including those related to digital trade and U.S. agricultural exports. In particular, the EU will not implement or maintain any network usage fees, and will streamline requirements for sanitary certificates for U.S. pork and dairy products.

- The EU will eliminate “red tape” and “burdensome” requirements that U.S. exporters face when conducting business in the EU.

- The EU will purchase significant amounts of U.S. military equipment.

- As of now, the EU will continue to face 50% sectoral tariffs on steel, aluminum, and copper.

It remains unclear when this agreement will take effect. Additionally, the deal has not yet been finalized, and may be subject to change.

Separately, the U.S. is expected to announce the results of a Section 232 investigation into semiconductors in about two weeks—meaning chip imports could potentially face new levies.

Finally, U.S.-China trade talks will resume today—just over two weeks ahead of August 12, the deadline for the two nations to finalize a trade agreement. U.S. Treasury Secretary Scott Bessent indicated last week that “we’ll be working out what is likely an extension,” referring to the temporary 90-day agreement that took effect in May.

Updated July 23, 2025:

Yesterday, President Trump announced on Truth Social that the U.S. and Japan had reached a trade deal. Per the agreement, Japan will face a 15% reciprocal tariff; invest $550 billion into the United States, which will receive 90% of profits; and “open their country to trade, including cars and trucks, rice, and certain other agricultural products.”

Japan is the U.S.’s fifth-largest trade partner, with the U.S. importing $148.2 billion in Japanese goods in 2024 alone. More than a third of those imports consisted of automobiles and auto parts, according to the International Trade Administration.

Updated July 16, 2025:

On July 7, President Trump began publishing his first batch of tariff letters laying out trade agreement terms with select nations. These include proposed reciprocal tariff rates—all expected to take effect on August 1, 2025, pending official confirmation via executive order or Federal Register notice.

Duties proposed so far include:

| Nation | Proposed Reciprocal Tariff |

|---|---|

| Japan | 15% |

| Indonesia | 19% |

| Philippines | 19% |

| Vietnam | 20% |

| Brunei | 25% |

| India | 25% |

| Kazakhstan | 25% |

| Malaysia | 25% |

| Moldova | 25% |

| South Korea | 25% |

| Tunisia | 25% |

| Algeria | 30% |

| Bosnia | 30% |

| European Union | 15% |

| Iraq | 30% |

| Libya | 30% |

| Mexico | 30% |

| South Africa | 30% |

| Sri Lanka | 30% |

| Bangladesh | 35% |

| Canada | 35% |

| Serbia | 35% |

| Cambodia | 36% |

| Thailand | 36% |

| Laos | 40% |

| Myanmar | 40% |

| Brazil | 50% |

Per the letters, if any of the aforementioned nations raises tariffs on the U.S., then the U.S. will increase its reciprocal tariff on that nation by an identical amount. Additionally, any goods that are transshipped to evade a higher tariff will be subject to that higher tariff.

The original end date for the Trump administration’s 90-day country-specific reciprocal tariff pause was July 9, 2025. Per President Trump’s executive order published July 7, that end date has been postponed to August 1, 2025.

Separately, President Trump announced on July 9 that a 50% tariff on copper imports will take effect on August 1, now that the Commerce Department’s national security investigation into copper has concluded.

President Trump stated that he also plans to impose pharmaceutical tariffs as high as 200%—but will first “give people about a year, a year and a half, to [bring manufacturing operations to the U.S.].”

Finally, on July 6, President Trump announced on Truth Social that he intends to levy an additional 10% tariff on “any country participating in the anti-American policies of BRICS,” with “no exceptions to this policy.”

Prior to President Trump’s announcement, BRICS—an intergovernmental group that includes Brazil, Russia, India, China, South Africa, Egypt, Ethiopia, Indonesia, Iran, and the UAE—released a statement expressing “serious concerns” about unilateral tariffs that “are inconsistent with WTO rules.” BRICS’ statement did not explicitly mention the Trump administration or the United States.

Updated July 7, 2025:

Today, the White House published an executive order postponing the end date for the country-specific reciprocal tariff pause to August 1, 2025. Until then, reciprocal tariffs will remain at their current rates.

Updated July 4, 2025:

The Big Beautiful Bill: A New Chapter in Global Trade

The "Big Beautiful Bill,” represents a significant shift in international trade policy. This legislation aims to rebalance global trade relationships through a combination of targeted tariffs, enhanced supply chain security provisions, and investment in domestic manufacturing capabilities. The bill seeks to address economic concerns through a two-pronged approach: reforming business taxation to incentivize domestic job creation while implementing stronger immigration enforcement measures. For global markets, this signals a move away from unrestricted free trade toward a more managed approach that prioritizes national economic interests and supply chain resilience. While supporters argue it will revitalize domestic industries and create jobs, critics warn that the bill could stifle economic growth by increasing costs for businesses through stricter compliance requirements while potentially exacerbating labor shortages in key industries that rely on immigrant workers. As implementation begins, businesses worldwide are reassessing their international strategies to navigate this evolving trade landscape.

With the passing of the Big Beautiful Bill, many ‘Big’ changes have been made but let’s discuss one in particular…

SEC. 70531 - End of De Minimis

This portion of the bill clarifies that this is for commercial de minimis only. SEC. 70531 of the bill creates a new penalty that is effective in 30 days from enactment. If an importer tries to claim de minimis where they are not otherwise allowed to then a new penalty will be introduced: $5,000 for the first violation and up to $10,000 for each subsequent violation.

Lastly, the Big Beautiful Bill will end De Minimis for all countries on July 1st, 2027 (however, China is still banned from De Minimis today).

Updated July 2, 2025:

President Trump announced on Truth Social a trade agreement between the U.S and the Socialist Republic of Vietnam. Following discussions with To Lam, General Secretary of the Communist Party of Vietnam, the agreement establishes new tariff structures aimed at strengthening economic relations.

The U.S. will apply a 20% tariff on all goods of Vietnamese origin, and a 40% tariff on transshipping activities. As part of the agreement, the U.S. is granted full access to the Vietnamese market, allowing American products to enter Vietnam without any tariffs.

This agreement could significantly impact the export of SUVs and large engine vehicles from the U.S. into Vietnam, expanding the product range available in the Vietnamese market.

A formal announcement, including clarification around the transshipping activities, is still pending.

Updated June 27, 2025:

President Trump stated yesterday that the U.S. had “just signed [a deal] with China,” though it appears that the agreement is unrelated to tariffs. Since then, White House officials have indicated that the deal involves streamlining American access to Chinese rare earth minerals—an essential component of semiconductor manufacturing.

Increasing U.S. access to Chinese rare earth shipments comprised part of the proposed U.S.-China trade agreement President Trump announced earlier this month. However, that agreement—which also includes a 55% tariff rate on China—has yet to be approved by President Trump and President Xi.

Separately, President Trump announced on Truth Social today that the U.S. is “terminating all discussions on trade with Canada, effective immediately,” in light of Canada’s digital services tax on American technology companies. The Trump administration will “let Canada know the tariff that they will be paying to do business with the United States within the next seven-day period,” he added.

The current effective tariff rate on Canada is 25%, excluding energy products (10%) and goods that fall under the United States-Mexico-Canada Agreement (USMCA) (0%).

About the Author

March 28, 2025

More from Flexport

![GettyImages-723523781 1199x800]()

Blog

The End of the EU’s Duty-Free Exemption for Low-Value Goods: Timelines, Upcoming Changes, and Impacts on Ecommerce Brands