Global Logistics Update

President Trump to Cut Tariffs on China; Congestion Persists at Major European Base Ports

Updates from the global supply chain and logistics world | October 30, 2025

Global Logistics Update: October 30, 2025

October 30, 2025

Trends to Watch

Talking Tariffs

- U.S.-China Tariff Developments: Earlier today, President Trump and President Xi met in South Korea. While the meeting did not yield a trade agreement, President Trump told reporters after the meeting that one may be signed “pretty soon,” and that he will visit China for another round of talks in April. President Trump and President Xi agreed upon the following today:

- Effective immediately, President Trump will lower the “fentanyl” tariff on China from 20% to 10%, citing President Xi’s commitment to curbing the flow of fentanyl precursors. This change awaits official confirmation via executive order or Federal Register notice, and would bring the combined duty rate on China to approximately 45%: a 10% reciprocal tariff, a 10% “fentanyl” tariff, and up to 25% in Section 301 tariffs.

- China will delay the implementation of its latest rare earth export controls for one year.

- China will resume purchases of American soybeans. Historically the biggest buyer of American soybean exports, China had not purchased any soybean shipments this season, with China’s retaliatory tariffs driving up prices. However, in the days leading up to today’s meeting, China purchased its first soybean cargoes of the season.

- The U.S. will suspend its recently implemented port fees on Chinese vessels for one year. In response, China will suspend its retaliatory port fees on American vessels for one year.

- President Trump and President Xi discussed Chinese access to American semiconductors, but did not agree on any specific provisions. President Trump told reporters after today’s meeting that China will “be talking to Nvidia and others about taking chips.”

- China will begin the process of purchasing American energy, which may include a potential large-scale oil and gas deal in Alaska.

- Check out our live blog for more details.

- Updates from U.S. Customs and Border Protection (CBP): CBP recently announced two critical changes. First, effective today (October 30), CBP has implemented an automated application process for new Automated Commercial Environment (ACE) Portal accounts, which streamlines access to users’ import activities, entries, payments, and compliance data. And second, effective December 15, Periodic Monthly Statement (PMS) test participants will be required to pay all supplemental duty bills electronically.

- For businesses navigating these updates, Flexport can assist with documentation, filing with CBP, and other critical action items. Check out our blog to learn more about these changes, including how Flexport can help.

- Medium- and Heavy-Duty Truck (MHDV) Tariffs: Beginning this Saturday (November 1), MHDVs and MHDV parts will be subject to a 25% tariff, while buses and other vehicles classified under HTSUS heading 8702 will be subject to a 10% tariff.

- Importers of MHDVs that comply with the United States-Mexico-Canada Agreement (USMCA) may submit documentation detailing the amount of U.S. content in each truck, and pay the 25% tariff only on non-U.S. content. USMCA-compliant MHDV parts will be exempt from the 25% tariff until the Secretary of Commerce and U.S. Customs and Border Control (CBP) establish a process for applying the tariff to MHDVs’ non-U.S. content.

- MHDVs and buses manufactured 25+ years before their date of entry will be exempt from these upcoming tariffs.

- Imports subject to MHDV tariffs will not face any other Section 232 tariffs (steel, aluminum, copper, or timber), or any IEEPA tariffs (reciprocal, “fentanyl” on Canada/Mexico, or other levies). This is the case with automobile and auto part tariffs.

- U.S. and South Korea Announce Trade Deal: On October 29, the U.S. and South Korea finalized the key terms of a trade agreement. The U.S. will reduce the reciprocal tariff rate on South Korean goods from 25% to 15%, while South Korea will invest up to $20 billion in cash each year in the U.S. economy. Additionally, South Korea will invest $150 billion in the U.S. shipbuilding industry.

- President Trump Signs Trade Agreements with Southeast Asian Nations: On October 26, President Trump signed new trade deals with Malaysia and Cambodia, while announcing frameworks for new deals with Thailand and Vietnam. Under these agreements, the U.S.’s reciprocal tariff rate for each of the four nations will remain in place. All four agreements also involve the removal of many tariff and non-tariff barriers on U.S. exports, along with increased purchases of U.S. products in sectors like aerospace, energy, and agriculture.

- Critical Mineral Agreements: On October 26, President Trump also signed non-binding memorandums of understanding (MOUs) with Malaysia and Thailand, intended to promote the development and processing of critical minerals in these nations.

- Despite the MOU, Malaysia’s trade minister stated on October 29 that Malaysia intends to maintain its ban on exporting critical minerals and rare earths.

- While these agreements may aim to reduce U.S. dependence on China for minerals and rare earths, China maintains a monopoly on the world’s rare earth supply, including 70% of global mining capacity and 90% of global processing.

- President Trump Suggests Increased Tariffs on Canada: On October 25, President Trump announced plans to increase tariffs on Canada by 10%, following the release of an anti-tariff ad by the government of Ontario. This announcement awaits official confirmation via executive order or Federal Register notice. Currently, Canada faces an IEEPA “fentanyl” tariff of 35%.

Calculate your tariff and landed cost impacts in real time with the Flexport Tariff Simulator.

Ocean

TRANS-PACIFIC EASTBOUND (TPEB)

- Capacity and Demand:

- Capacity is expected to bounce back to 84-86% for November, up sharply from the 60-70% in October and the capacity reduction implemented during China’s Golden Week holiday.

- Overall utilization has improved after a recovery in volumes following Golden Week, along with a slight increase driven by a potential late-October rush related to previously anticipated tariff hikes.

- Overall, vessel utilization has improved compared to pre-Golden-Week levels. Specifically, some Pacific Southwest (PSW) strings are reportedly close to full or are beginning to reach high utilization in light of earlier tariff expectations.

- Freight Rates:

- The Shanghai Containerized Freight Index (SCFI) has increased 11.2% for the West Coast and 6.2% for the East Coast, which aligns with the full October 15 General Rate Increase (GRI).

- The October 15 GRI was successfully implemented and is currently holding.

- Carriers have announced another round of GRIs for November 1; we are closely monitoring the final amount.

- The Peak Season Surcharge (PSS) has been postponed to November 15.

FAR EAST WESTBOUND (FEWB)

- Capacity and Demand:

- Major European base ports are continuing to see significant congestion. This is delaying vessel returns to Asia, leading to an estimated 21% capacity reduction in Week 45 and a projected 10% weekly loss for the rest of November. As a result, carriers are anticipating schedule disruptions and equipment shortages in early November.

- Market demand has recovered gradually since Golden Week. Shippers aiming to secure space ahead of the General Rate Increase (GRI) implementation have driven a slight surge in late October bookings.

- For now, November demand levels appear to be stable.

- Equipment:

- Carriers have reported equipment shortages at the Ports of Shanghai and Ningbo, along with feeder ports. Other carriers' inventories are currently tight, but remain manageable. To mitigate risk, we recommend printing Equipment Interchange Receipts (EIRs) as early as possible and adhering strictly to pickup windows.

- Freight Rates:

- The capacity reduction, combined with a rising Shanghai Containerized Freight Index (SCFI) (from $971 to $1,246/FEU over four weeks), has solidified the market's upward momentum. The GRI announced for November is expected to be implemented.

- As carrier loading data emerges, we expect a partial pullback of the GRI in the coming weeks. Currently, elevated rate levels are potentially slowing down fresh bookings for November, and may prompt carriers to adjust rates later on.

TRANS-ATLANTIC WESTBOUND (TAWB)

- Capacity and Demand:

- Antwerp: The pilots’ strike was previously suspended amid resumed negotiations. Yard utilization is at 75%, with berth delays of two to three days.

- Rotterdam: Yard utilization is at 81-89%, with berth delays of two to three days.

- Hamburg: Yard utilization is at 75%, with berth delays of five to seven days.

- Bremerhaven: Yard utilization is at 75-85%, with berth delays of five to seven days.

- South Mediterranean (Piraeus, Genoa, Valencia): Significant yard congestion persists, with vessel wait times of three to seven days.

- Equipment:

- As of October 27, container and chassis shortages in Europe remain critical, especially in Austria, Slovakia, Hungary, Southern and Eastern Germany, and Portugal. This has resulted in ongoing operational delays and equipment challenges.

- Freight Rates:

- As of October 27, spot rates remain soft, averaging between $1,800 and $1,900/FEU. This reflects consistent and modest demand, along with balanced vessel and equipment availability on the trade.

INDIAN SUBCONTINENT TO NORTH AMERICA

- Capacity and Demand:

- After a slight booking uptick leading into the Diwali holiday, routes from the Indian subcontinent to the U.S. are in a tariff-escalation-induced status quo. Demand remains soft after August’s tariff escalation, and carriers are continuing to implement blank sailings to balance supply and demand.

- Capacity to the U.S. East Coast: Supply continues to outstrip demand; carriers have announced blank sailings that will take place throughout the month of November.

- Capacity to the U.S. West Coast: Capacity remains available, given supply dynamics on the TPEB into the U.S. West Coast.

- Freight Rates:

- Cargo moving to the U.S. East Coast: The market continues to dip slightly on base lanes. Ongoing capacity management has helped balanced supply, but rates are further eroding.

- Cargo moving to the U.S. West Coast: August’s tariff increases and oversupply on core TPEB lanes continues to keep rate levels low.

Air

- North China:

- The TPEB market continues to see strong momentum, with sustained high demand and limited capacity expected to persist through the week.

- Although new capacity has entered the market, conditions remain tight and we anticipate additional rate increases. Ongoing demand from the electronics and ecommerce sectors, along with tariff-driven shipments, continues to support current pricing trends.

- Space availability remains extremely constrained, particularly for destinations along the Eastern Seaboard of the U.S. A large volume of industrial materials that require air transport is adding further pressure to an already-constrained market.

- The Asia-Europe market remains consistent with the previous week. Demand is steady, capacity remains limited, and pricing continues to reflect the supply-demand imbalance. We expect a slight upward movement in rate levels as tight conditions persist across major trade lanes.

- South China:

- Demand remains strong as shippers move to secure space for export shipments ahead of November.

- Market conditions indicate continued upward pressure on pricing in the coming weeks.

- Customers are encouraged to confirm shipments as early as possible, as later bookings are likely to face both limited capacity and higher costs.

- Taiwan:

- Demand remains strong toward the end of the month, especially on Trans-Pacific routes.

- The Asia‑Europe market remains stable, though space is expected to tighten slightly as the month concludes, which may lead to modest rate movement.

- Vietnam:

- Market demand has risen sharply toward month‑end, leaving minimal space for last‑minute bookings. Carriers now require advance reservations; in most cases, space will need to be secured at least several working days before departure.

- Heavy congestion continues to impact primary gateways, with backlogs building at key airports.

- Cambodia:

- Space availability remains limited, and price levels are trending higher than in prior weeks.

- Shippers should secure space well in advance—approximately one to two weeks before departure—to ensure timely uplift.

- South Korea:

- The market remains under pressure, with most capacity already fully utilized through the end of the month. Early November space is also filling quickly.

- Shippers are advised to plan and book ahead to minimize potential delays.

- Malaysia:

- Outbound cargo volumes to major global hubs continue to increase, leading to reduced space availability and upward rate momentum. These trends are expected to persist through November.

- Indonesia:

- Demand to key international destinations remains elevated. A sharp rise in export volumes has resulted in significant capacity constraints, which are likely to continue in the near term.

- To ensure smoother operations, bookings should be made at least seven days before scheduled departure.

- Thailand:

- The local market is continuing to experience robust demand.

- Capacity on both Trans-Pacific and Asia‑Europe routes is tightening toward the end of the month, as exporters push to complete shipments before closing their monthly targets.

- To secure uplift, shippers are encouraged to book space early—ideally one to two weeks before departure.

- India:

- Conditions remain similar to last week: stable demand and a gradual tightening in space, particularly on Trans-Pacific routes. Continued growth in regional demand may further impact capacity in the coming days.

- Shippers are encouraged to make reservations early.

- Bangladesh:

- Operations at Dhaka Airport have resumed following a recent disruption, though minor delays and congestion remain as handling activities recover. Some backlogs persist for outbound shipments, and advance booking is highly recommended.

- Shippers should plan additional lead time and consider consolidating smaller shipments to optimize for cost efficiency.

(Source: Flexport)

Please reach out to your account representative for details on any impacts to your shipments.

North America Vessel Dwell Times

Webinars

North America Freight Market Update Live

Thursday, November 13 @ 9:00am PT / 12:00pm ET

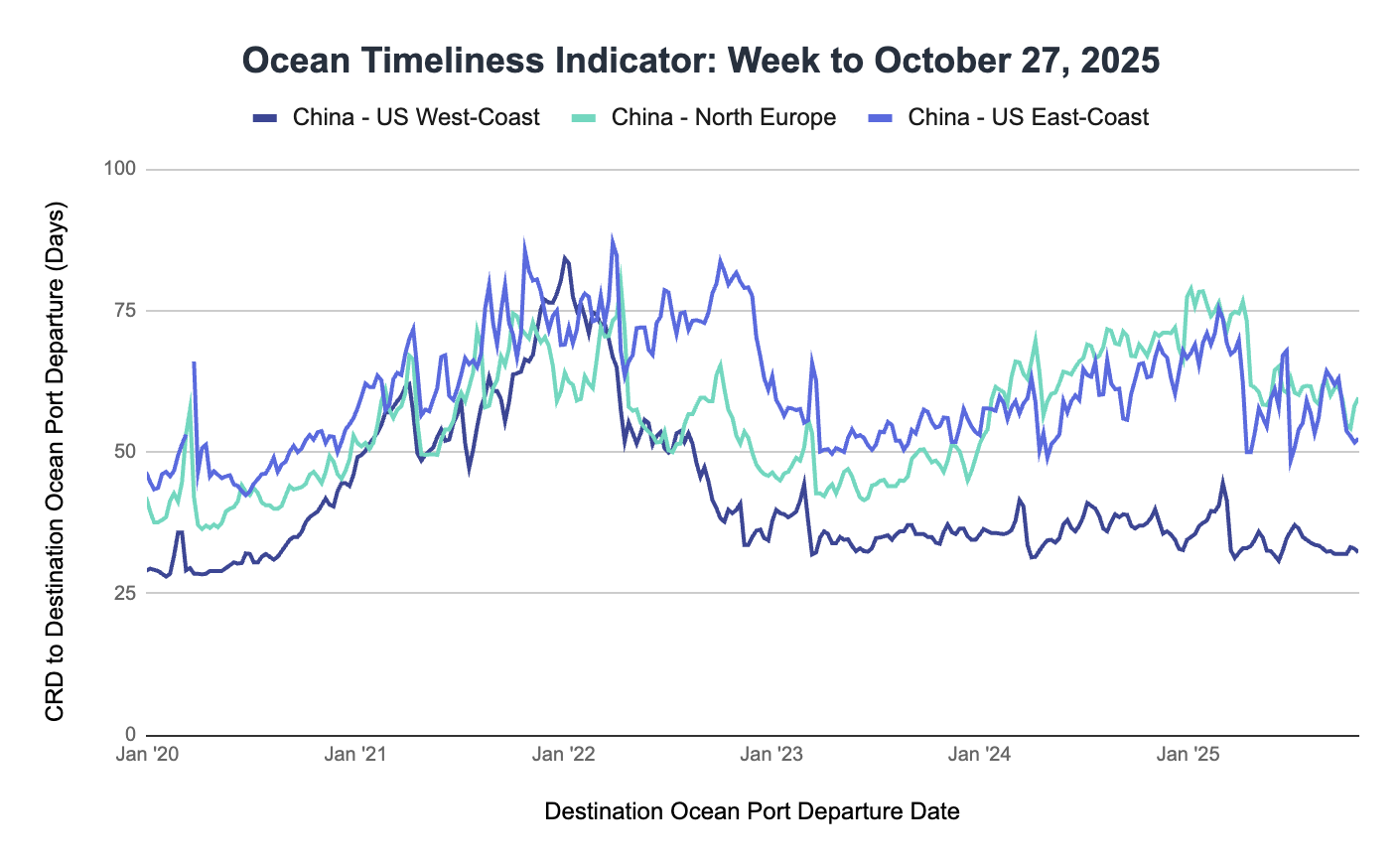

Ocean Timeliness Indicator

Transit time remained near-constant from China to the U.S. West Coast, increased slightly from China to the U.S. East Coast, and increased moderately from China to North Europe.

Week to October 27, 2025

Transit time from China to the U.S. West Coast remained near-constant again, declining from 32.9 to 32.3 days. Transit time from China to the U.S. East Coast saw an increase, from 51.7 to 52.4 days. Transit time from China to North Europe also increased, rising from 58.2 to 59.6 days.

See the full report and read about our methodology here.

About the Author

October 30, 2025

Related content

![White House GettyImages-603224136 (1)]()

Blog

Live Updates: Trump Administration Tariffs, Trade Policy Changes, and Impacts on Global Supply Chains

![GettyImages-1411182583 1199x800]()

Blog

CBP’s Latest Guidance on Reporting Country of Smelt and Cast for Section 232 Aluminum Tariffs

More from Flexport

![Ocean Port GettyImages-89849286]()

Global Logistics Update

CIT Orders IEEPA Tariff Refunds; Middle East Escalation Disrupts Air and Ocean Operations

![GettyImages-1295614211]()

Global Logistics Update

Prepare for Potential IEEPA Tariff Refunds; U.S. Blizzards Disrupt Europe and North America Air Freight Operations

![WarehouseGettyImages-535667233]()

Global Logistics Update

U.S. and Taiwan Finalize Trade Deal; FEWB Spot Rates Soften Amid Lunar New Year Lull

Ready to get started?

Learn how Flexport’s supply chain solutions can help you capture greater opportunities.